Community banking

Community banking

-

Giving back to the community is ingrained in the credit union philosophy, but the holiday season provides the movement with a good reason to go the extra mile. Here's a look at how CUs across the country are celebrating the holidays.

December 22 -

Banks are looking for ways to capture and retain deposits as interest rates rise, including promotional offers and focusing on relationship banking.

December 21 -

The acquisition will give LCNB its first branch and deposits in the Columbus, Ohio, market.

December 21 -

Provident Financial Holdings in Riverside, Calif., announced that it expects to record a $650,000 litigation charge to settle two more long-running lawsuits related to overtime compensation.

December 21 -

The company has registered shares that three private equity firms have held since early 2010.

December 21 -

The wealth management firm Boston Private has agreed to sell Anchor Capital Advisors to Anchor’s management team.

December 21 -

Though Marlene Caride has no direct experience in the banking industry, she could play a key role in carrying out Governor-elect Phil Murphy’s pledge to create a public bank in the Garden State.

December 21 -

Heritage Commerce will pay $32 million for Tri-Valley in a deal that should be accretive to tangible book value and earnings.

December 21 -

Fifth Third said it will give a bonus or raise to about three-quarters of its employees while Wells Fargo raised its minimum hourly pay in the wake of Congress' passing a tax reform bill.

December 20 -

Regional and community banks will offer low-cost or no-cost financial products through Bank On, which has already reached agreements with Regions Bank, Wells Fargo and SunTrust.

December 20 -

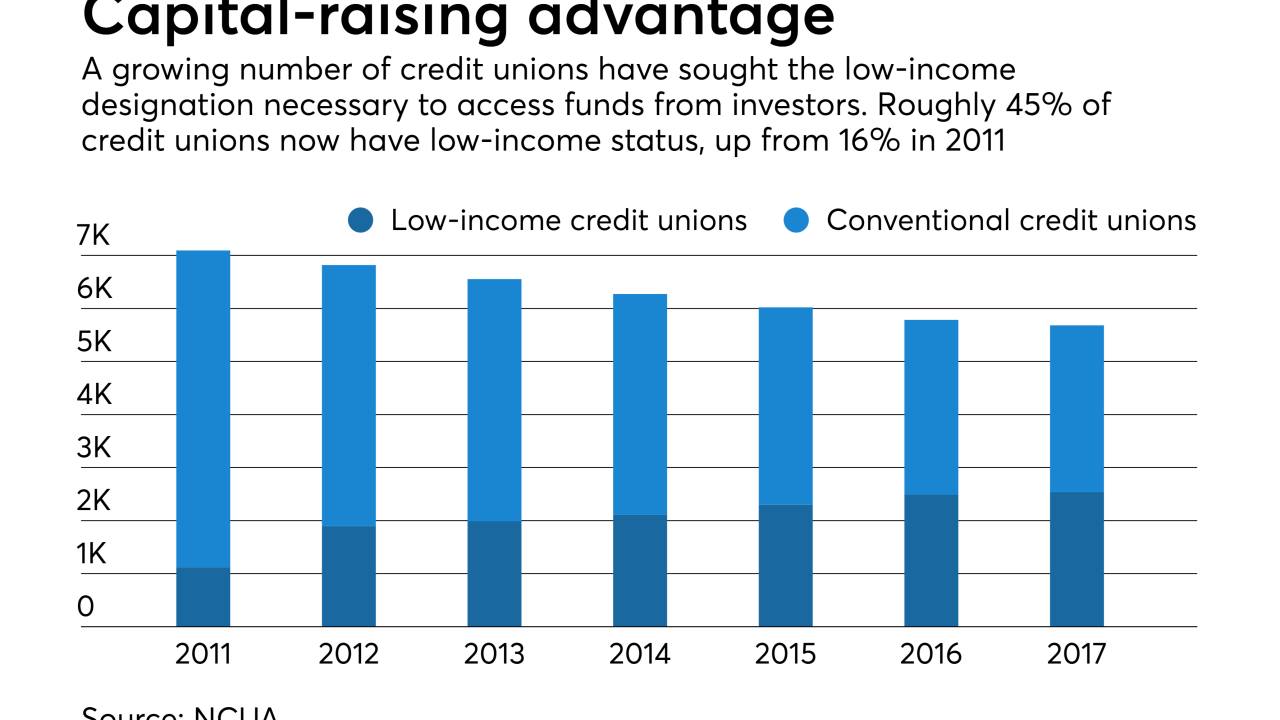

Notre Dame Federal Credit Union in Notre Dame, Ind., said late last week that it raised $12 million from a new fund created to provide secondary capital to credit unions, angering bankers who see it as a disturbing trend.

December 20 -

Notre Dame Federal Credit Union in Notre Dame, Ind. said late last week that it raised $12 million from a new fund created to provide secondary capital to credit unions. It comes a month after a similar move by Jefferson Financial Federal Credit Union.

December 20 -

The Fed approved an application giving Natcom Bancshares indirect control over Republic Bank, declining to take into account claims the transaction imperils the target's S corporation status.

December 19 -

Amalgamated in New York wants to enter several left-leaning cities across the country, but it might be tough to find more like-minded banks to buy.

December 19 -

The company agreed to buy PBB Bancorp in Los Angeles just five weeks after completing its last bank acquisition.

December 19 -

The company will set aside more than $10 million, with most of the provision addressing an issue with a commercial loan.

December 19 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

Gabriel Hamani has been named chief executive of BHI USA, the U.S. banking arm of Bank Hapoalim.

December 18 -

Washington Federal in Chicago, which had a clean balance sheet and plenty of capital on Sept. 30, was shuttered shortly after the death of its CEO and regulators' discovery of "substantial dissipation of assets."

December 18 -

With tax reform close to the finish line, bankers are still clear winners from the compromise worked out between House and Senate negotiators. But the bill includes some caveats that might give institutions pause.

December 18