-

New requirements and guidance from the Payment Card Industry Security Standards Council will be released to merchants in April, which is about six months earlier than its normal update cycle.

March 3 -

Financial Services Committee approves bill requiring financial regulators to tailor rules to ensure they are appropriate for small FIs.

March 2 -

The pace of new regulations appears to be slowing slightly in 2016, but that does not mean the regulatory burden on credit unions is lessening.

March 2 -

The Consumer Financial Protection Bureau on Wednesday ordered online payment processor Dwolla Inc. to pay a $100,000 fine for deceiving customers about its security practices the first action it has taken related to data security.

March 2 -

NCUA Board Member McWatters nomination to Export-Import Bank must go through Senate Banking Committee, which the senator chairs.

March 2 -

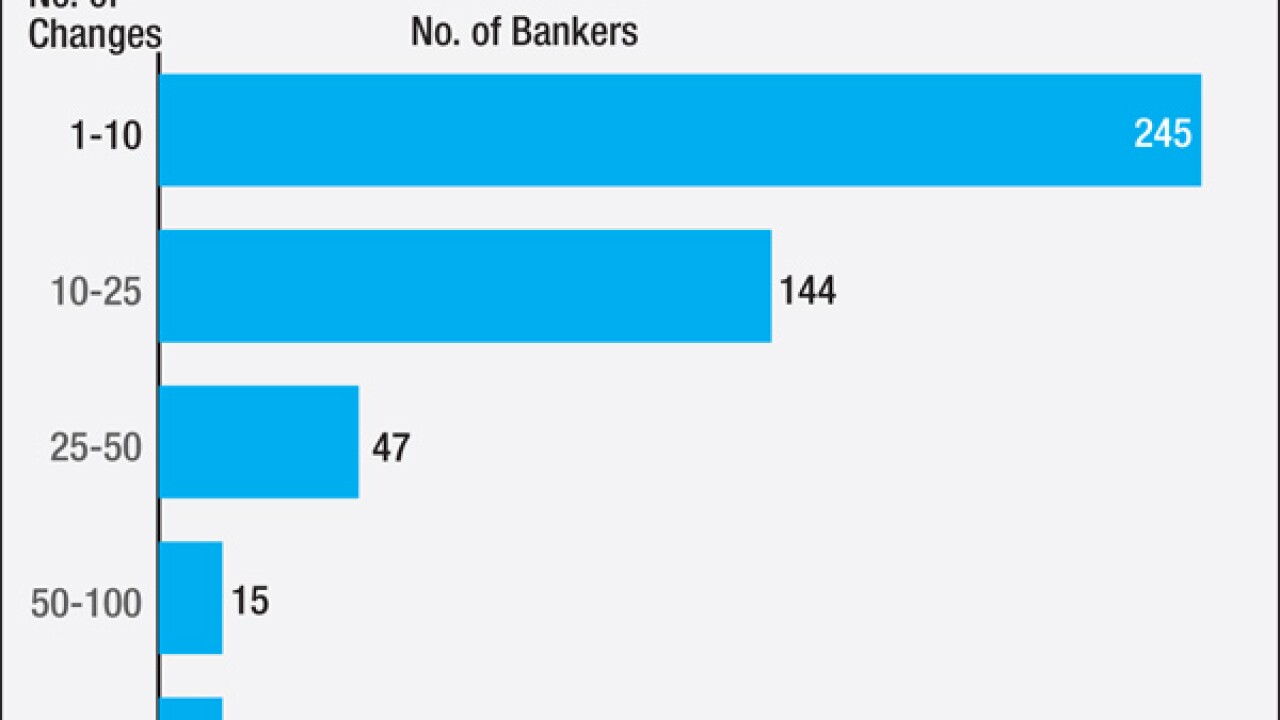

Bankers are still grappling with vendor software problems, longer processing times and delays in mortgage closings as a result of new disclosures that went into effect four months ago, according to a new survey by the American Bankers Association.

March 1 -

WASHINGTON The House Financial Services Committee will hold a vote Wednesday on a credit union-backed bill that would provide regulatory relief for financial institutions that are not considered systemically important.

March 1 -

The mortgage servicer said it has received letters from the Securities and Exchange Commission regarding separate probes into its collection practices and fees.

March 1 -

National Credit Union Administration announces the Temporary Corporate Credit Union Stabilization Fund received its seventh consecutive "clean" audit opinion.

March 1 -

NCUA issued its prohibition orders for the month of February, prohibiting four people from employment and activity in the affairs of any federally insured financial institution.

February 29