Community banking

Community banking

-

The transition to Stein from Hadley Robbins is the result of a multiyear succession process, the Tacoma, Wash., company said. Robbins had succeeded the late Melanie Dressel.

September 30 -

Gulf Capital Bank has received conditional approval from state and federal officials and could be up and running late this year or early next year, its organizers say.

September 30 -

Bankers are expected to field numerous questions on third-quarter earnings calls about the threat of shrinking loan yields, stubbornly high deposit prices and what they're going to do about them.

September 30 -

Caught in the middle of a credit-subsidy debate, the program would have shut down on Tuesday without congressional action.

September 27 -

Ernest Pinner, who co-founded the Florida company in 1999, will become non-executive chairman in January.

September 27 -

Warsaw Federal will keep its name and charter after joining First Mutual Holding in Lakewood, Ohio.

September 27 -

The regulator has pledged to put forth a rule on credit union-bank purchases before the end of the year. It's likely to lead to another clash with bankers.

September 27 -

Their challenge is creating a viable, profitable product that doesn't get flagged for being predatory.

September 26 -

An initial review determined that lax oversight at Enloe State Bank allowed for the origination of more than 100 allegedly fraudulent or fictitious loans.

September 26 -

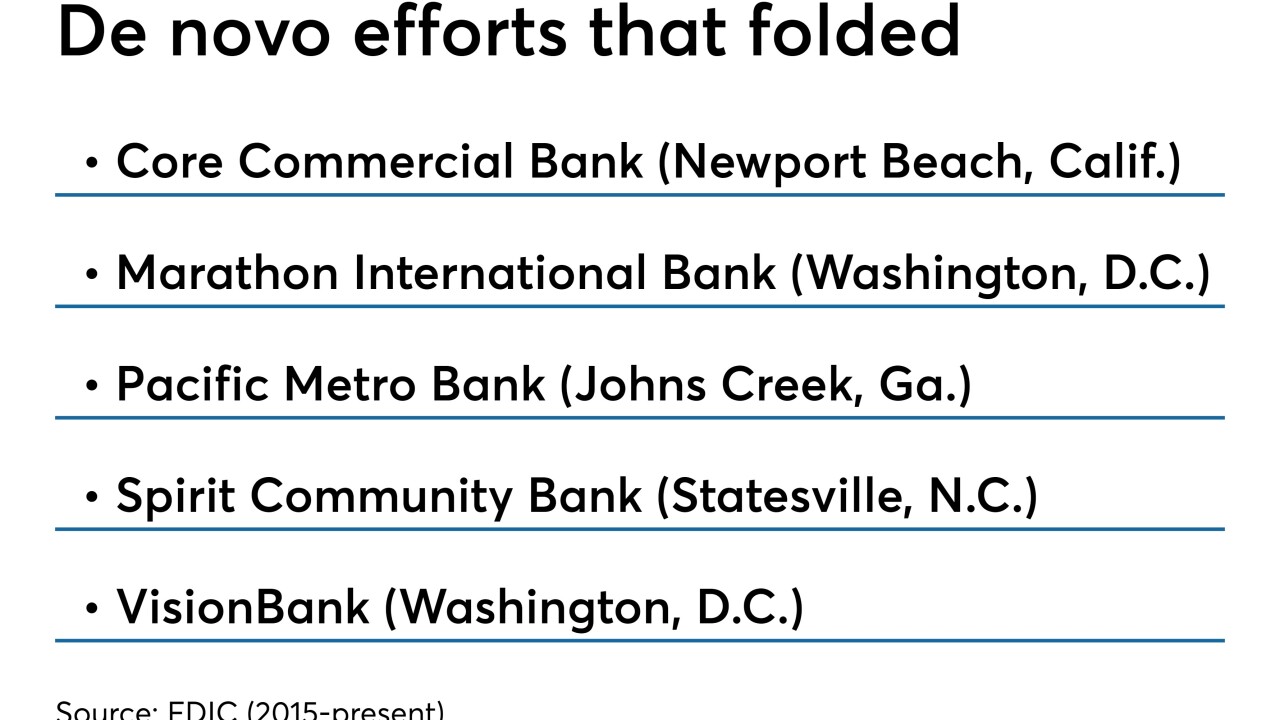

Regulators may be willing to grant new charters, but economic uncertainties, capital hurdles and inexperience have led the organizers of numerous bank startups to give up in the last few years.

September 25 -

The legislation included changes designed to attract more Republican support, which is key to the measure ultimately becoming law.

September 25 -

The Miami unit of Chile’s Banco de Credito e Inversiones is acquiring Executive National Bank. It bought Miami's TotalBank last year.

September 25 -

The North Carolina company agreed to buy the much-smaller Community Financial Holding.

September 24 -

The Maryland company says two recent deals, including its agreement to buy Revere Bank, give it the right amount of coverage across Washington's suburbs.

September 24 -

FWBank would be led by Marianne Markowitz, former acting SBA director. Amy Fahey, a former JPMorgan Chase executive, would serve as chairman.

September 24 -

The Dallas company inherited the loan relationship from a bank it bought in 2017.

September 24 -

The company will add nearly a dozen branches in the Maryland suburbs of Washington.

September 24 -

The Florida banks had spent years addressing credit quality and capital issues.

September 23 -

The rise in prices caused by the attacks on Saudi Arabian oil installations should help banks recoup some losses from the 2016 downturn. Harder to gauge is the impact the price volatility will have on U.S. energy production and, in turn, loan demand.

September 23