Community banking

Community banking

-

First Federal Bank of Kansas City has agreed to a $2.8 million settlement with the Department of Housing and Urban Development to resolve allegations of redlining in African-American neighborhoods.

February 29 -

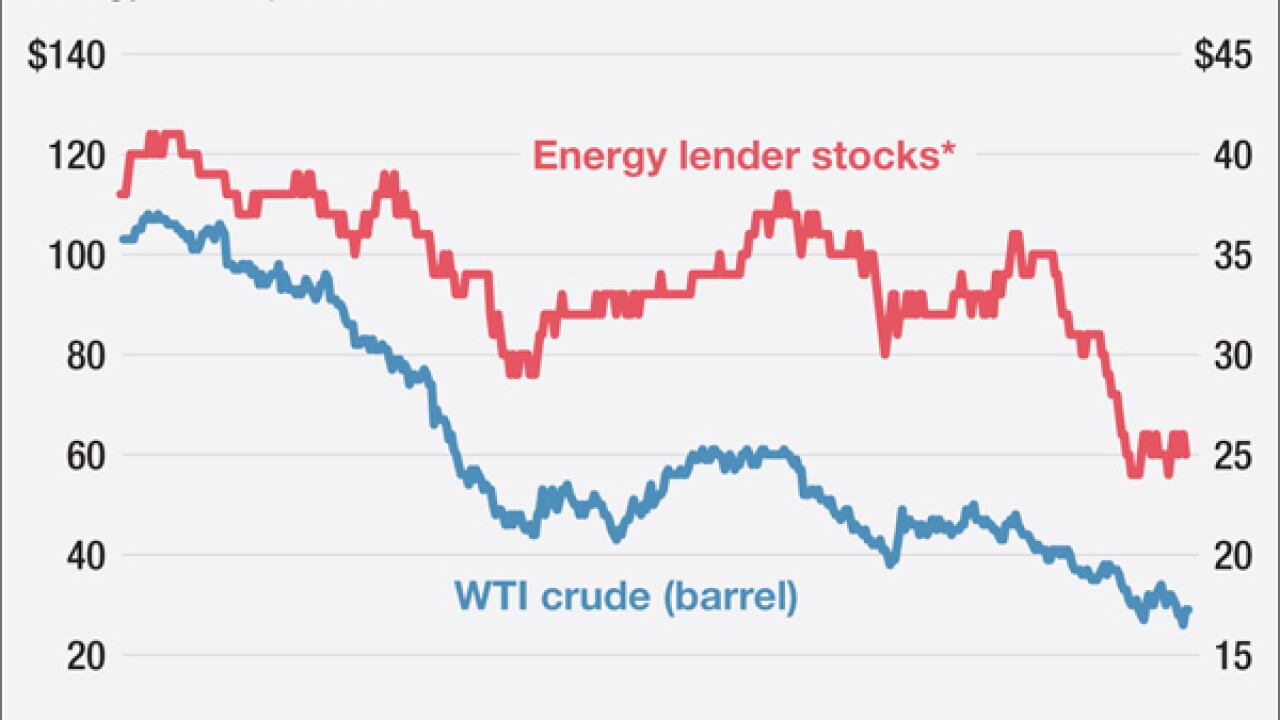

Comerica in Dallas is warning that its loan-loss provision this quarter will be larger than previously estimated because of falling oil prices.

February 29 -

Benjamin Bochnowski will be named chief executive of both the holding company and the $865 million-asset Peoples Bank at the bank's April 28 annual meeting.

February 29 -

Unity Bancorp of Clinton, N.J., has repurchased $5 million of subordinated debt it issued before the financial crisis.

February 29 -

Bankers in the Bakken Shale region of Montana and North Dakota are keeping an eye on exposure to hotels, apartments and retail space as economic slowdowns occur in energy-producing markets. Bankers in the Marcellus Shale region are also on alert, though there might be less exposure since that region had not yet had a development boom.

February 29 -

There are good, bad and ugly stories about how marijuana entrepreneurs deal with taxes and other financial management issues while having little access to banking services.

February 29 -

Many of the presidential candidates have backed steps to lighten community banks' burden, but we don't need to count on grandiose stump speeches and campaign pledges to make a difference.

February 29 -

Poage Bankshares in Ashland, Ky., has promoted Thomas Burnette to chairman of the boards of the company and its Town Square Bank subsidiary.

February 29 -

The banking industry's rate of expansion hit a seasonal wall in January, leading to the weakest reading for the Index of Banking Activity since its inception in 2012. While January has consistently yielded some of the softest readings in the IBA, a relatively mild winter in the Northeast (a stark contrast to the previous two winters) puts the loss of momentum in a different light from those in recent years. Index components that track loan applications and loan approvals retreated below 50 in January on both the consumer and commercial sides of the business, marking the first time that those indicators simultaneously signaled a contraction in business activity. Most of the components that monitor trends in credit quality have remained positive, although respondents did indicate that delinquency trends in consumer lending had turned somewhat negative in January. Survey respondents also continued to report generally favorable trends in the pricing environment for new loans. Trends in other areas of business tracked by the IBA remained largely intact: The components that monitor the generation of new transaction accounts, the overall level of commercial and consumer loans outstanding, and local business and real estate conditions in the markets where respondents do business all remained above 50, pointing to ongoing improvements in each of those banking-activity metrics.

February 29 -

Buying and selling branches is routine for a lot of banks, but it's big news at First National Bank of Dwight in Illinois.

February 26 -

The Houston-based institution plans to build profit into the repayment agreement for a loan, with profit replacing interest, under the model of other Muslim-based lenders.

February 26 -

Pacific Mercantile Bank in Costa Mesa, Calif., announced four executive promotions Friday.

February 26 -

Texas has had a fair share of M&A since the financial crisis, but deal volume has declined since oil prices began to plummet in late 2014. Uncertainty over sellers' exposure and depressed stock prices for aspiring buyers are largely to blame.

February 26 - Georgia

The former chief executive of a Georgia community bank that participated in the Troubled Asset Relief Program was sentenced to prison and fined $3.9 million for hiding the bank's past-due loans and committing other fraud.

February 26 -

After the financial crisis led to a long nationwide drought in the creation of new banks, the second de novo bank application in less than a year has been submitted in California.

February 25 - Minnesota

The Independent Community Bankers of Minnesota said Jim Amundson will be its next president and chief executive.

February 25 -

Preparing for the inevitable future credit crisis by setting aside more loss reserves is a step toward avoiding government bailouts.

February 25 -

Though bank analysts like Matthew Schultheis generally expect M&A activity to continue at a brisk pace for several years to come, stock market volatility could prove to be an issue for potential dealmakers in the near term.

February 25 -

County Bank, the holding company for the $324 million-asset Lapeer County Bank & Trust, said in a press release that it will pay $20 million, or $27 a share, in stock for the parent of the $245 million-asset CSB Bank.

February 25