Community banking

Community banking

-

David Brager, the California company's sales division manager, will replace Christopher Myers on March 16.

February 20 -

The company will nearly double the amount of marine loans on its books after buying a division from People's United.

February 19 -

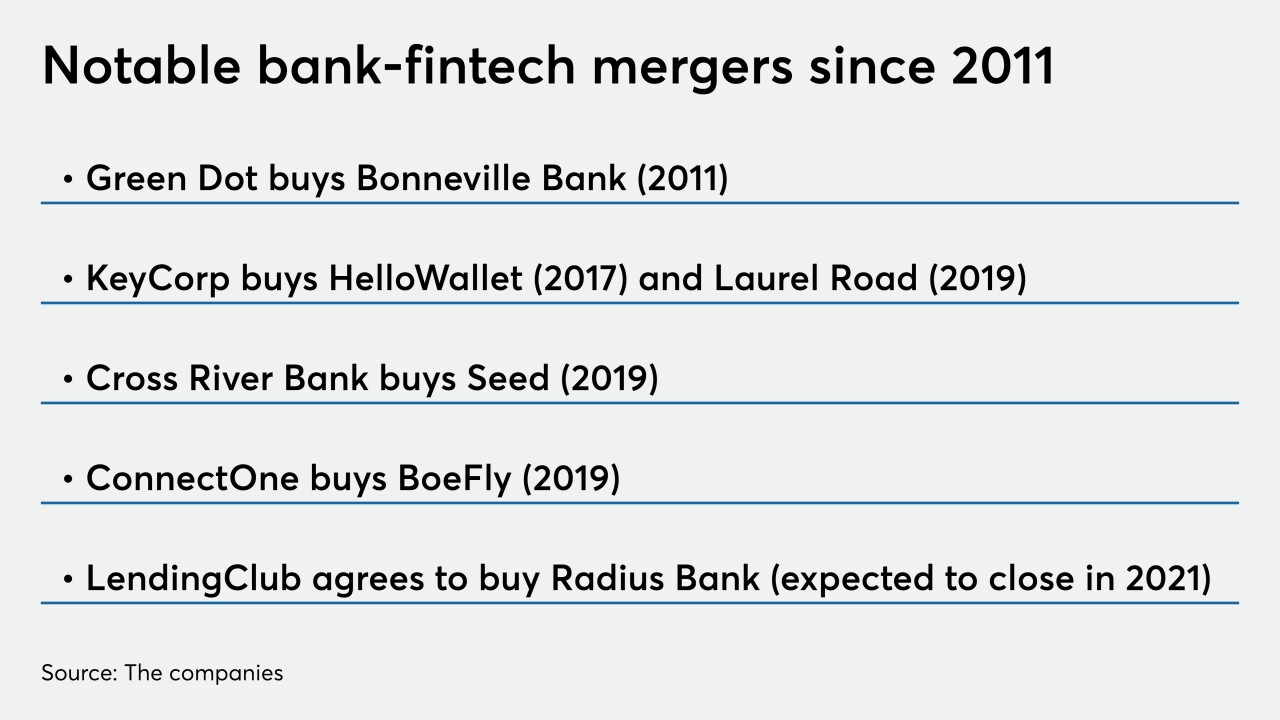

The challenge for other fintechs will be to find banks that are as compatible as Radius Bank, an online-only lender, is for LendingClub.

February 19 -

The game has changed and bank executives will have to do more homework before striking a deal.

February 19 -

Clearer standards make it easier for shareholders to boost their stakes in banks without having to file for bank holding company status.

February 18 -

The deal for Boston-based Radius would be the first in history in which an online lender buys a mainstream bank.

February 18 -

The company will pay $130 million for Commerce Financial Holdings.

February 18 -

Ericson State Bank, which had been in regulators’ sights for a decade, was closed by state and federal authorities Friday. Another bank acquired all of its deposits and a fraction of its assets.

February 14 -

Hanover Bancorp is facing a proxy battle after its CFO and two other bankers bolted to a rival.

February 14 -

The entire banking industry needs to join the fight instead of waiting for Congress to act.

February 14 -

A large charge-off and an additional loan-loss provision reduced quarterly profit by 12%, to $47.8 million.

February 14 -

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

Broadway Financial prefers a small balance sheet and loans to real estate investors that offer affordable housing. Capital Corps and its founder, Steven Sugarman, want the bank to expand by making more loans directly to low- and moderate-income borrowers.

February 13 -

Congress should further expand a tiered regulatory system to help community banks better serve local neighborhoods.

February 13 -

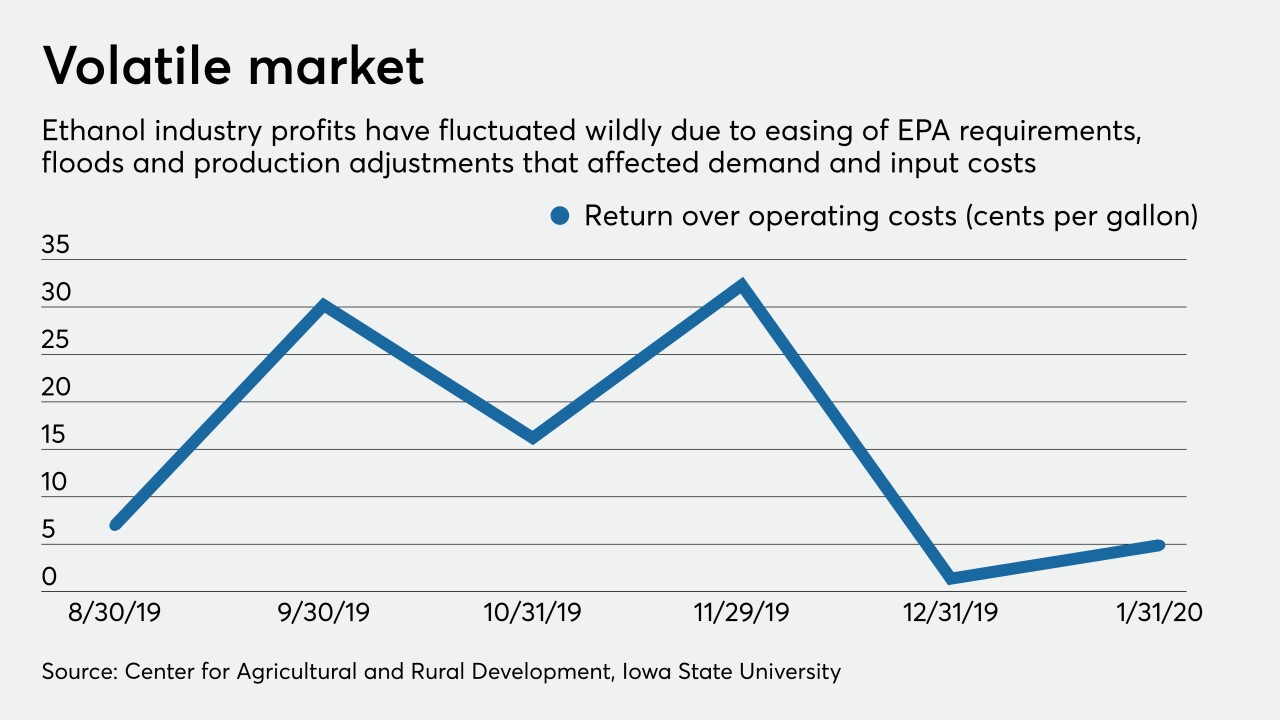

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

Capital Corps, founded by former Banc of California CEO Steven Sugarman, wants the minority-run Broadway sold to a buyer that serves low- and moderate-income borrowers.

February 12 -

Regulators are alarmed about banks' rising exposure to high-risk corporate credits and want more data on how they would perform in a recession.

February 11 -

The Iowa company will pay $280 million to gain 25 branches and $1.2 billion in loans.

February 11 -

Ken Karels will be succeeded by Mark Borrecco, who had been CEO of Rabobank's U.S. bank.

February 11 -

The agency released two new manual supplements and other materials to help nonbanks and its own staff better understand application procedures.

February 10