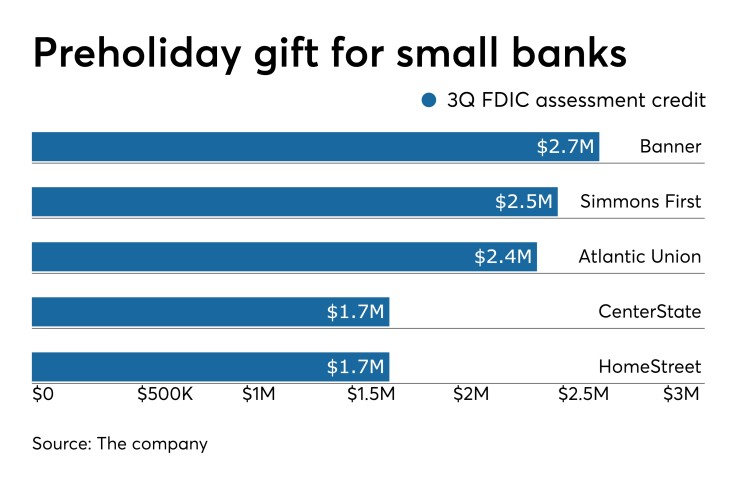

A large number of community banks received an early holiday-season gift this year.

The Deposit Insurance Fund’s ratio of reserves exceeded 1.38% in the third quarter, triggering a temporary

The credits, which lowered noninterest expense, were timely for small banks facing falling net interest margins and weakening loan demand. And some lenders should have more offsets in coming quarters, assuming the ratio remains above 1.38%.

“It’s a nice little positive” for smaller banks, Robert Fehlman, chief operating officer and chief financial officer at Simmons First National, said during the company’s quarterly call.

Expenses at the $17.8 billion-asset Simmons First were reduced by about $2.5 million in the third quarter. The Pine Bluff, Ark., company is still in line to receive another $1.5 million credit.

“With margins under pressure, you’re going to see banks identify and point out whatever positives they can on the expense side of things,” said Damon DelMonte, an analyst at Keefe, Bruyette & Woods.

At the $9.9 billion-asset Provident Financial Services, expenses were flat with the second quarter, helped by the recognition of a $660,000 assessment credit. Provident still has the potential for $1.8 million in remaining credit, Thomas Lyons, the Jersey City, N.J., company’s chief financial officer, said during a quarterly earnings call.

The $6.9 billion-asset Seacoast Banking Corp. of Florida reported a $300,000 reduction in its assessment and the potential for $1.2 million in remaining credit. The $9 billion-asset Eagle Bancorp in Bethesda, Md., had a $1.1 million benefit; it could tap into another $600,000 this quarter.

Bankers were quick to caution that the credits are a temporary — and finite — positive.

“Once that's completed, then that's the end of it,” Randy Chesler, president and CEO of the $13.7 billion-asset Glacier Bancorp, noted during the Kalispell, Mont., company’s call.

Glacier’s FDIC assessment fell by 68% from the second quarter, to $1.3 million. More credit could be recognized in the future.

Some banks, including the $12.3 billion-asset First Merchants in Muncie, Ind., which had a third-quarter credit, are modeling in higher assessment costs next year. The company surpassed $10 billion in assets in the first quarter.

Atlantic Union Bankshares in Richmond, Va.; Banner Corp. in Walla Walla, Wash.; CVB Financial in Ontario, Calif.; HomeStreet in Seattle; and Sandy Spring Bancorp in Olney, Md., were among the other banks that reported meaningful credits during the third quarter.

Overall, about $765 million in credits should be distributed to more than 5,000 banks.

The credits could prove a useful bridge for bankers searching for other ways to cut costs or boost revenue.

Margins are expected to stabilize at some point next year, as most banks set floors on floating-rate loans and as funding costs eventually decline. For now, analysts are looking for banks to increase fee income as much as they can in areas such as credit and debit cards, swap fees and treasury management. Cost control will also be a key factor.

“To the degree they have levers to pull, community banks will be doing everything they can to mitigate pressure on the spread side of the business,” said Stephen Scouten, an analyst at Sandler O’Neill.