-

Payment technology provider Stripe aims to equip global entrepreneurs with the necessary banking and payments relationships to launch an online business in the U.S.

February 24 -

Director of Consumer Financial Protection Bureau makes appeal to CUs to work with his agency; says they have 'much ground in common.'

February 24 -

The top leaders of the National Credit Union Administration said Tuesday that they support an alternative option that would allow credit unions to merge some operations.

February 24 -

Nearly 5,000 credit union advocates are in Washington for the Credit Union National Associations Governmental Affairs Conference this week. Keynote speakers include Lisa Bodell, Ted Koppel and a 2016 Elections Point-Counterpoint with Paul Begala and Mike Murphy. Key policymakers include CFPB Director Richard Cordray, NCUA board members Debbie Matz, J. Mark McWatters and Rick Metsger as well several U.S. senators and representatives.

February 23 -

Western Union Co. is at the center of a preliminary European Union antitrust inquiry into allegations the company colluded with banks to drive rivals out of the multibillion dollar money-transfer market.

February 23 -

With the stakes so high for compliance officers, their rights and responsibilities should be clearly defined, including a safe harbor for those who play by the rules.

February 22 Orrick

Orrick -

Online gambling is like gun shows and weedlegal and very lucrative, though with enough regulatory baggage that most service providers are reluctant to go near them.

February 22 -

WASHINGTON A public interest coalition is calling on financial regulators to declare the drinking water contamination in Flint, Mich. a "disaster" and encourage lenders from around the nation to extend credit to the area to counteract the damage.

February 19 -

Even as credit unions continue to urge NCUA to revert to an 18-month examination cycle, federal bank regulators unveiled an interim final rule Friday allowing highly-rated community banks to qualify for an 18-month examination cycle.

February 19 -

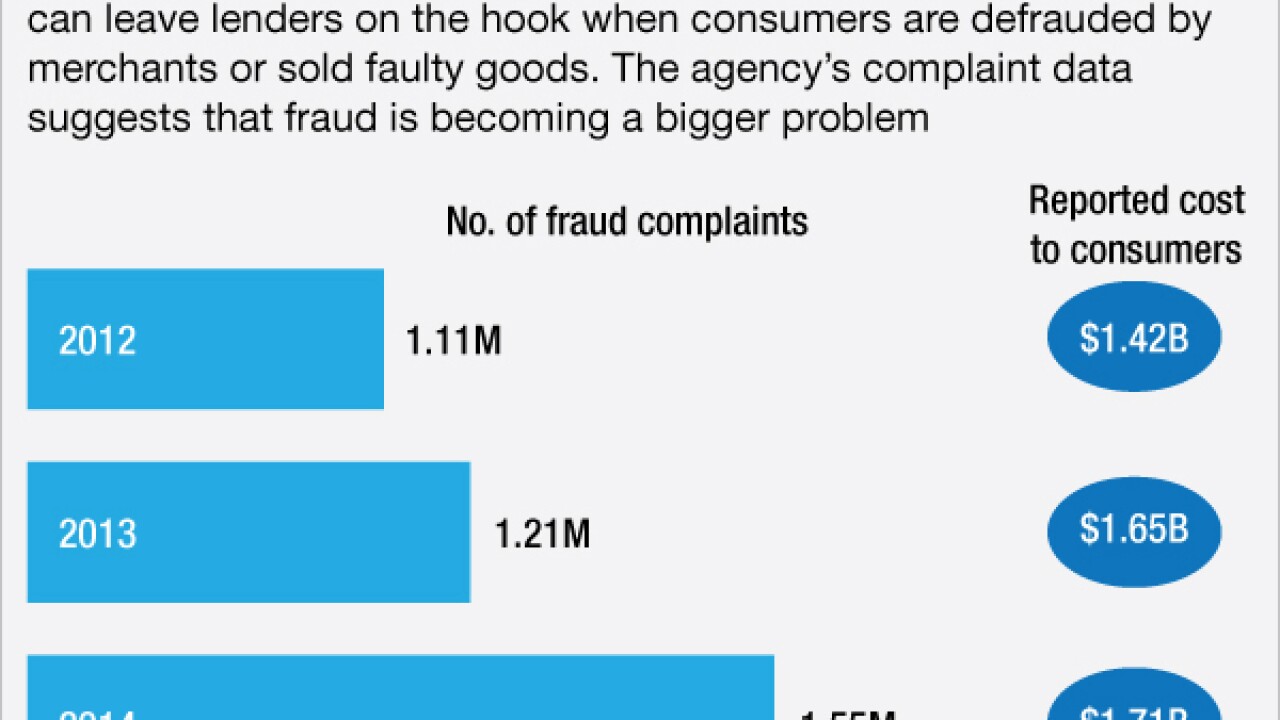

Shoppers who finance the purchase of cars, furniture and home improvements are protected under a decades-old federal regulation. Now consumer groups are urging the FTC to update its rule and consider offering the same protections to victims of home-mortgage or auto-leasing scams.

February 19