-

Credit One Bank in Las Vegas, Nev., a credit card specialist, plans to almost double its workforce over several years to support business growth.

December 16 -

Pacific Metro Bank would cater to Chinese-Americans around Atlanta. The application process is worth watching since the group is seeking the first Georgia charter in seven years and would be based in a market where more than 90 banks have failed since 2007.

December 16 -

Kevin S. Kim thought he was joining a bank board to bring youth to an aging slate of directors. Eight years, four acquisitions and a banking crisis later, he is now the chief executive of the nation's largest Korean-American bank.

December 4 -

The Music City is booming because of entertainment and health care. Still, banks are monitoring growth in areas such as real estate development for signs of stress.

December 2 -

Anthony Labozzetta, CEO of Sussex Bancorp in New Jersey, isn't afraid of change. His unusual approach to banking helped Sussex emerge from the financial crisis with momentum. Now he's building a branch model that could serve as a blueprint for growth-minded banks.

November 30 -

The pending purchase of Carlile Bancshares will lower Independent's concentration in commercial real estate, while introducing the company to fast-growing markets in Texas and Colorado.

November 22 -

Commercial mortgage lenders, and investors in their bonds, have been more eager than the residential market to embrace Property Assessed Clean Energy loans even though those loans hold a superior-lien position. Here's why.

November 16 -

Franklin Financial Network in Franklin, Tenn., has filed plans to raise up to $62 million in a common stock offering.

November 16 -

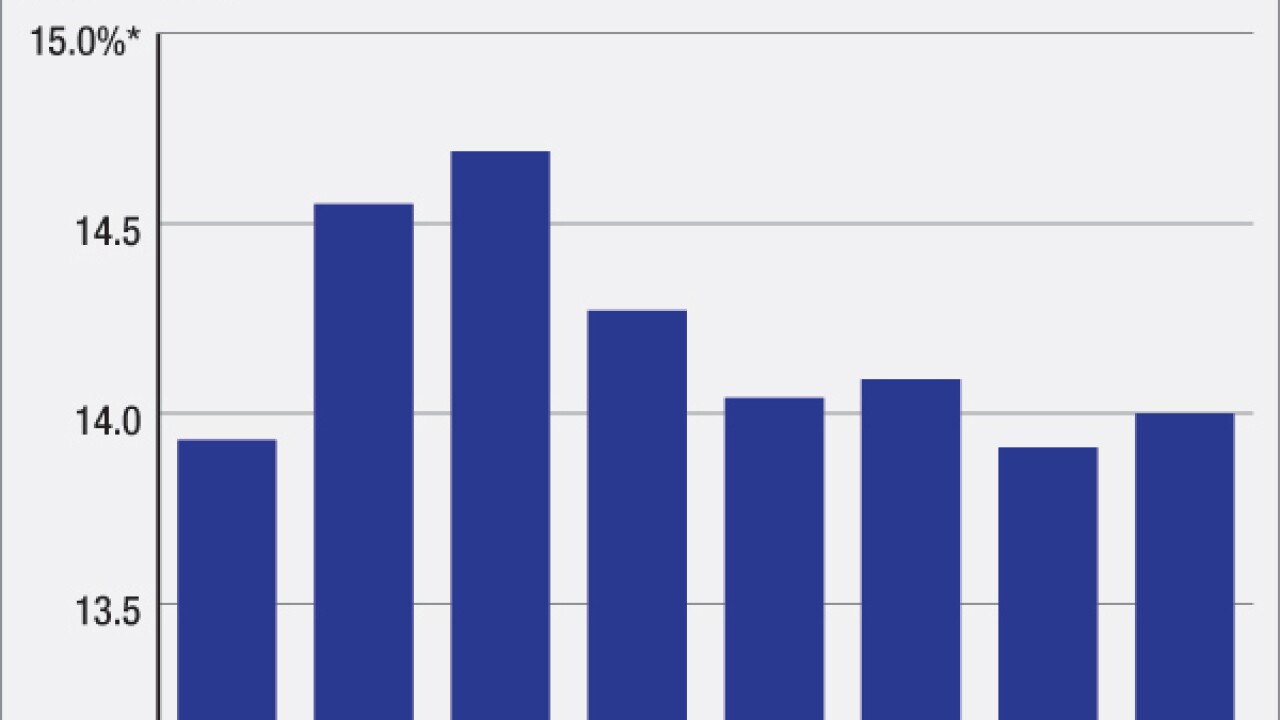

Trends in commercial real estate lending, which has reached record levels at U.S. banks, are unsustainable, Fitch Ratings warned.

November 7 - New York

Regulators have pressed banks to watch out for rising concentrations of commercial real estate loans. Some banks have paid heed, but others are skyrocketing past recommended thresholds.

November 3 -

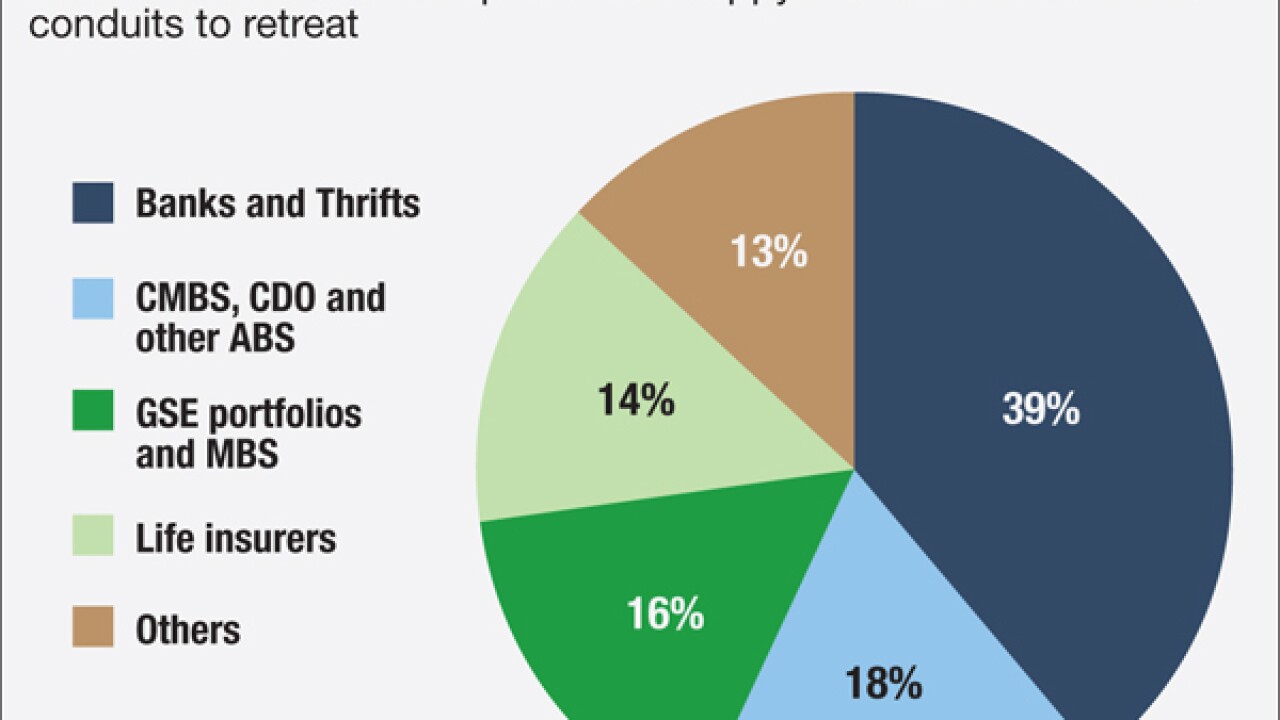

More than $100 billion in securitized commercial mortgages come due soon, many of them still underwater.

October 4 -

Orrstown Financial in Shippensburg, Pa., has agreed to pay a $1 million to settle charges that it misled investors as it raised capital in the wake of the financial crisis.

September 29 -

The high volume of commercial mortgages maturing this year has left some property owners scrambling for funds to refinance. Not so for these eight landlords, who took advantage of the strong price appreciation of their iconic office buildings, luxury hotels, super regional shopping malls, and a portfolio of rental homes, to cash out — in some cases, to the tune of hundreds of millions of dollars of equity. Bank commercial real estate lenders, who know all too well the cyclical nature of this sector, will want to take a close look at these transactions, details courtesy of our colleagues at Asset Securitization Report.

September 22 -

Bankers generally expect loan demand to increase over the next year, but global shocks, domestic politics and regional economic variations may be prompting them to prepare for slightly slower growth than before.

September 21 -

Banks that are heavily involved in commercial real estate lending may shy away from buying institutions with similar concentrations.

September 16 -

While troubling factors such as higher risk profiles may be behind the recent lending boom, the industry could also just be returning to the historical average for loan growth following the "Great Panic" of 2008-2010.

September 12

-

The Bancorp in Wilmington, Del., has sold a loan portfolio as part of its effort to reduce the size of its discontinued commercial loan book.

August 24 -

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

United Community and Wells Fargo are among the banks building platforms to lend to senior-care facilities. Demographics suggest the business should grow significantly in coming years.

August 12 -

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

August 8