-

With a Democrat set to take the White House in January, the agenda for agencies like the CFPB could undergo a rapid transformation, housing finance reform could be turned on its head and progressive banking ideas that were unthinkable over the past four years could gain traction.

November 7 -

The agency overreached in its proposal to revamp the Community Reinvestment Act when it should have simply required branchless banks to invest more in areas where deposits are taken.

October 28 K.H. Thomas Associates

K.H. Thomas Associates -

The agency's May rule modernizing the Community Reinvestment Act had deferred action on establishing numeric metrics for meeting the law's requirements, but acting Comptroller of the Currency Brian Brooks said banks will soon get more clarity in a follow-up proposal.

October 26 -

USAA Federal Savings Bank’s downgrade shows how customer mistreatment stemming from flaws in internal controls can hurt Community Reinvestment Act scores. Some want consumer compliance to carry more weight in the CRA calculus.

October 21 -

Delaying a proposed benchmark for grading banks' performance in Community Reinvestment Act exams to appease critics of its initial proposal will make it harder to gauge the final rule’s impact.

October 21 Buckley LLP

Buckley LLP -

House Democrats had already approved a measure blocking the regulation reforming the Community Reinvestment Act, but the resolution faced more resistance in the upper chamber.

October 20 -

Lawmakers’ attempt to stall the OCC’s final rule, preventing regulators from reforming a 1977 law meant to help underserved communities, does far greater harm than any changes that are raising objections, says the acting comptroller.

October 19

-

USAA's regulatory troubles now include OCC fine, CRA downgrade; Citi CEO Michael Corbat and CFO Mark Mason dodged questions on cost of risk overhaul; PNC unlikely to buy a digital bank, CEO Demchak says; and more from this week's most-read stories.

October 16 -

While the two agencies have disagreed on key areas of reforming the Community Reinvestment Act, the acting comptroller of the currency said there is commonality between their two approaches and he has not given up on developing a joint plan.

October 1 -

The agencies are still at odds over how to reform the scoring system in Community Reinvestment Act exams, but experts say the central bank’s recent draft proposal suggests a deal could be struck.

October 1 -

Waiting for the SBA to sign off on PPP loan forgiveness; banks criticized for requiring balloon payments on loans in forbearance; how backlash over Scharf remarks affects Wells Fargo’s diversity push; and more from this week’s most-read stories.

September 25 -

The central bank's proposal to overhaul the Community Reinvestment Act differs markedly from the OCC's regulation in testing, data collection and other areas.

September 21 -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

The Federal Reserve Board will discuss an advance notice of proposed rulemaking on the Community Reinvestment Act at an open meeting. The central bank had previously declined to support an OCC rule overhauling the 1977 law.

September 17 -

The four-year plan submitted as part of its acquisition of E-Trade includes grants to community development organizations and support for uniform vendor diversity standards.

September 11 -

Bank of America announced how it plans to spend a third of its $1 billion commitment to address racial and economic inequities and the effects of the coronavirus pandemic in communities of color.

September 8 -

A three-stage plan combining data analysis, public disclosure and market-based regulatory intervention would better align financial services with what consumers really need.

September 2

-

The Dallas regional is placing deposits in several minority depository institutions, providing each with low-cost funds that can be redeployed in underserved communities.

August 19 -

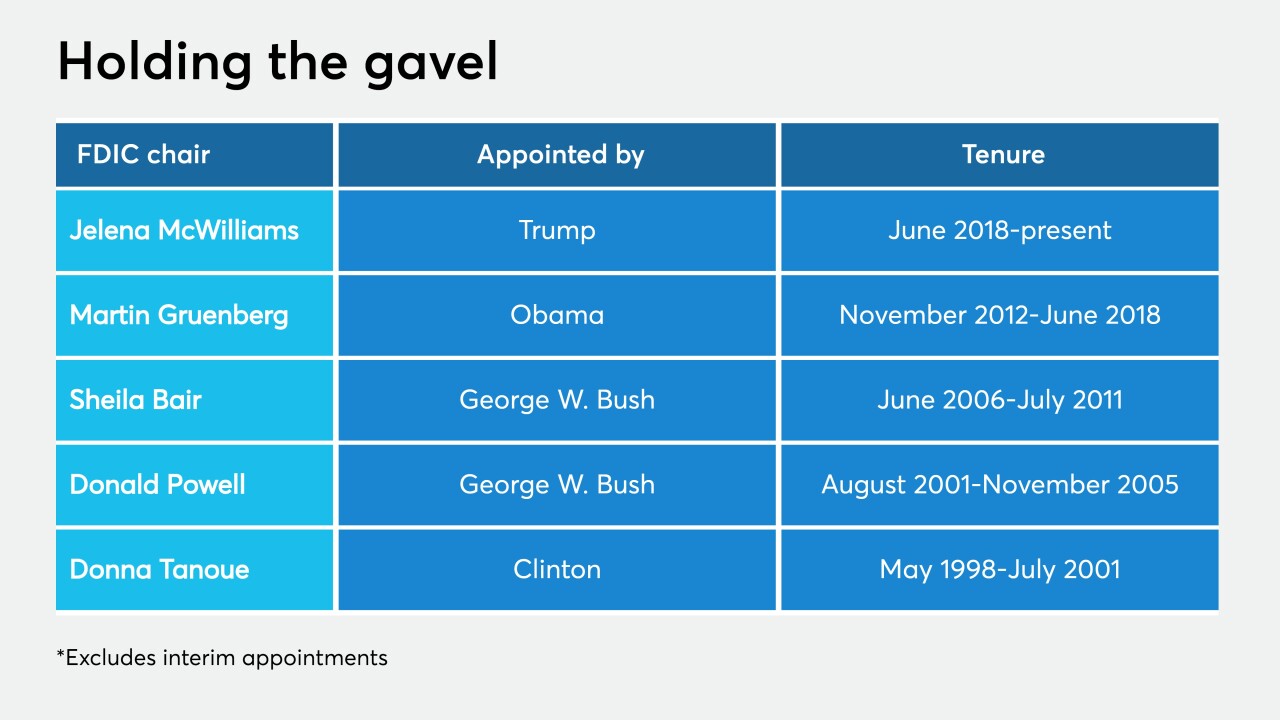

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 12