Community banking

Community banking

-

Credit unions hit new highs in membership, deposits and loans in 2025. But it was also a chaotic year for the industry's governing body, and the sector faced renewed attacks by banks.

December 30 -

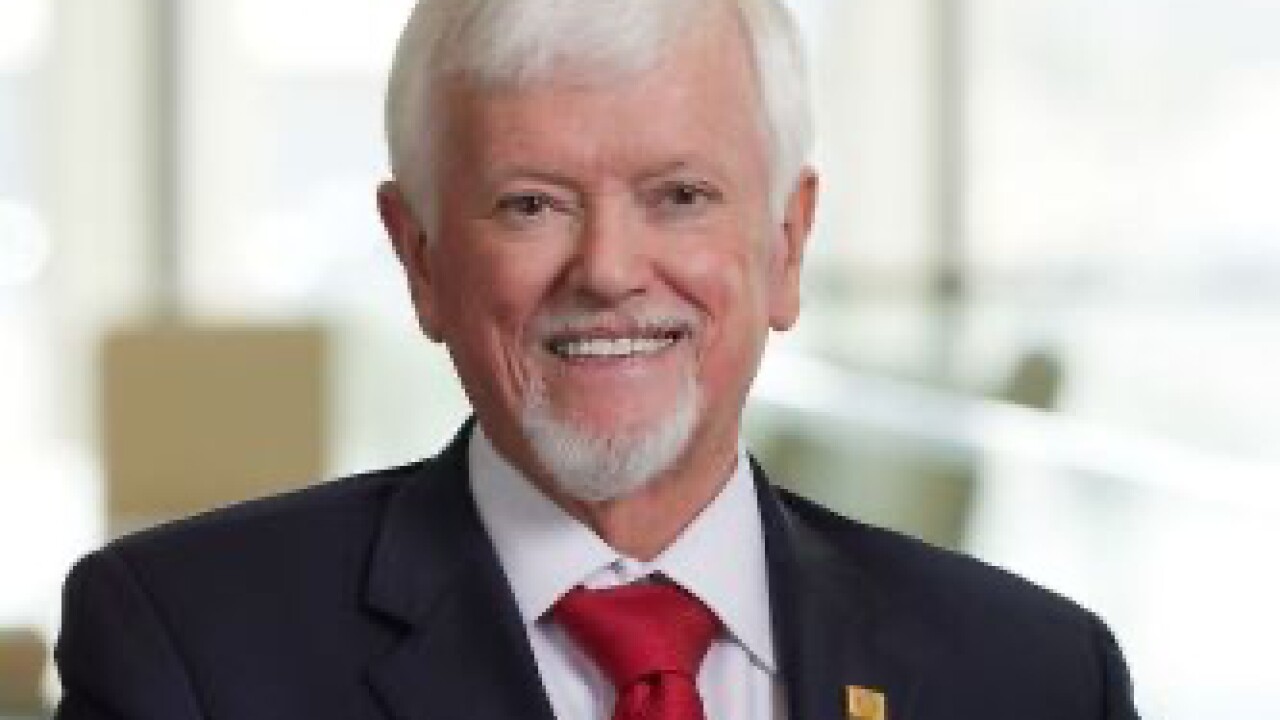

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

Fintechs are wrong to demand wholesale consolidation of community banks in the U.S. Real innovation doesn't stem from wiping out smaller institutions or forcing consolidation. Innovation comes from fair competition, secure data protocols, and clear rules that apply equally to banks and fintechs of all sizes.

December 23 -

Once its second deal in less than three years closes midway through 2026, the Alexandria-based company will operate more than 100 branches and hold $11 billion in assets.

December 19 -

The merger with Heritage Financial joins two commercially focused banks, creating a $21.7 billion-asset institution with a presence in all of the Golden State's major markets.

December 18 -

Banesco USA in Miami is among the banks that are eyeing the government-guaranteed lending program as a source of growth.

December 17 -

Daryl Byrd, who led Iberiabank until it was acquired by First Horizon, has assembled an investor group to acquire MC Bancshares and its subsidiary, MC Bank & Trust Co. in Morgan City, Louisiana. Byrd will become CEO.

December 17 -

Federal regulators' plan to dial back supervision of community banks is coming at a dangerous time. Rising climate risk creates unique vulnerabilities for small banks that regulators should be tracking.

December 17 -

Two former chairmen of the Independent Community Bankers of America take issue with the trade group's decision to support legislation that would dramatically increase federal deposit insurance levels.

December 16 -

GBank will serve as the bank partner for a cashless slot machine betting app that is looking to expand nationwide after getting a key regulatory approval in Nevada.

December 15 -

The small Missouri community bank partnered with embedded banking provider Treasury Prime to connect with fintechs and signed on its first sponsoree earlier this year.

December 15 -

The all-stock acquisition of Mountain Commerce Bancorp in Knoxville marks the Arkansas-based company's first M&A foray since 2022.

December 8 -

Danny Seibel, who led First National Bank of Lindsay from 2007 until shortly before the bank's failure last year, is accused of falsifying bank documents to conceal the condition of loans.

December 5 -

More than 400,000 consumers may be affected after Marquis Software Solutions suffered a breach traced to a bug in SonicWall software disclosed last year.

December 4 -

Midland States Bancorp has completed three major asset sales in the past 12 months, exiting national business lines and shifting focus to its core community banking franchise.

December 4 -

South Plains Financial agreed to pay $105.1 million in stock to acquire a seven-year-old Houston community bank in its first M&A foray since 2019.

December 2 -

The Wisconsin-based regional bank plans to acquire American National Corp. in an all-stock transaction valued at $604 million. It is Associated's first acquisition announcement since Andy Harmening became CEO in 2021.

December 1 -

The latest linkup with the software provider Wave gives Fundbox access to more than 350,000 potential borrowers. It's the fourth major partnership that Texas-based Fundbox has announced in 2025.

December 1 -

Bank of Marin Bancorp in Novato has sold a big chunk of low-yielding securities, replacing them with investments that should produce significantly more income.

November 25 -

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

November 24