-

The Consumer Financial Protection Bureau has appointed eight new credit union representatives to its Credit Union Advisory Council.

August 19 -

The Consumer Financial Protection Bureau on Thursday urged student loan servicers to provide more help to consumers who apply for income-driven repayment plans.

August 18 -

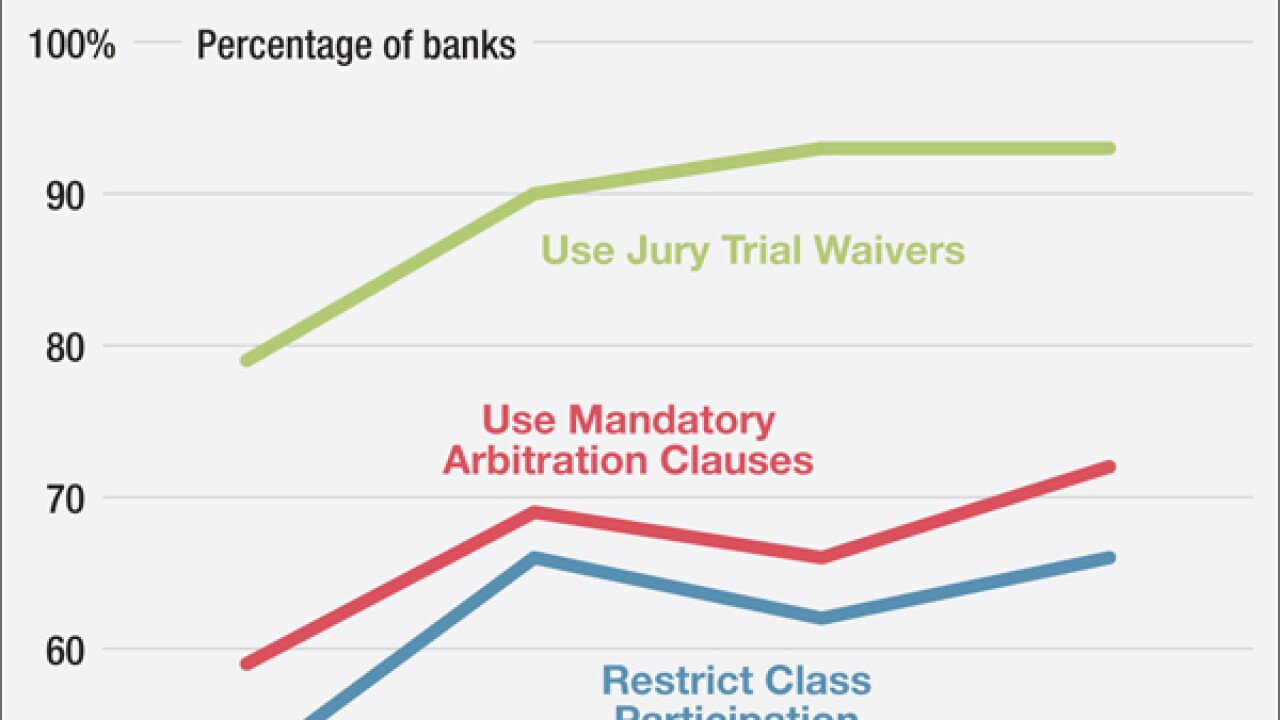

Industry representatives pushed back against a report that continues to paint a negative picture of arbitration clauses just as the Consumer Financial Protection Bureau plans to restrict such agreements.

August 18 -

For the first time, EMVCo, the card network-operated EMV standards body, has established an approval process to formally certify that contactless mobile payment devices can operate at EMV approved terminals.

August 18 -

Illinois Governor Bruce Rauner has signed two pieces of credit union-friendly legislation this summer amending the Illinois Credit Union Act and the state's Labor and Storage Lien Acts, effective immediately.

August 18 -

Call Report data shows a loss of more than $300,000 during the first two quarters of this year, following losses in 2014 and 2015.

August 18 -

The national credit union trade associations have joined with unlikely partners as co-signers on a letter that calls out the U.S. Department of Housing and Urban Development (HUD) over lending issues.

August 17 -

Congress and CU trade groups have questioned the CFPB on its interpretation of the Dodd-Frank Act's exemption authority, claiming the regulations have increased unnecessary burdens on credit unions and restricted services for consumers. The CFPB has fired back, stating the issue was addressed when Dodd-Frank was passed six years ago.

August 16 -

California state lawmakers have dropped plans for legislation this year to create a new license for bitcoin companies.

August 15 -

Industry trade groups react to call report modernization proposal and the CFPB posts a public comment request regarding TRID changes.

August 15