Community banking

Community banking

-

There is concern that a decline in condo pricing could create loan problems similar to those that cropped up before the financial crisis. Bankers in the area, however, believe foreign investors would take the biggest hit.

February 16 -

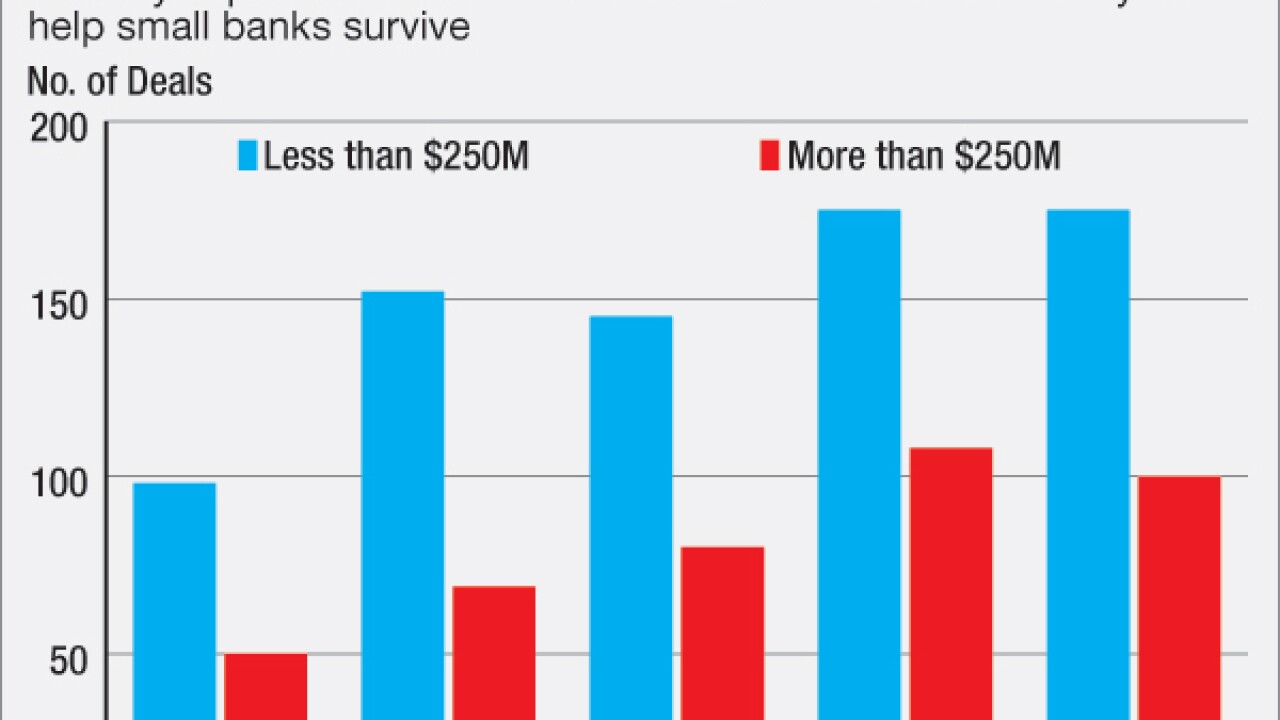

A rough economy, regulation and evolving technology will keep forcing small banks to merge, said Richard Hunt, head of the Consumer Bankers Association. Hunt's position puts him at odds with bank advocates, including Camden Fine at the Independent Community Bankers of America, who believe small banks should ignore the drumbeat calling for more consolidation.

February 12 -

Flagstar Bancorp in Troy, Mich., has launched a national homebuilder lending platform.

February 12 -

Sterling Bancshares in Poplar Bluff, Mo., has completed its purchase of Bootheel Bancorp in Poplar Bluff.

February 12 -

Community bank executives need to focus on these three areas in order to embrace change and cater to younger, tech-savvy customers.

February 12 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

February 12 -

Bank of Missouri knew that using new technology was important in making its business processes more efficient. But its IT team also knew that it had to get buy-in from the employees actually completing the steps as well to see real results.

February 11 -

Bank of Prairie Village in Kansas went through a core conversion last year. Its chairman hopes that his sons, who are set to take over the bank eventually, won't be afraid to embrace new technology since they've experienced the scariest of all bank IT projects.

February 11 -

Banks stocks fell further than the overall market yet again Thursday, as concerns about negative interest rates, the energy sector and other matters showed no signs of abating.

February 11 -

Inspired by marketplace lenders, Live Oak Bancshares created a largely digital product that can make a credit decision on a small-business loan within 48 hours. The product, which combines human decision-making and automated credit scoring, could go national as early as next year.

February 11 - Virginia

Bank of Botetourt in Buchanan, Va., founded in 1899, said Thursday it has opened a mortgage division to pursue unmet demand for home loans in southwestern Virginia.

February 11 -

Rather than replace aging servers and add an on-site backup system, The Eastern Colorado Bank moved its IT infrastructure to the cloud. While some bankers fear outsourcing such systems, the community bank has had a hosted core for several years.

February 10 -

The $2 billion-asset Hampton Roads said in a press release Wednesday that it will pay $107.2 million in stock for the $1 billion-asset Xenith.

February 10 -

Strong demand for rentals will keep pace with new construction over the next few years, the government-sponsored enterprise says.

February 10 -

Kelly King, the North Carolina company's chief executive, also noted that BB&T is busy integrating a number of recent acquisitions. It is leaning toward buying back stock, though management could be coaxed into making a deal if the right bank became available.

February 10 -

The Bancorp in Wilmington, Del., named Sepideh Behram to the role of chief compliance officer. Her hiring comes as the $4.8 billion-asset company works to shore up its risk and compliance management.

February 10 -

Banks are coming up short in trying to keep pace with other more advanced app providers, but emulating these five steps taken by nonbanks can help drive mobile engagement.

February 10 -

Several big banks have promised their customers cardless ATMs this year, but customers of the $1.2 billion-asset Avidia have been able to get cash without taking out their cards since last summer.

February 9