-

Since the pandemic began, many members of small credit unions have defected to banks that offer better digital products and services. The credit unions are focusing on in-person banking or catering to small businesses and other niches to rebuild their customer base.

November 1 -

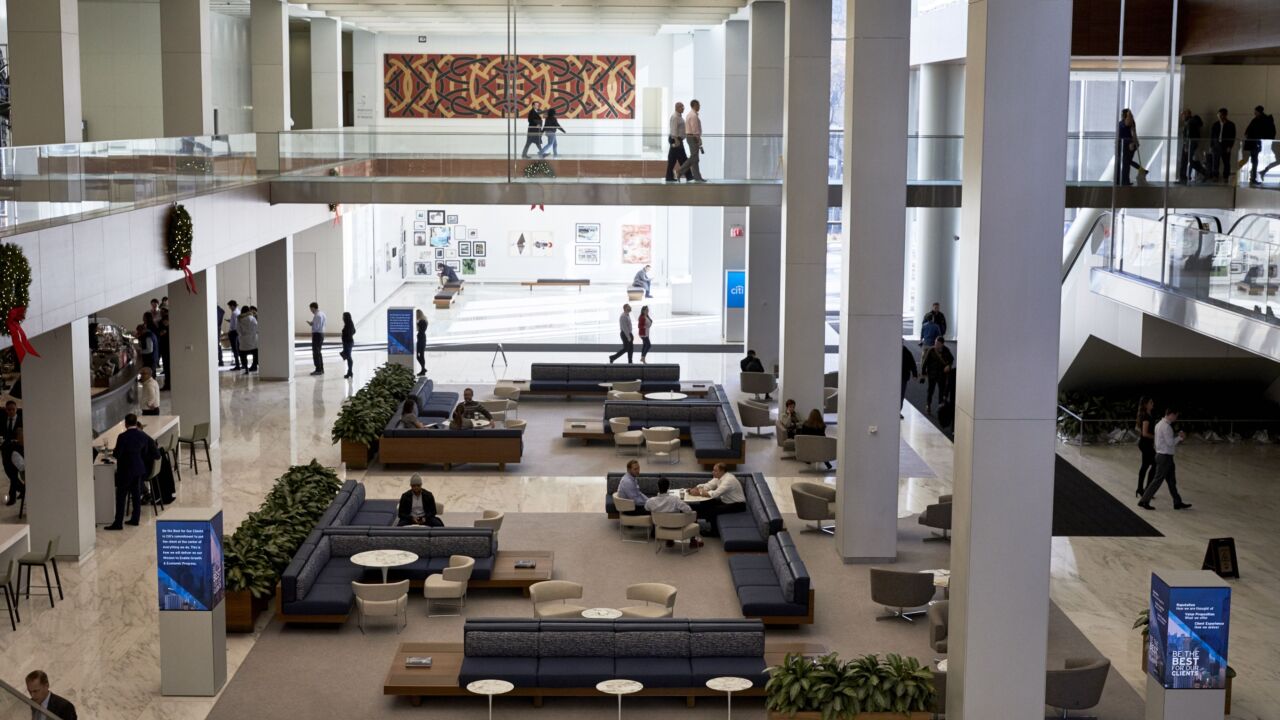

Citigroup will require all U.S. employees be vaccinated against COVID-19 as a condition of their employment, citing new orders from President Biden.

October 28 -

Toronto-Dominion Bank is thanking employees for their pandemic-era resilience with a new reward: a piece of the company.

October 28 -

Lending momentum is building and tourists have come back, but the coronavirus is a lingering concern for a state that relies heavily on vacationers.

October 27 -

American Express will allow employees to work from wherever they want at least four weeks a year as part of the company’s push to offer greater flexibility even after the pandemic subsides.

October 18 -

Capital One Financial delayed reopening its offices until sometime next year as the delta variant continues to upend banks’ plans to fully repopulate workplaces across the U.S.

October 7 -

Bank of America is offering $200 awards to Merrill Lynch Wealth Management branch employees who return to the workplace and confirm they’re fully vaccinated against COVID-19.

October 6 -

The company will now begin bringing back staffers who have been working remotely on Oct. 18, rather than Oct. 4, according to an internal memo Wednesday from Chief Operating Officer Scott Powell.

September 1 -

Some banks and credit unions, once hopeful of a swift end to the pandemic, are beginning to toughen credit underwriting and rethink growth strategies as if the coronavirus will influence the economy for years to come.

August 26 -

The more stringent safety measures, announced to staff on Tuesday, signal escalating caution at Goldman, which greeted the return of employees in June with live music and food trucks.

August 24 -

The banks reported fiscal third-quarter results that topped analysts’ estimates on gains in domestic personal and business loans as well as continued strength in the Canadian housing market.

August 24 -

The COVID-19 pandemic has exacerbated income inequality in America, and that has implications for banks and other lenders. Among those suffering most: renters, front-line workers and minority small-business owners.

August 23 -

Community banks have played and will continue to play a key role in supporting local economies across the country. Join us in a lively conversation with Dennis E. Nixon, President & CEO of International Bank of Commerce (Laredo, Texas) & Chairman, International Bancshares Corporation and Eddie Aldrete, Senior Vice President at International Bank of Commerce as we discuss: (1) the need for bankers and the business community to become involved in political issues. From minimum wage and issues that affect small businesses to regulatory issues that directly affect the banking industry, banking and business leaders need to be thought leaders in the public conversation and (2) how bankers can play a pivotal advocacy role in the free trade process.

-

The regional Fed bank said it was making the move “due to the recently elevated COVID-19 health risk level in Teton County, Wyoming.”

August 20 -

Bankers are hopeful that the rebound in oil prices and a spike in natural gas use are precursors to more borrowing. But banks are maintaining above-average levels of reserves in case the delta variant stifles economic momentum.

August 20 -

The Boston-based firm plans to close its two midtown Manhattan offices, the company said. Its New York-based staff will work remotely or from buildings in New Jersey and Connecticut.

August 16 -

The announcement came a day after Citigroup said it would mandate vaccines for many of its workers. Capital One also said it is delaying its office reopening.

August 11 -

The influx that began around the start of the pandemic has yet to subside, as loan demand remains weak even though consumers are again spending money. Some of the excess liquidity now seems likely to remain for a long time, forcing banks to make tough calls about how and when to deploy it.

August 9 -

Local financial institutions have fewer branches than big banks, and closing even one location makes it harder for them to serve their communities.

August 9 -

The largest U.S. bank, which often sets policies ultimately adopted by the broader financial industry, announced the change in a memo to staff Friday.

August 6