-

Revised legislation would exclude credit unions from Community Reinvestment Act requirements, but could make the National Credit Union Administration the de facto enforcer of how CUs meet the needs of underserved markets.

March 18 -

Recounting her family’s financial struggles, Jelena McWilliams said regulatory policy should address the plight of the underbanked.

March 14 -

The Federal Reserve and Federal Deposit Insurance Corp. will hold two public meetings to consider the deal's impact on the U.S. banking system.

March 14 -

The 2020 presidential hopeful removed the contentious provision from a previous version of the bill that had won praise from bankers but sparked fierce opposition from credit unions.

March 13 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

With the two companies said to be still mulling which charter to seek, the various options each have possible advantages and drawbacks.

February 27 -

Lawmakers on the Senate Banking Committee pushed Federal Reserve Chair Jerome Powell for details about how he plans to review the proposed merger between the two regional banks.

February 26 -

Criticism of the National Credit Union Administration is unwarranted given the myriad of abuses banks commit.

February 14

-

The National Credit Union Administration has become too soft on the industry it is supposed to regulate. A hearing on two board nominees is a chance for Congress to change this.

February 13 Iowa Bankers Association

Iowa Bankers Association -

The company on Monday also announced an initiative to boost economic opportunities for African-Americans that will focus on job training, career-leadership pathways and wealth building.

February 11 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

After essentially failing its 2013 CRA exam, BBVA Compass embarked on an ambitious plan to achieve the highest possible CRA grade. Here’s how it succeeded.

February 6 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

A Financial Services subcommittee planned by Democrats to root out discrimination and expand financial inclusion could put institutions on the hot seat, but it could also foster regulatory relief.

January 7 -

A Financial Services subcommittee planned by Democrats to root out discrimination and expand financial inclusion could put banks on the hot seat, but it could also foster regulatory relief.

January 7 -

The Office of the Comptroller of the Currency advanced the ball last year by collecting public feedback on modernizing the law, but all three federal bank regulators will have to reach consensus on a formal proposal.

January 3 -

From stress tests to tailoring the Dodd-Frank Act to the Volcker Rule, the banking agencies have a number of important proposals to finalize in the coming year. But there are several potential obstacles that could throw those plans off track.

December 26 -

Readers respond to one fintech startup's tough talk, debate failed plans to change the Consumer Financial Protection Bureau's name, weigh reforms to the Community Reinvestment Act and more.

December 20 -

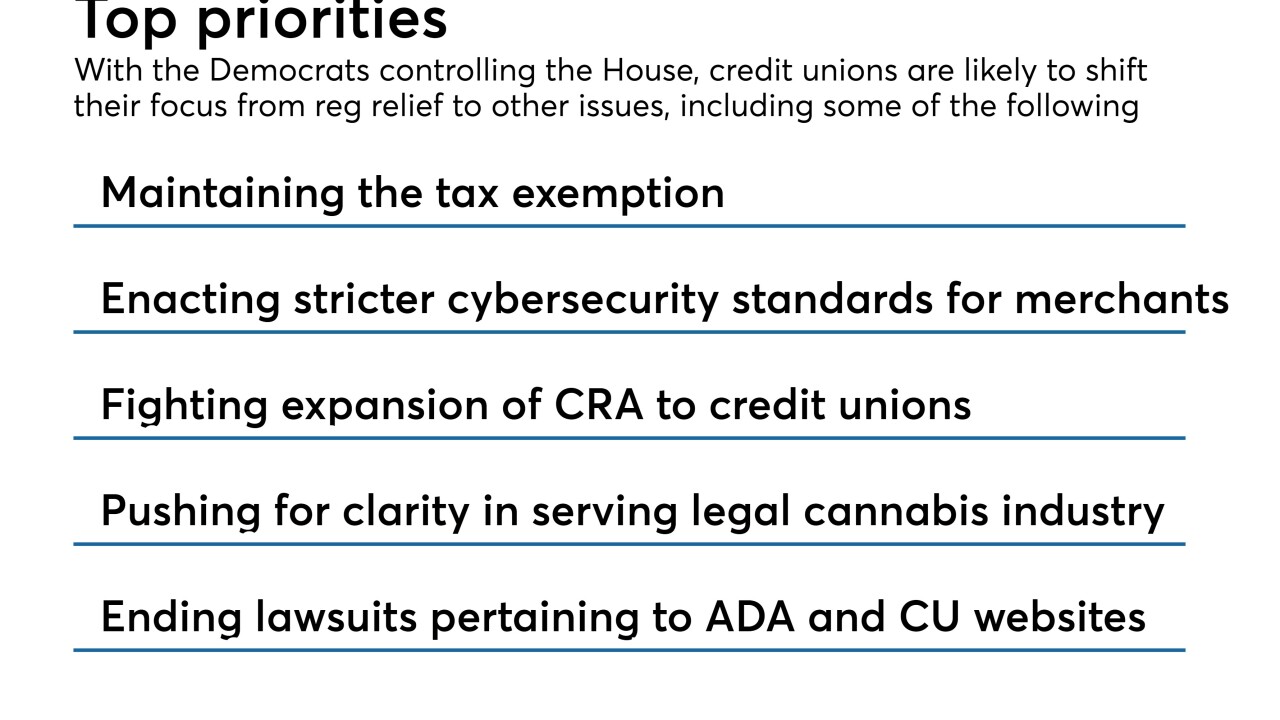

With control of the House changing hands in January, credit unions are set to shift their focus from regulatory relief to cybersecurity and fighting CRA.

December 18 -

Any serious discussion of how best to update the Community Reinvestment Act for the 21st century must focus on strengthening the law, not eliminating it.

December 13