-

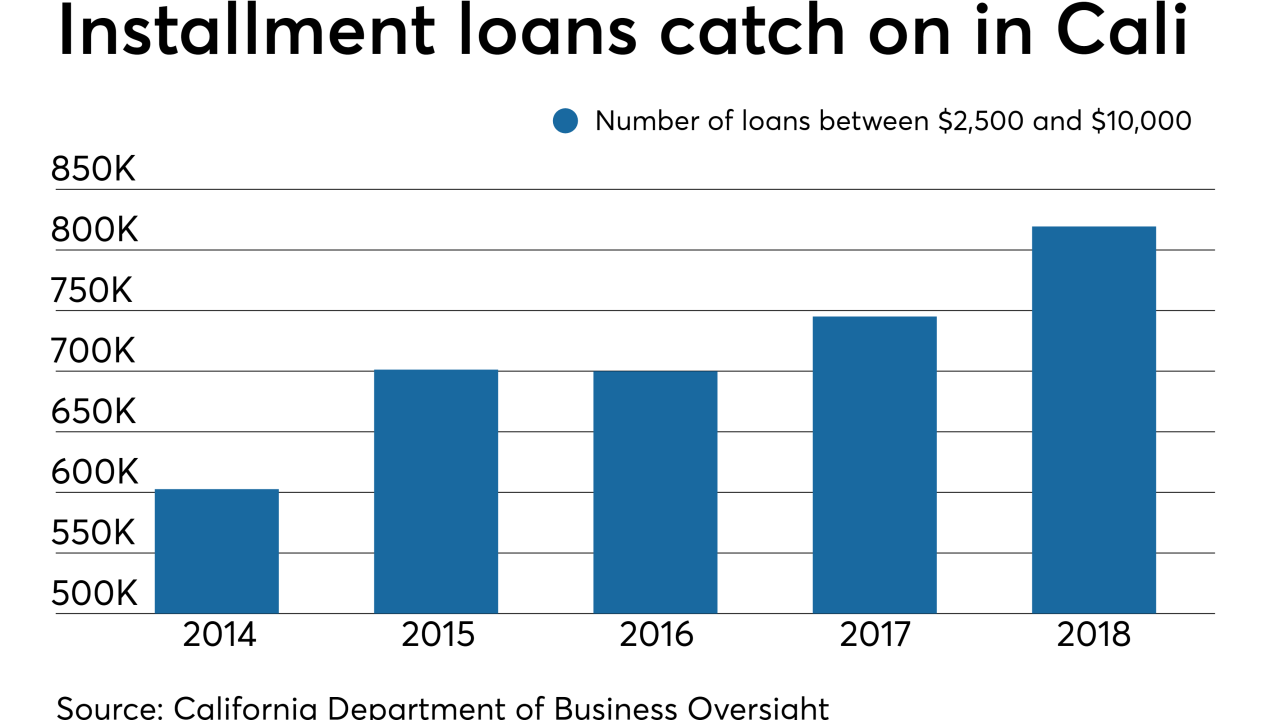

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

New York and 10 other states are looking into whether companies in the fast-growing sector are violating payday lending laws.

August 7 -

The card company is buying the corporate-services businesses of Danish payments provider Nets A/S; the online lender’s stock plunged after it missed second quarter earnings expectations.

August 7 -

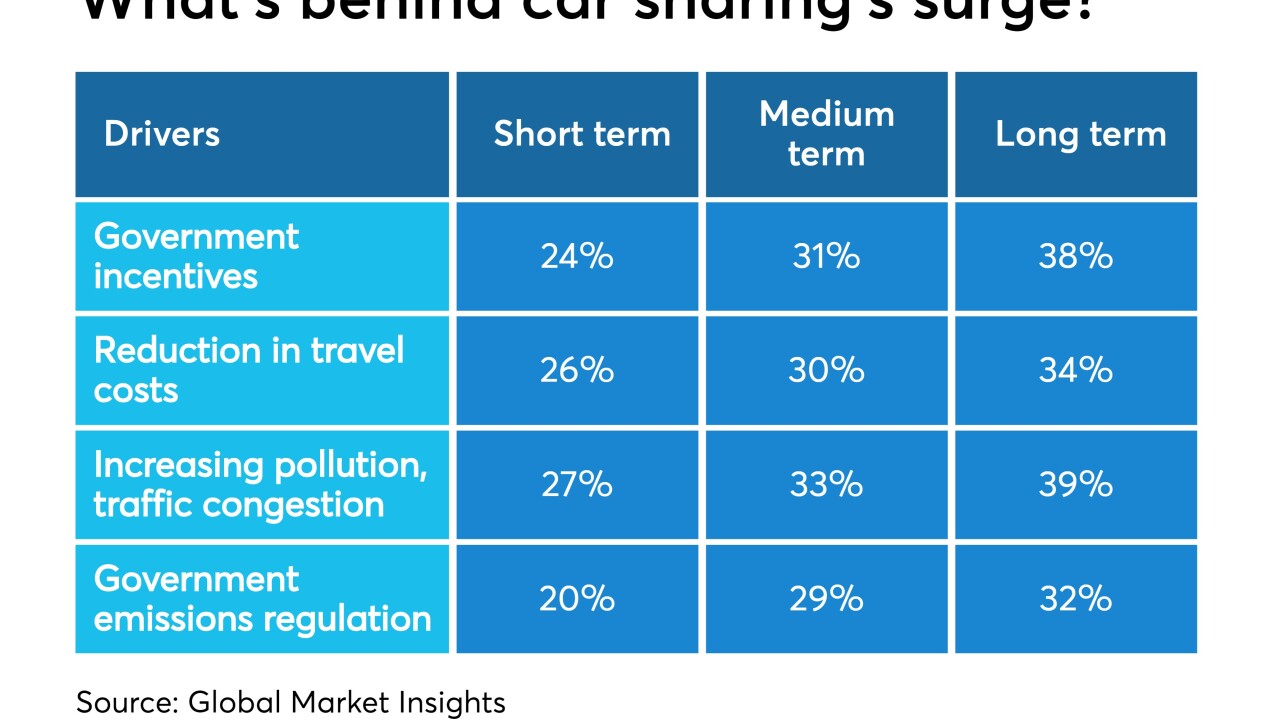

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The CFPB is giving the public an additional 30 days so consumer groups have more time to respond.

August 2 -

“Digital Vault” will allow customers to store encrypted documents on third-party servers; bank accuses Orcel of misdeeds.

July 26 -

State and federal authorities say the network of firms in upstate New York sought debts that consumers weren't obligated to pay and impersonated government officials, among other things.

July 25 -

Total loan volumes at institutions in both states increased by more than 1%, far above the national rate.

July 24 -

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22 -

On Mar. 31, 2019. Dollars in thousands.

July 22 -

On Mar. 31, 2019. Dollars in thousands.

July 22 -

Finance ministers call for tight regulation of cybercurrencies; Williams says the Fed must “act quickly to lower rates at the first sign of economic distress.”

July 19 -

The credit card issuer reported expense growth that rose faster than net interest income during the second quarter.

July 18 -

In a registration statement filed with the SEC, the company revealed new details about its financial performance and its growth plans.

July 18 -

Credit unions reported gains in a number of key areas but member business lending and new auto loans took a hit as overall growth continued to slow.

July 18 -

The company, which announced the conclusion of a three-year-old credit card partnership with TD Bank, is shifting to digital financing of individual consumer purchases.

July 18 -

Alleged discrimination over immigration status is the latest legal headache for Wells Fargo.

July 17 -

The company revealed its pretax losses for its forays into consumer and other digital banking services, which began in 2016 with the launch of a consumer deposit franchise and an installment loan product.

July 16 -

William Mellin will serve as a lending institution representative on the task force, which will evaluate the evolution of the taxi medallion industry.

July 12