-

Wider net interest margins compared to a year earlier helped make up for a slight decline in loan balances, as nearly two-thirds of banks reported higher profits in the first quarter.

May 29 -

The scandal-plagued bank announced Wednesday that it is adding a board member with deep experience in accounting. It is also considering a switch to flat pricing in indirect auto lending, a change long favored by consumer advocates.

May 29 -

Currently, the maximum a federal credit union can charge on most loans is 18%. But a proposal from Sen. Bernie Sanders and Rep. Alexandria Ocasio-Cortez to lower that to 15% on consumer credit could reduce access, experts said.

May 29 -

Better analytical tools could help banks spot and address potential issues before a customer goes delinquent.

May 28 FICO

FICO -

Borrowers with poor credit make up less than 15% of the industry's total auto loan portfolio. That has shielded CUs from some delinquency issues, but some say it raises questions about whether the movement is reaching the consumers it was chartered to serve.

May 28 -

Kathy Kraninger, the bureau's director, is in a standoff with Democrats about her claim that the agency cannot supervise institutions under the Military Lending Act.

May 27 -

CUNA and NAFCU have filed amicus briefs supporting the world’s largest credit union in a suit they say could set a precedent for CUs across the country.

May 23 -

As part of the deal, the agency summarized its policy on account terminations and issued a letter acknowledging that some employees “acted in a manner inconsistent with FDIC policies with respect to payday lenders.”

May 22 -

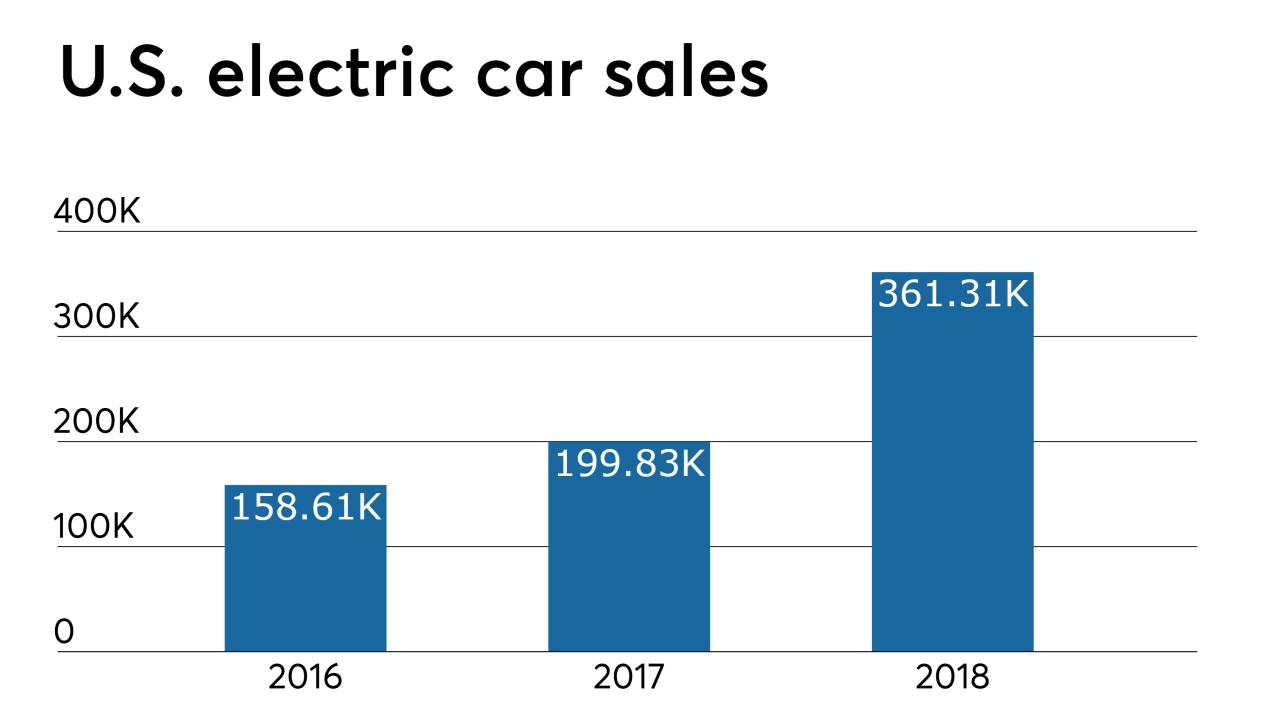

All-electric, zero-emission vehicles make up less than 2% of the market, but a handful of credit unions see an opportunity despite some unusual variables.

May 22 -

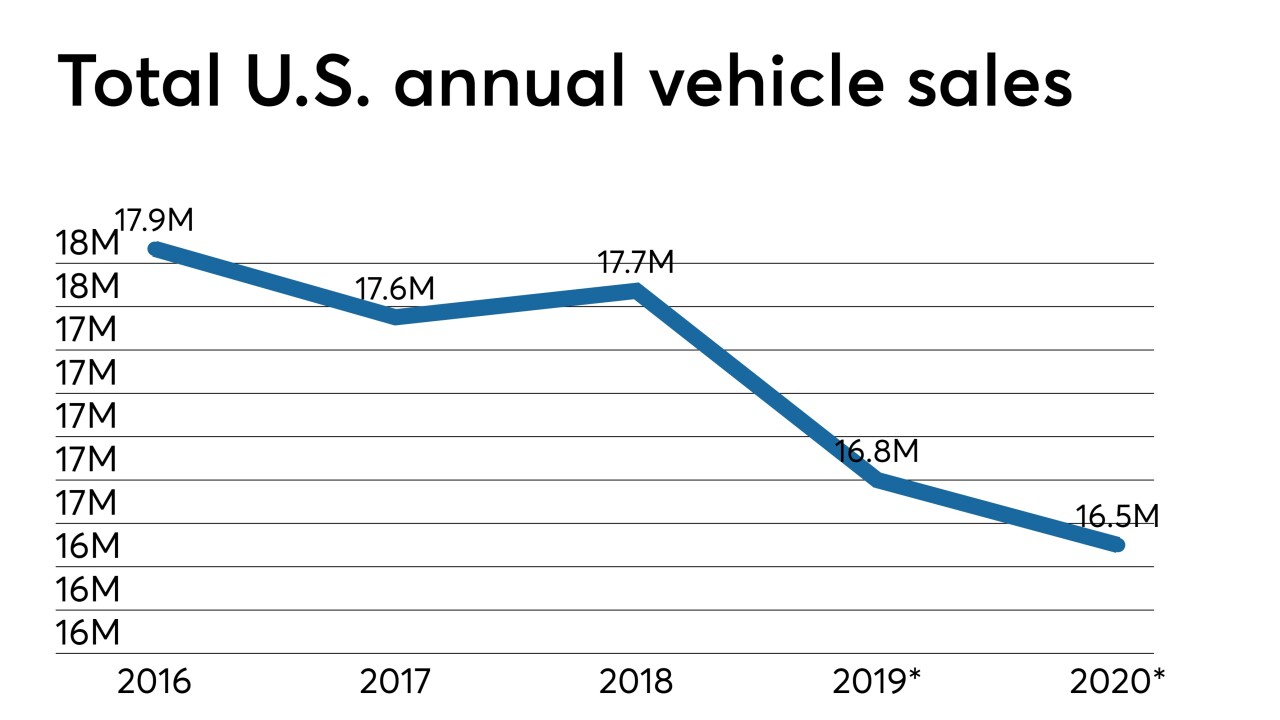

Credit union executives reported seeing an uptick in car loans as the weather improved but some predicted lending would be down this year.

May 21 -

Mainland-based credit unions with operations in the territory witnessed a surge in auto lending after Hurricane Maria ravaged the island but demand for these loans seems to be ticking down.

May 21 -

From data analytics to focusing on a service culture and more, here's a look at how technology is radically remaking lending.

May 20 -

A year after trying to save faltering payday lender Wonga, Balderton Capital is investing in the other side of the model by leading a $19 million Series A funding round in Wagestream, a U.K. startup that provides flexible payroll technology to avoid payday loans.

May 20 -

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

The AGs say the agency's plan to rescind ability-to-repay requirements for payday loans would undermine states' ability to enforce their own laws.

May 17 -

As CFPB mulls privatizing database, consumer complaints are on the rise; an argument for continued human oversight of artificial intelligence; how some banks are luring talent from big tech; and more from this week's most-read stories.

May 17 -

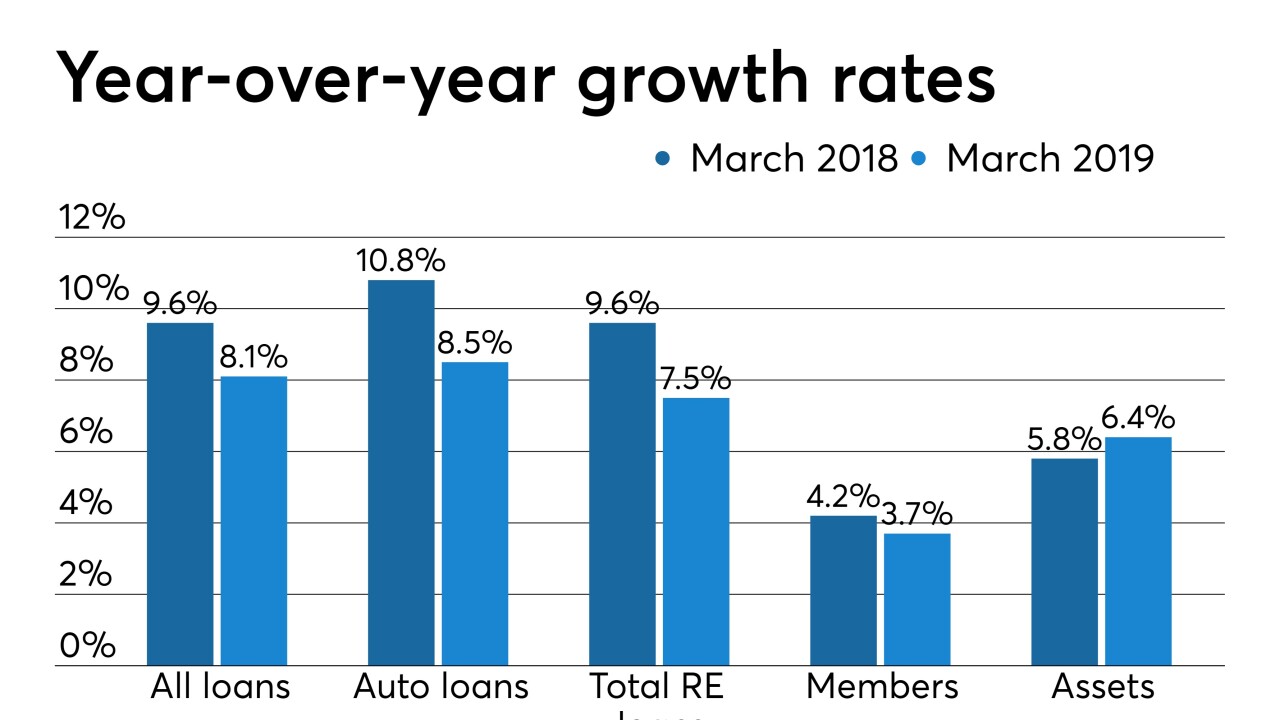

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

Regions Financial said Thursday that it will not renew its contract with GreenSky — a move analysts say could prompt other banks to re-examine their lending arrangements with the fintech.

May 16 -

The official told lawmakers Thursday that the research underlying the bureau's 2017 payday rule proposal did not support strict underwriting requirements of small-dollar loans.

May 16 -

Recent letters from NAFCU and CUNA called on the Consumer Financial Protection Bureau to provide a carve out in its payday lending rule for loans made by credit unions.

May 16