Community banking

Community banking

-

Dennis Zember Jr. stepped down as the Georgia bank's CEO, citing personal matters. Palmer Proctor, an executive at the recently acquired Fidelity Southern, succeeded Zember.

July 1 -

The Pittsburgh regional, once among the most industry’s most active acquirers, hasn’t bought a bank in more than two years — and it’s in no rush to do so.

July 1 -

The digital bank has grand ambitions for its new student loan refinancing platform as it looks to finally turn a profit for its parent company, Customers Bancorp.

June 28 -

Consumer groups applauded the California bank's announcement.

June 28 -

Organizers of Community Bank of the Carolinas in Winston-Salem said that they will return capital to investors and pursue other alternatives, including buying an existing bank.

June 28 -

The accounting rules group is weighing whether to consolidate and push back deadlines for smaller firms to comply with credit-loss accounting change in light of concerns they will not be ready.

June 27 -

FB Financial is selling its correspondent lending channel to Rushmore Loan Management Services, which will complete the bank holding company's restructuring of its mortgage business.

June 27 -

The $550 million purchase will include a branch in the U.S. Virgin Islands.

June 27 -

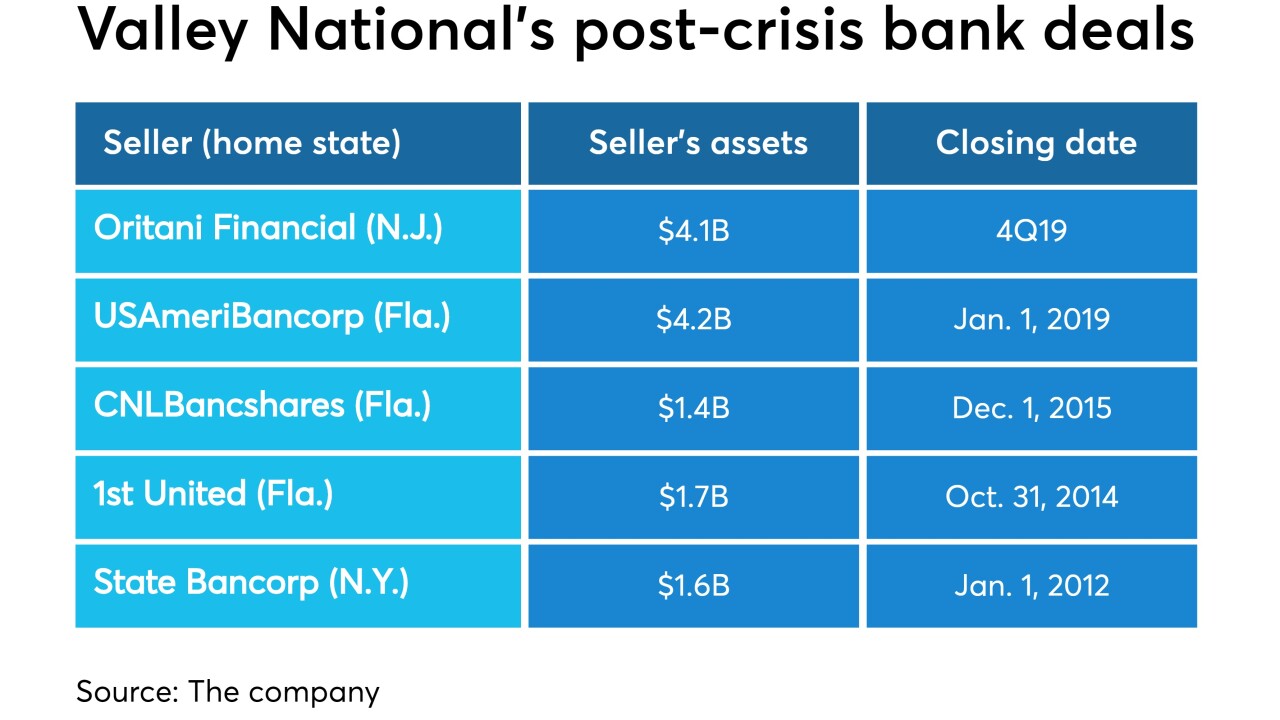

The New Jersey regional will have higher capital levels after buying Oritani Financial. That was just one of the reasons why CEO Ira Robbins overcame his aversion to M&A.

June 26 -

First American Bank agreed to sell its Iowa branches to GreenState just weeks after arranging the transfer of its Florida locations to another credit union.

June 26 -

Credit unions and the rest of the financial services sector, in the spirit of recent criminal justice reform, should be more open to hiring workers with low-level criminal convictions.

June 26 -

Valley, which had focused on Florida in recent years, will double its market share in Bergen County with the $740 million acquisition.

June 26 -

Ken Lehman recently bought a block of shares in Village Bank & Trust Financial.

June 26 -

Brad Goedken wants agreements for HarborOne Bancorp to include better protections, such as cost reductions if a service fails.

June 25 -

The number of minority depository institution charters is declining even as their financial performance is going up, according to a new study by the FDIC.

June 25 -

The biggest challenge for credit union acquirers involves retaining commercial customers at the banks they buy. That's why constant communication, and having more commercial products and services, matter.

June 25 -

The deal with Frandsen Financial is the 12th bank M&A transaction this year involving a seller in Wisconsin.

June 24 -

Seed, a San Francisco startup, has developed a platform that lets small businesses quickly open accounts online. That's an important feature for Cross River as it courts more fintech clients.

June 24 -

Shore Community Bank, which has five branches in Ocean County, will sell for $53 million.

June 24 -

Sterling Bancorp must enhance its BSA policies and hire an outside firm to review its account activity.

June 24