Community banking

Community banking

-

Big banks are expected to report that commercial lending weakened in the third quarter thanks to tax cuts, nonbank competition and seasonal factors. It raises questions about whether the second-quarter rally was an anomaly and if an overall economic slowdown is edging closer.

October 9 -

Bank Novo isn't a business lender (lots of firms already do that) or an account provider (it has a bank partner for that). Instead, it provides small businesses tools to track and analyze their banking activities.

October 9 -

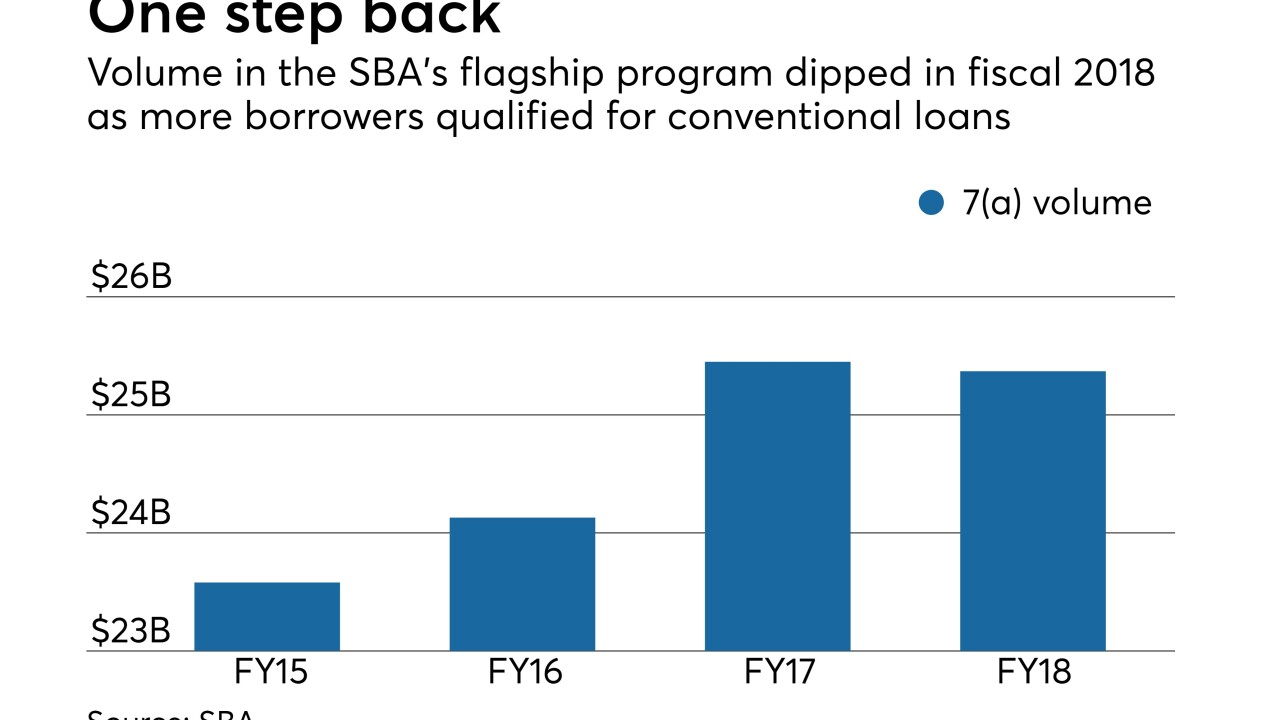

The agency's 7(a) program had a small year-over-year decline, with bankers pointing to lender discipline and more borrowers qualifying for conventional loans.

October 9 -

On Jun. 30, 2018. Dollars in thousands.

October 9 -

On Jun. 30, 2018. Dollars in thousands.

October 9 -

American Banker's Most Powerful Women in Banking and Finance gala, recorded live on Oct. 4 at Cipriani Wall Street in New York City.

October 5 -

Union Bankshares will gain 15 branches and $2 billion in loans in northern Virginia after it buys Access National.

October 5 -

Speaking at an industry conference Thursday, two tech executives and a community banker said that community banks should be allowed to experiment with new products without worrying about running afoul of regulators.

October 5 -

The Community Bank Sentiment Index, an outgrowth of a yearly survey conducted by the Conference of State Bank Supervisors, is intended to bring attention to market conditions and how they affect small banks' growth prospects.

October 4 -

MiCommunity Bancorp would be the first bank to open in Michigan in 10 years.

October 4 -

In what would be its third acquisition in a year, the company formerly known as BofI Holding is buying a firm that clears trades for independent broker-dealers.

October 4 -

The central bank’s top regulatory official discussed how the Fed is using listening sessions in isolated communities to understand the effect of losing the one bank in town.

October 4 -

The 2018 Most Powerful Women in Banking festivities kicked off Wednesday night with cocktails and conversation at the Alley Cat Amateur Theater in New York's Financial District.

October 4 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

A new agency Web page has information on nearly every aspect of the agency's operations, including de novo applications, bank exams and failures.

October 3 -

Better incentives to lend and invest in underserved communities are also worthy of consideration, Loretta Mester says, as regulators try to blend the best of the Community Reinvestment Act with new ideas in updating its rules.

October 3 -

The agencies issued a joint statement on the types collaborative arrangements that a bank could employ to make BSA/AML compliance more efficient.

October 3 -

Hanmi alleges that SWNB's directors actively advised the Houston bank's investors to reject the merger.

October 3 -

Applications this year are more than double the 2017 mark and the most since 2009. But with some fintechs withdrawing their bids, observers are urging caution.

October 3 -

The regional bank is putting its corporate stamp on branches in the two states.

October 3