-

Community banks that were pushed past key asset limits by the Paycheck Protection Program say they will be unable to shrink their balance sheets back to normal size by the 2022 deadline, especially if there is a new round of rescue aid.

November 25 -

Big banks and other financial firms predict the cost of warding off cybercriminals will keep climbing in 2021 as they work to secure digital financial services popularized by the pandemic.

November 24 -

Improvements have been made in reducing the number of unbanked households over the past few years, but progress hasn't been even across different communities. There are also new obstacles coming to light, as COVID-19 drives more banks and consumers to digital channels to acquire and service new financial products.

November 24 -

The risk of catching COVID-19 through using banknotes is low, according to research by the Bank of England that suggests the aversion to using cash during the pandemic is unnecessary.

November 24 -

As COVID-19 infections break records nationwide, some banks are once again closing lobbies. But many others are maintaining the status quo after instituting a host of safety protocols that didn’t exist in the spring.

November 23 -

Yellen, the former head of the Federal Reserve, would become the first woman to hold the nation’s top economic policy job just as the coronavirus pandemic threatens another downturn.

November 23 -

PayPal Holdings Inc. employees will probably spend more time working from home even after the coronavirus pandemic is over.

November 23 -

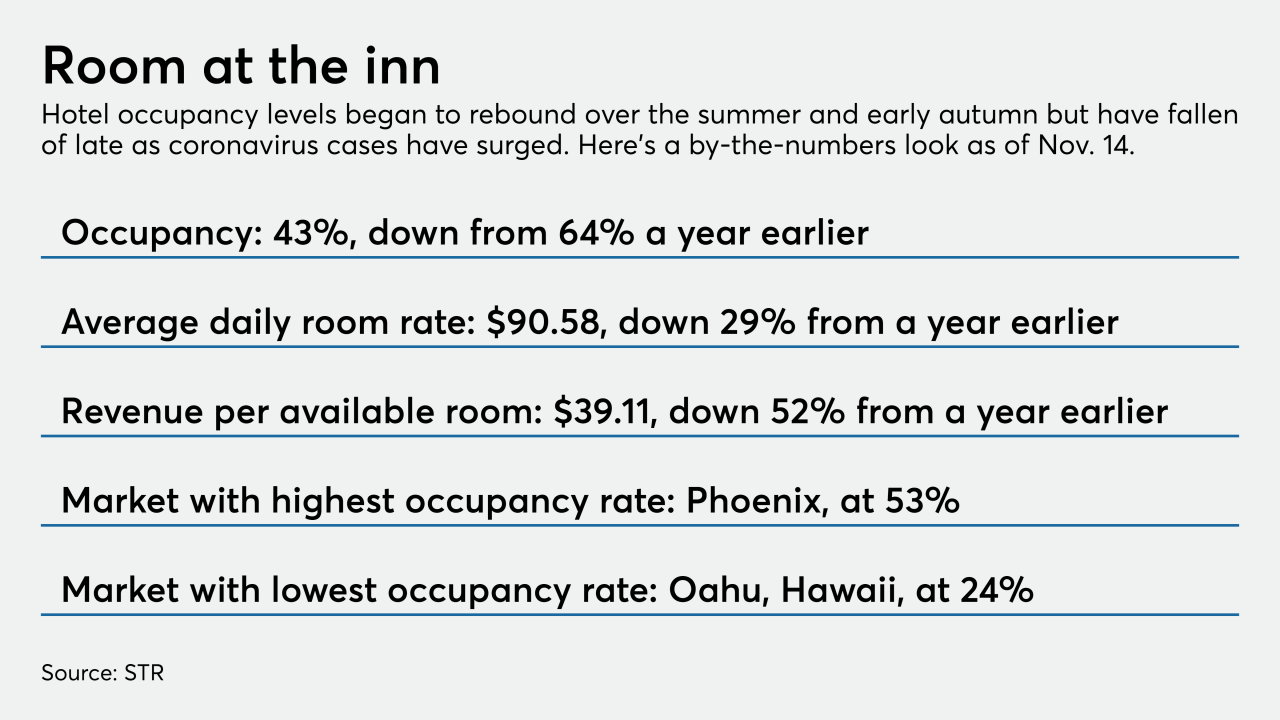

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Banks have made great strides in applying digital technology to the world of checks, but companies that receive checks still have to physically receive them in order to digitize them, says Santander's Greg Murray.

November 23Santander -

In 2017 the creators adapted the technology into a touchless restaurant order-and-pay system that’s seen exponential demand during the pandemic, as dining establishments race to replace paper menus and card payment devices with contactless alternatives.

November 23