-

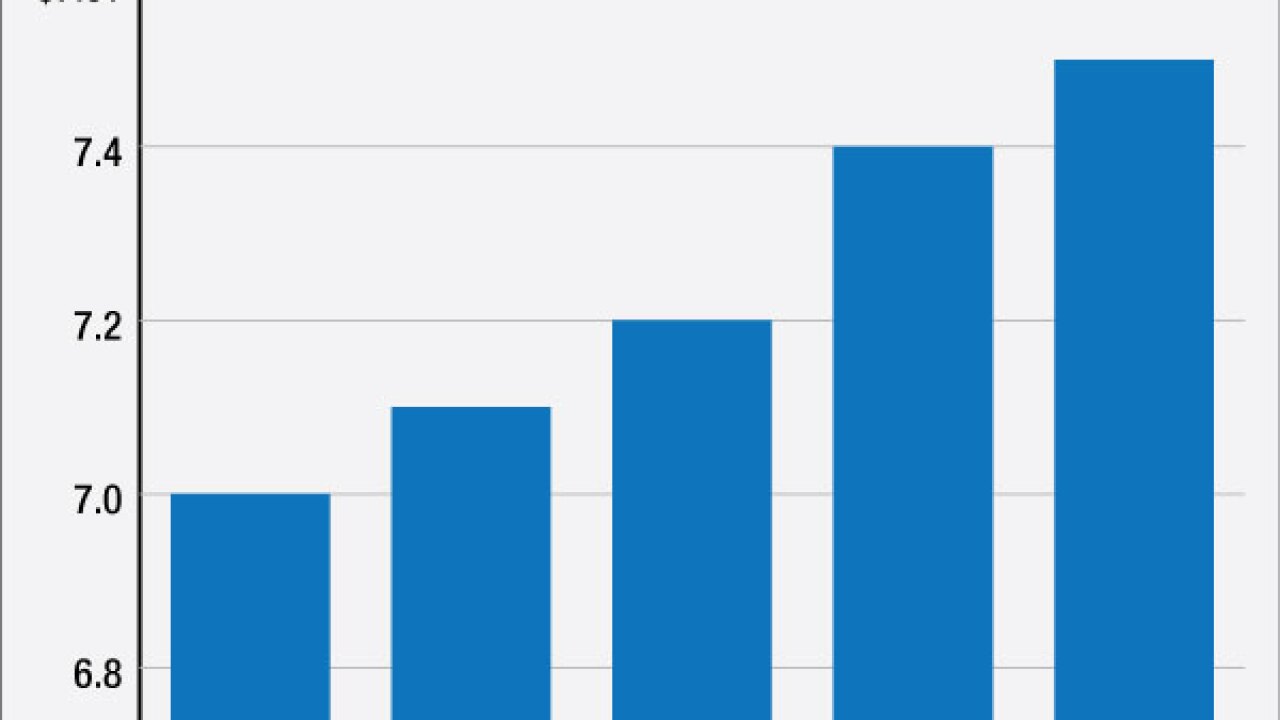

The impressive loan growth in the second quarter is surprising in an economy that grew by 1.2% in the second quarter and by only 0.8% in the first quarter.

August 4

-

Carver Bancorp in New York is dealing with a new set of challenges just months after being released from a longstanding enforcement order. The companys woes highlight the challenges for banks with narrowly constrained business models.

July 29 -

Regulators' recent warnings on emerging risks with commercial real estate indicate banks have reverted to CRE practices that got them in hot water once before.

July 29

-

Suffolk Bancorp in New York, which recently agreed to be sold to People's United Financial, discouraged several suitors from bidding due to concerns about concentrations of commercial real estate loans at those banks. The disclosures highlight the challenges that banks with heavy CRE exposure could face as buyers or sellers if they want to do deals.

July 27 -

Multifamily family construction is reaching the point where some markets can't absorb the new supply of units.

July 22 -

The management team at Bank of the Ozarks knows it has a dependency on commercial real estate. But they assert that sound underwriting, and efforts to diversify, are what really matters when assessing risk.

July 11 - Washington

Delinquencies on non-owner-occupied commercial real estate loans ticked up in the first quarter after years of steady declines. Some are shrugging off the increase, saying it was expected given the strong demand for CRE loans, but others say there's good reason to be concerned.

June 14 -

Small-business lenders are scrambling for financing to accommodate a possible real-estate-related borrowing surge once a key federal rule change takes effect next week.

June 13 -

An executive from Regions Financial said recently that his bank plans to pad fee income by expanding into syndication of low-income housing credits. The comment shed light on an increasingly competitive business and reminded the world again how eager banks are for even incremental boosts to revenue.

June 9 -

A number of executives are warning that midsize borrowers are hoarding cash rather than borrowing, reflecting increased concern about the economy.

June 1 -

The financial services sector would benefit from companies banks included submitting dedicated disclosures on the impact of climate change.

May 19

-

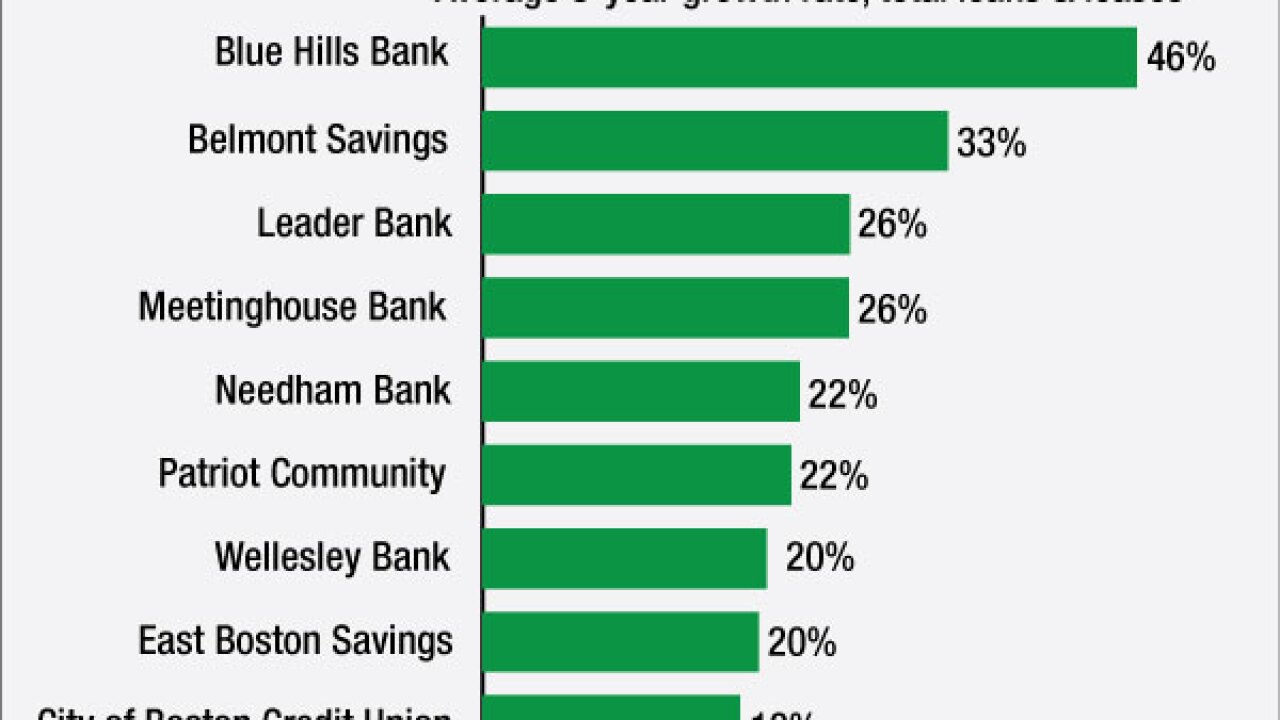

Loan growth at several Boston banks, including many former mutuals, is higher than the national average. Still, bankers are closely watching for any indication that a bubble is forming.

May 6 -

Shares in Bank of the Ozarks slid Wednesday after an investor known for shorting stocks warned about risk in the company's construction portfolio. The stock recovered some by the end of trading, and several analysts said the concerns are unfounded.

May 4 -

At least one banker has gone public with expectations that the OCC will force his institution to hold more capital. More could soon follow.

May 3 -

Two St. Louis-area investors have been indicted on charges they defrauded the failed Excel Bank on real estate loans.

April 20 -

Signature Bank in New York reported record profits in the first quarter as strong loan, asset and deposit growth more than offset increased expenses and deterioration in its portfolio of taxi-medallion loans.

April 20 -

Several small and midsize banks generated large year-over-year loan growth despite a belief by some outsiders that a slowdown was looming. Bankers may have to spend coming months assuring investors that they can keep booking loans while adequately managing risk.

April 19 -

Dime Community Bancshares has agreed to sell its headquarter building in Brooklyn for $12.3 million.

April 18 -

Enterprise Bancorp in Lowell, Mass., has purchased the site of a former hotel that recently burned to the ground and plans to put a new branch there.

March 30 -

ChoiceOne Financial Services in Sparta, Mich., will begin work on remodeling its bank's headquarters in May.

March 22