Community banking

Community banking

-

Sound Bank has new management as part of the transaction. It will also get a new name and expand into higher-growth markets.

May 7 -

The Mile High City has been disrupted by a number of big M&A deals, providing an opening for other banks to benefit.

May 6 -

The Maryland company has hired interim CEO Susan Riel to officially take over the post.

May 6 -

The California company was issued a consent order after it failed to meet the conditions of a January 2018 informal agreement.

May 6 -

The company will record a $2.1 million pretax gain in the second quarter after selling Summit Insurance Services to the Hilb Group.

May 6 -

Banco Bradesco said it will use the acquired bank to expand its investment offerings in the United States.

May 6 -

Profitability improved significantly last year for banks with less than $2 billion of assets, but not because of anything they did. Some troubling trends lurk beneath those big gains too.

May 5 -

Tandem Bank has approval from the Georgia Department of Banking and Finance as its aims to become the state's first new bank since the financial crisis.

May 4 -

Aging tech systems have become a "pain point" in financial services, and VC firms have backed newcomers trying to push aside traditional vendors and win over banks and credit unions.

May 3 -

Community banks in the state have struggled to attract the funds to meet surging loan demand, but that could change now that a new law has made it easier for them to accept government deposits.

May 3 -

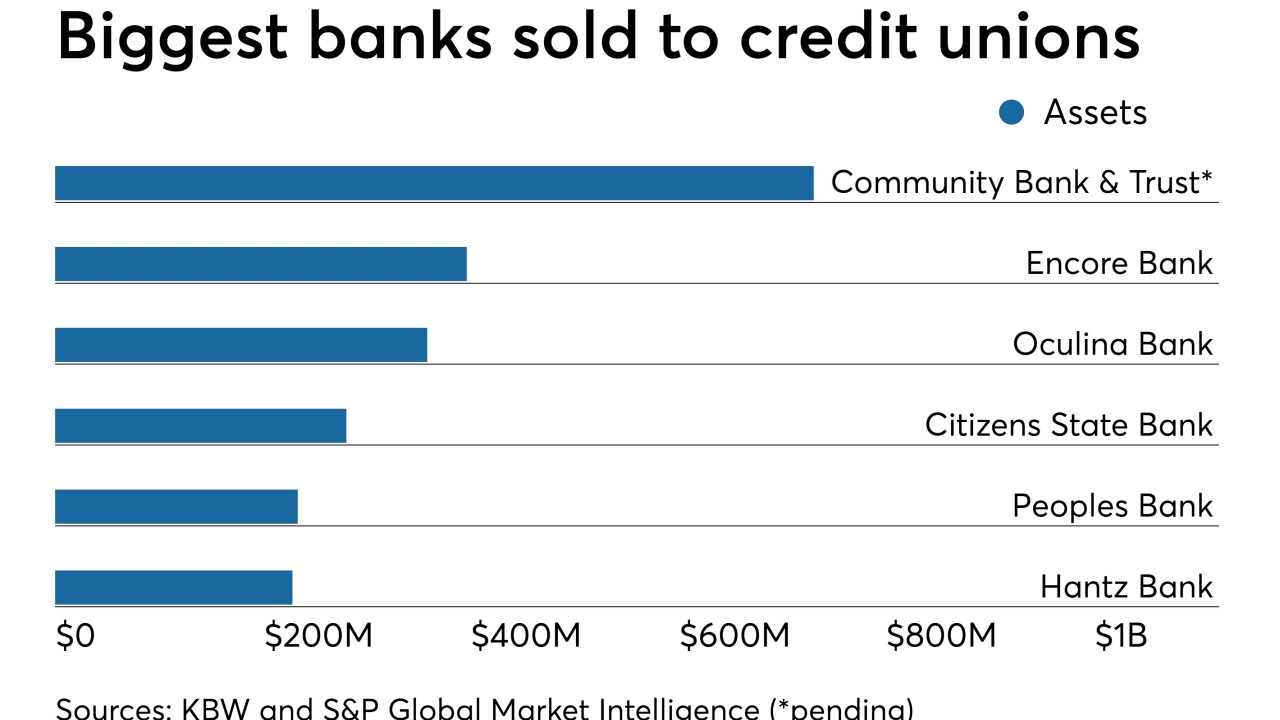

MidFlorida Credit Union has agreed to buy the $730 million-asset Community Bank & Trust of Florida in Ocala.

May 3 -

The National Credit Union Administration and the Small Business Administration have established a program to boost SBA lending by credit unions, which was very light last year. It is sure to irk bankers, who have raised competitive concerns.

May 3 -

The Consumer Financial Protection Bureau proposed steps to ease Home Mortgage Disclosure Act requirements, just days after announcing it was retiring a platform to let users analyze raw mortgage data.

May 2 -

Give Lindsay Lawrence a big job to do and she just might find a way to make it even bigger.

May 1 -

Paul Taylor previously served as CEO of Guaranty Bancorp in Denver, which was sold in January to Independent Bank.

May 1 -

Shelley Seifert had been the bank's chief operating officer.

May 1 -

It is comfortable with the deal for MidSouth despite the seller's lingering credit issues, given a shared history and the opportunity to add low-cost deposits.

May 1 -

It just got harder for banks in Georgia to enforce noncompete agreements in employee contracts. For employees of two merging banks, BB&T and SunTrust, the timing couldn’t be better.

May 1 -

Innovation is part of Emily Girsch's daily routine. That's why the chief financial officer at Lincoln Savings Bank in Cedar Falls, Iowa, spends a lot of time thinking about the need to modernize bank regulations for the digital age.

April 30 -

MidSouth had spent the last two years improving credit quality by reducing its exposure to energy credits.

April 30