Community banking

Community banking

-

The Federal Deposit Insurance Corp. is arguing that Colorado has the right to establish an interest rate cap that all state-chartered banks must follow. Three industry groups are suing the state in an effort to stop its attempted crackdown.

April 28 -

The Philadelphia-based bank's parent company, Republic First Bancshares, had been roiled by a yearslong proxy battle involving activist investors groups and its former CEO.

April 26 -

The Wisconsin banking company forecasted loan growth of 4% to 6% for the full year, driven by an expansion into new commercial and consumer credit lines as well as enduring economic strength in the Midwest.

April 26 -

Liberty Bank in Salt Lake City had been "structurally unprofitable" since 2008, according to its regulators. Experts criticized the FDIC for allowing the bank's demise to play out in slow motion.

April 25 -

The Jackson, Mississippi, company will use proceeds from the sale of its Fisher Brown Bottrell Insurance unit to restructure its investment portfolio, moving $1.6 billion of low-yield securities off the balance sheet.

April 24 -

Brendon Falconer, finance chief of the Indiana company since 2019, faces felony child molestation charges. But CEO James Ryan says management is focused on the CapStar integration and organic growth.

April 23 -

As recently as a few months ago, many observers predicted a surge of bank mergers this year. But longtime obstacles to dealmaking are still there and have been joined by new ones.

April 21 -

The Office of the Attorney General in New York says the bank violated the state's Exempt Income Protection Act, illegally transferring customers' money to debt collectors.

April 17 -

Should the all-stock transaction close as planned later this year, Wintrust Financial in the Chicago area would gain about $2.7 billion of assets.

April 15 -

Launched last July, FedNow had enrolled more than 600 participants by mid-March, according to government officials. That marked a 100% increase from the start of the year, with more banks and credit unions viewing fast payments capabilities as essential. Fraud concerns linger, however.

April 11 -

The beleaguered Long Island bank has recently seen at least 16 teams walk out the door, according to announcements by Dime Community Bancshares and Peapack-Gladstone Financial.

April 9 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

April 9 -

A combination of higher interest rates and increased vacancies — especially in office buildings — are leading to more apprehensions in commercial real estate.

April 8 -

A year ago, the National Community Reinvestment Coalition accused KeyBank of redlining. On Wednesday, the NCRC and Key announced a $25 million "agreement" that NCRC CEO Jesse Van Tol says could open the door to a new community benefits plan.

April 3 -

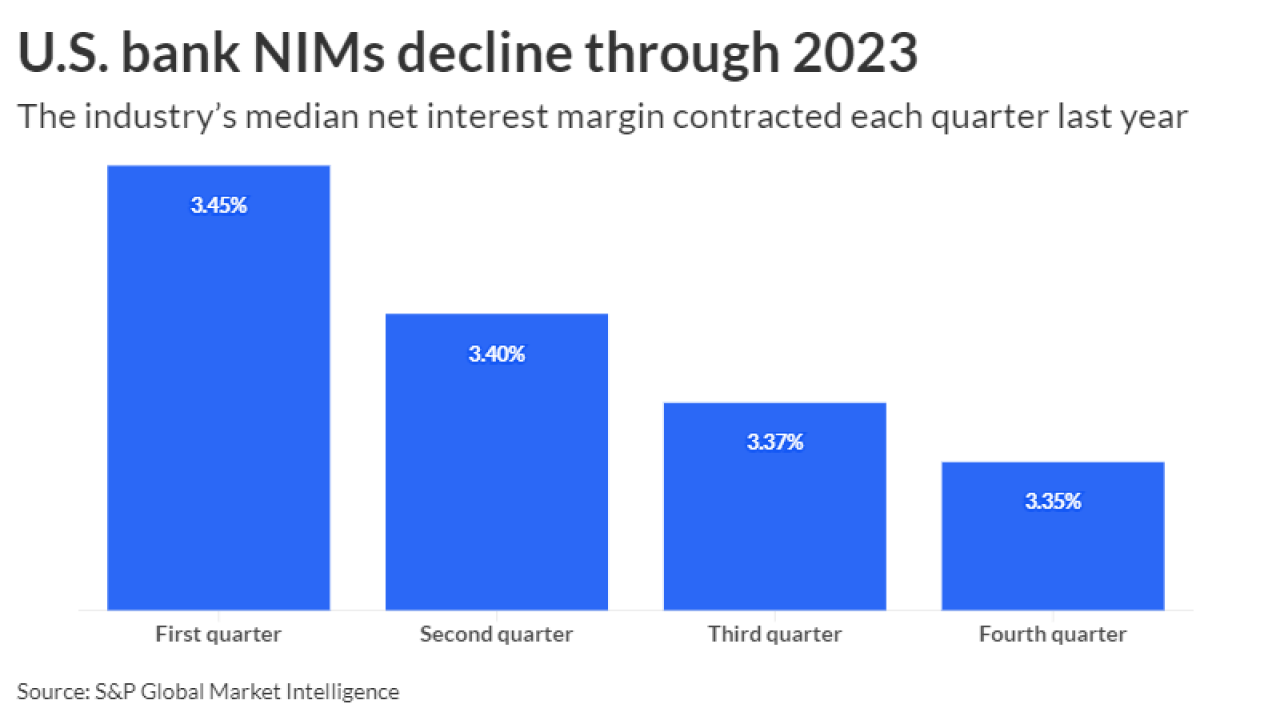

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Houston-based Prosperity Bancshares said it closed its purchase of Lone Star State Bancshares about a year later than initially planned.

April 2 -

Mergers have left Virginia without an independent statewide financial institution. Atlantic Union CEO John Asbury is trying to change that.

April 1 -

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

VersaBank in London, Ontario, agreed nearly two years ago to buy a small Minnesota bank. The buyer's CEO says he remains hopeful approval will come soon.

March 27 -

Each spring during the rush of annual meetings, a handful of financial institutions take heat from shareholders who demand new strategies, management shakeups and, at times, even a sale of the company.

March 26