-

Banks dilemmas around sharing data and embracing open payments technology are becoming a more urgent concern in Europe due to regulatory pressure, and fintech firms are starting to take notice.

September 12 -

Regulators, analysts and investors are likely to take a thorough look at other banks' cross-selling tactics following Wells' settlement with federal agencies for illegally enrolling customers in products and services.

September 12 -

Cybersecurity enforcement efforts need to be better coordinated across government agencies, financial industry groups said in a letter Friday to the National Institute of Standards and Technology.

September 12 -

With fewer than 60 days until one of the most controversial elections in recent history, Congress is entering its second week back from recess. But questions remain as to how long the legislature will actually stick around before breaking for the general election.

September 12 -

State-chartered CUs now have full voting rights with the trade group something that was formerly only open to federally chartered credit unions.

September 12 -

Its become an all-too-familiar story a big bank is caught doing something bad, it pays a fine, some lower-level employees are let go while higher-level executives appear to get off scot free and no criminal charges are assessed. Many see that happening again at Wells Fargo.

September 9 -

Marketplace lenders that have partnered with banks face more scrutiny after a federal judge in California handed a legal victory last week to the Consumer Financial Protection Bureau.

September 9 -

The Federal Financial Institutions Examination Council has released updated cybersecurity guidance for bank examiners.

September 9 -

The settlement underscored how incentives and sales goals led employees to illegally open new accounts, transfer customer money to the accounts, and create PIN numbers and emails without customers' authorization, regulators said.

September 9 -

The Federal Financial Institutions Examination Council has released updated cybersecurity guidance for examiners at financial institutions.

September 9 -

Its well known that blockchain technology decentralizes decision making and fosters decision by consensus.

September 8 VirtusaPolaris

VirtusaPolaris -

Wells Fargos reputation as a consumer-friendly bank suffered a significant blow Thursday after it agreed to pay $190 million to settle charges that thousands of employees created unauthorized bank and credit card accounts for customers in order to collect bonuses for themselves.

September 8 -

CU trade groups have generally praised Jeb Hensarling's Financial Choice Act, though some analysts say it has little chance of becoming law.

September 8 -

The National Credit Union Administration announced a series meant to educate credit union board members on the fundamental concepts of strategic planning.

September 8 -

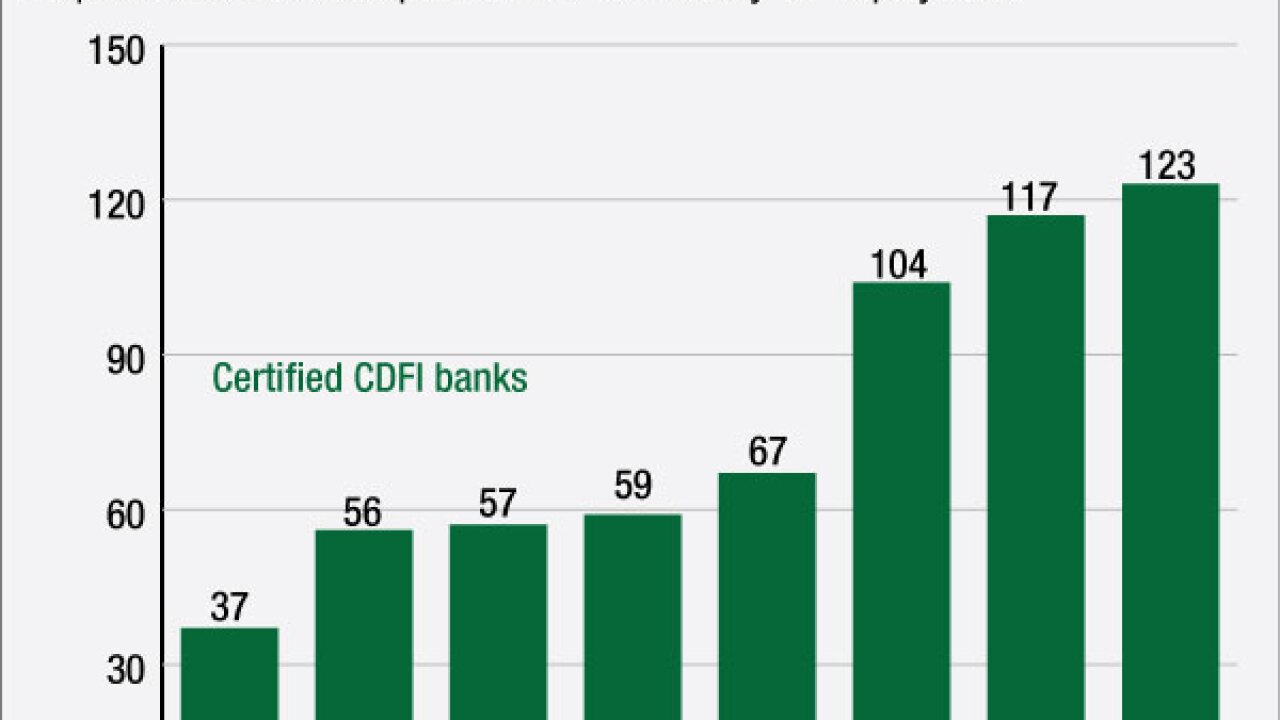

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

Trade groups cheered NCUAs long-awaited announcement of public budget hearings.

September 7 -

The trade group challenged the NCUA's member business lending rules enacted in February, but also hinted that it is prepared to file another lawsuit should the agency move forward with a separate regulation that would expand credit unions' field of membership.

September 7 -

The Federal Reserves structure and makeup and even geographical locations drew criticism from members of Congress and the public as favoring the wealthy and ignoring the conditions of ordinary Americans

September 7