-

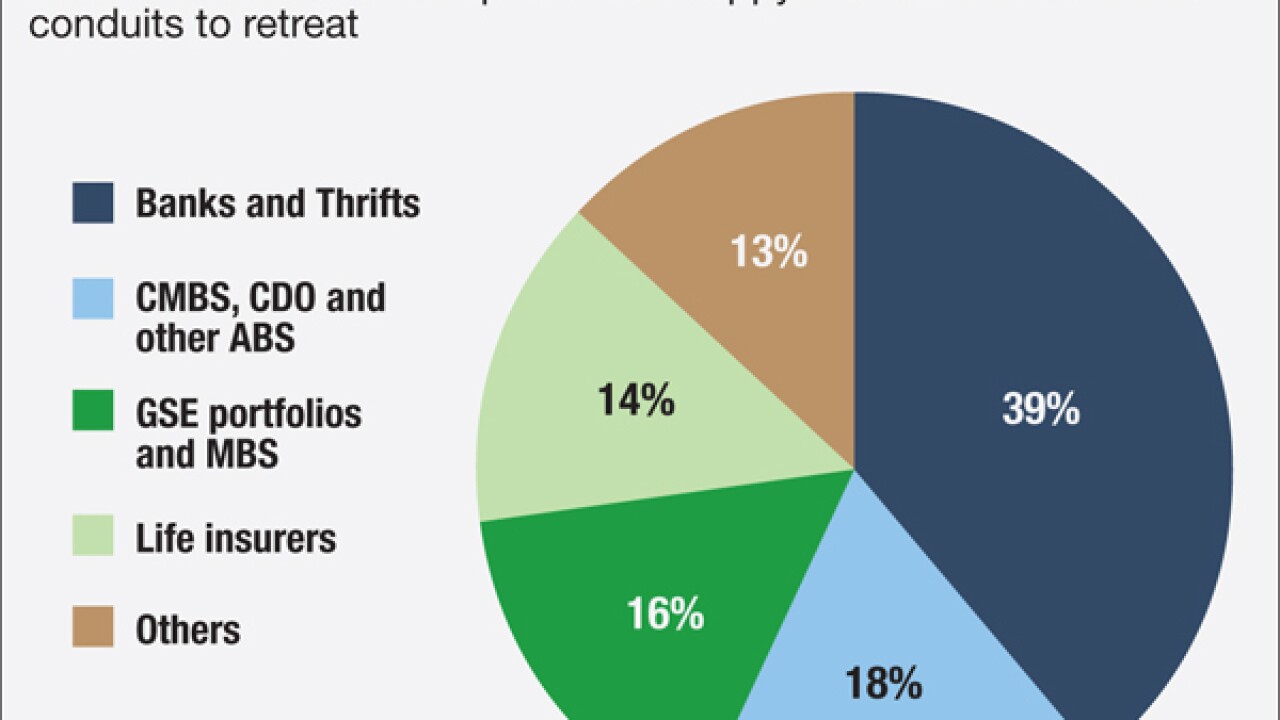

More than $100 billion in securitized commercial mortgages come due soon, many of them still underwater.

October 4 -

Orrstown Financial in Shippensburg, Pa., has agreed to pay a $1 million to settle charges that it misled investors as it raised capital in the wake of the financial crisis.

September 29 -

The high volume of commercial mortgages maturing this year has left some property owners scrambling for funds to refinance. Not so for these eight landlords, who took advantage of the strong price appreciation of their iconic office buildings, luxury hotels, super regional shopping malls, and a portfolio of rental homes, to cash out — in some cases, to the tune of hundreds of millions of dollars of equity. Bank commercial real estate lenders, who know all too well the cyclical nature of this sector, will want to take a close look at these transactions, details courtesy of our colleagues at Asset Securitization Report.

September 22 -

Bankers generally expect loan demand to increase over the next year, but global shocks, domestic politics and regional economic variations may be prompting them to prepare for slightly slower growth than before.

September 21 -

Banks that are heavily involved in commercial real estate lending may shy away from buying institutions with similar concentrations.

September 16 -

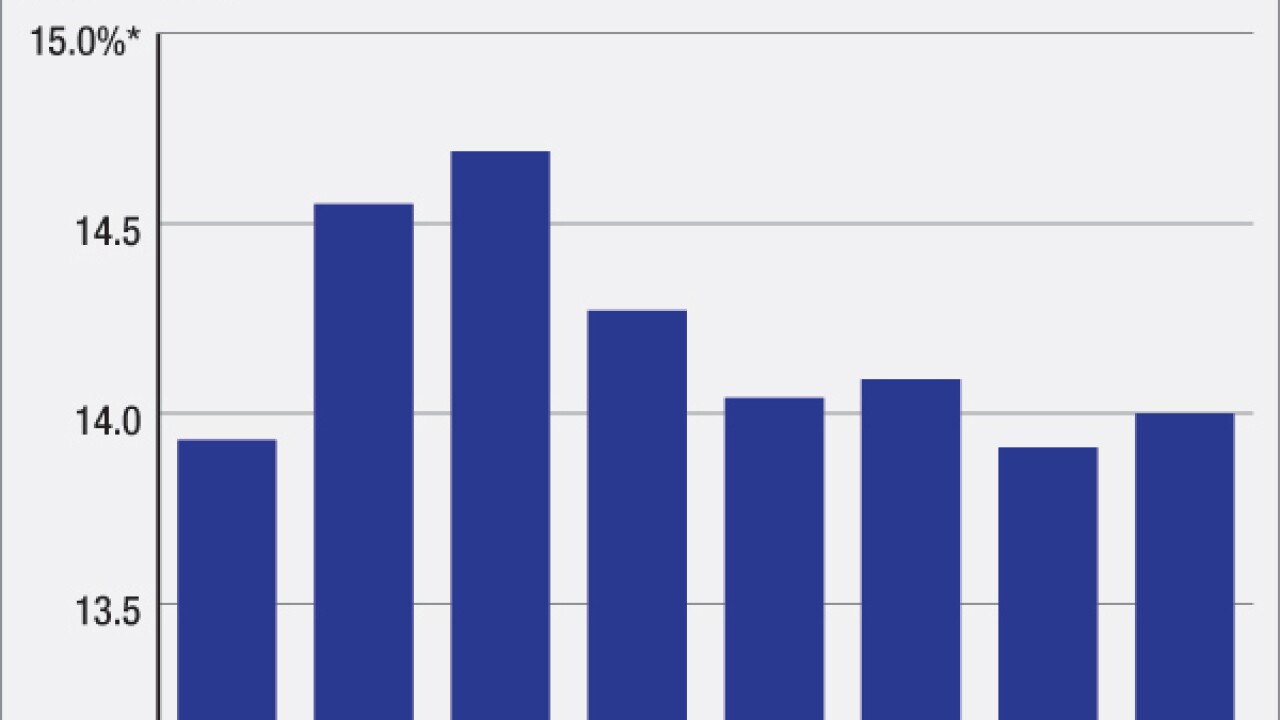

While troubling factors such as higher risk profiles may be behind the recent lending boom, the industry could also just be returning to the historical average for loan growth following the "Great Panic" of 2008-2010.

September 12

-

The Bancorp in Wilmington, Del., has sold a loan portfolio as part of its effort to reduce the size of its discontinued commercial loan book.

August 24 -

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

United Community and Wells Fargo are among the banks building platforms to lend to senior-care facilities. Demographics suggest the business should grow significantly in coming years.

August 12 -

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

August 8 -

The impressive loan growth in the second quarter is surprising in an economy that grew by 1.2% in the second quarter and by only 0.8% in the first quarter.

August 4

-

Carver Bancorp in New York is dealing with a new set of challenges just months after being released from a longstanding enforcement order. The companys woes highlight the challenges for banks with narrowly constrained business models.

July 29 -

Regulators' recent warnings on emerging risks with commercial real estate indicate banks have reverted to CRE practices that got them in hot water once before.

July 29

-

Suffolk Bancorp in New York, which recently agreed to be sold to People's United Financial, discouraged several suitors from bidding due to concerns about concentrations of commercial real estate loans at those banks. The disclosures highlight the challenges that banks with heavy CRE exposure could face as buyers or sellers if they want to do deals.

July 27 -

Multifamily family construction is reaching the point where some markets can't absorb the new supply of units.

July 22 -

The management team at Bank of the Ozarks knows it has a dependency on commercial real estate. But they assert that sound underwriting, and efforts to diversify, are what really matters when assessing risk.

July 11 - Washington

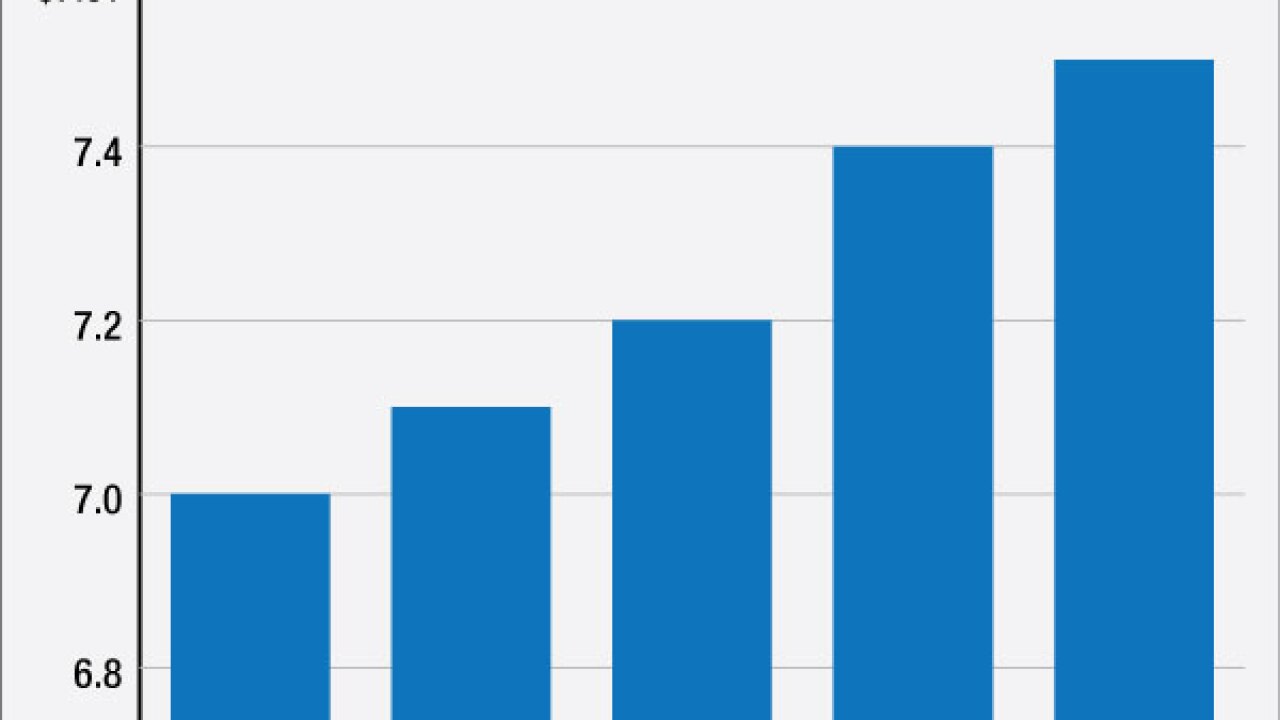

Delinquencies on non-owner-occupied commercial real estate loans ticked up in the first quarter after years of steady declines. Some are shrugging off the increase, saying it was expected given the strong demand for CRE loans, but others say there's good reason to be concerned.

June 14 -

Small-business lenders are scrambling for financing to accommodate a possible real-estate-related borrowing surge once a key federal rule change takes effect next week.

June 13 -

An executive from Regions Financial said recently that his bank plans to pad fee income by expanding into syndication of low-income housing credits. The comment shed light on an increasingly competitive business and reminded the world again how eager banks are for even incremental boosts to revenue.

June 9 -

A number of executives are warning that midsize borrowers are hoarding cash rather than borrowing, reflecting increased concern about the economy.

June 1