-

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

After essentially failing its 2013 CRA exam, BBVA Compass embarked on an ambitious plan to achieve the highest possible CRA grade. Here’s how it succeeded.

February 6 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

A Financial Services subcommittee planned by Democrats to root out discrimination and expand financial inclusion could put institutions on the hot seat, but it could also foster regulatory relief.

January 7 -

A Financial Services subcommittee planned by Democrats to root out discrimination and expand financial inclusion could put banks on the hot seat, but it could also foster regulatory relief.

January 7 -

The Office of the Comptroller of the Currency advanced the ball last year by collecting public feedback on modernizing the law, but all three federal bank regulators will have to reach consensus on a formal proposal.

January 3 -

From stress tests to tailoring the Dodd-Frank Act to the Volcker Rule, the banking agencies have a number of important proposals to finalize in the coming year. But there are several potential obstacles that could throw those plans off track.

December 26 -

Readers respond to one fintech startup's tough talk, debate failed plans to change the Consumer Financial Protection Bureau's name, weigh reforms to the Community Reinvestment Act and more.

December 20 -

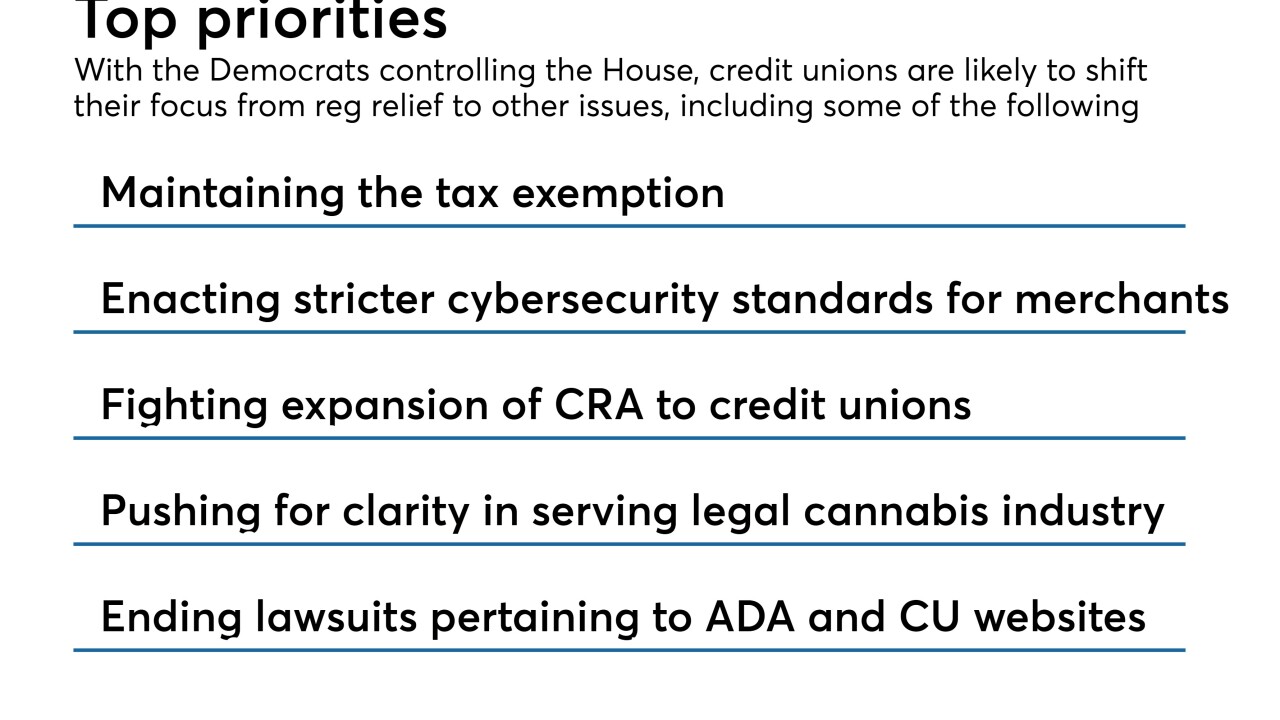

With control of the House changing hands in January, credit unions are set to shift their focus from regulatory relief to cybersecurity and fighting CRA.

December 18 -

Any serious discussion of how best to update the Community Reinvestment Act for the 21st century must focus on strengthening the law, not eliminating it.

December 13

-

More acquainted with the quick decision-making style of the banking world, the comptroller of the currency found a policymaking environment in D.C. that moves at a slower pace.

December 12 -

Readers sound off on the CFPB's name change, whether the Post Office should be allowed to engage in banking services and the FDIC's call to revamp the de novo process.

December 6 -

Regulators are considering reforms to the Community Reinvestment Act, but it’s not clear that the law is needed anymore.

December 3 Cato Institute

Cato Institute -

Zions' Harris Simmons named Banker of the Year; distilling the hopes and hang-ups around CRA reform; new grist in still ongoing debate over Operation Choke Point; and more from this week's most-read stories.

November 30 -

Regulators have yet to issue a formal plan for updating the Community Reinvestment Act, but a list of questions about the reform effort issued by the Office of the Comptroller of the Currency has produced a treasure trove of public feedback.

November 26 -

Regulators have yet to issue a formal plan for updating the Community Reinvestment Act, but a list of questions about the reform effort issued by the Office of the Comptroller of the Currency has produced a treasure trove of public feedback.

November 25 -

On the verge of controlling the Financial Services Committee, House Democrats criticized proposed changes to the Federal Reserve Board's post-crisis supervision program.

November 14 -

The head of the Consumer Bankers Association lays out four industry priorities for the regulatory push to overhaul the Community Reinvestment Act.

November 8

-

The focus since the 2016 election on easing rules, tax cuts and expanding access to credit is about to be turned on its head.

November 6 -

The presumptive chair of the House Financial Services Committee will likely take the panel in a sharply new direction and have a new bully pulpit to criticize the Trump administration.

November 6