Credit cards

Credit cards

-

Despite the hurdles facing technology giants in offering payments services, they remain keenly interested in the sector and more traditional service providers should stay on alert.

July 26 -

Now is the time to correct the mistakes of interchange price controls that harm consumers and community financial institutions to the benefit of merchants.

July 25 -

Some big banks are venturing further down the risk spectrum after a long period of unusually strong credit performance.

July 22 -

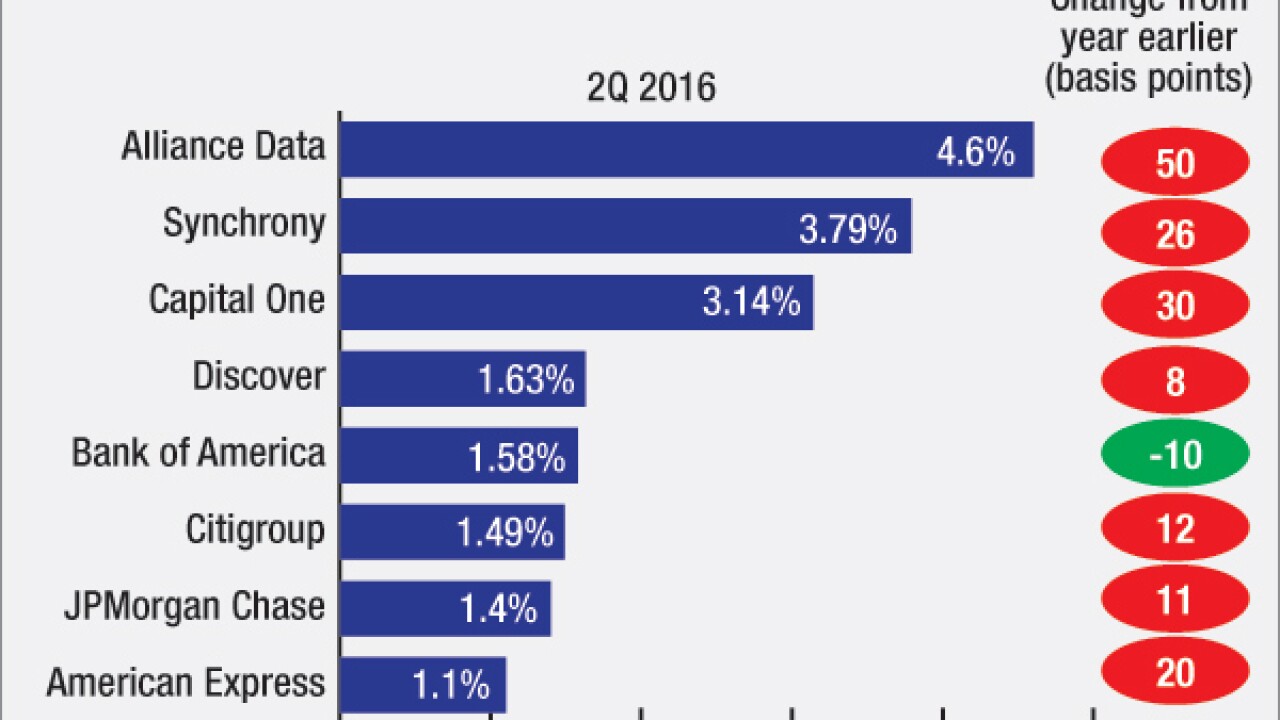

Synchrony Financial enjoyed strong loan growth in the second quarter, but gains in interest income were more than offset by a larger provision for losses.

July 22 -

Profits rose by 9% at Capital One Financial during the second quarter thanks to strong growth in the firm's credit card and commercial banking businesses.

July 21 -

Visa Inc., the world's largest payments network, posted fiscal third-quarter profit that beat analysts' estimates as customer card spending accelerated. The company said it will buy back as much as $5 billion of its shares.

July 21 -

American Express Co., the biggest U.S credit-card issuer by purchases, said second-quarter profit rose 37 percent as customers increased spending and the company booked a $1 billion gain from the sale of its Costco Wholesale Corp. portfolio.

July 20 -

Amalgamated Bank and Banco Popular, financial institutions with niche appeal, are rolling out national online platforms, calling into question what it means to be a community bank today.

July 20 -

Profits rose nearly 3% at Discover Financial Services in the second quarter thanks to solid loan growth and a one-time tax benefit.

July 19 -

Keefe Bruyette & Woods and Nasdaq have launched an index that tracks fintech companies.

July 19 -

Citigroup executives were at pains to explain the benefits and challenges of a new partnership with Costco that has netted the bank millions of new credit card customers but also added to its cost burden in the second quarter.

July 15 -

Lobbyists for the credit union industry are decrying a proposal to limit forced arbitration clauses despite ample evidence that credit unions dont use such clauses in the first place.

July 14 -

Congress should abandon the idea of repealing a section of the Dodd-Frank Act that has helped make pricing for payment processing more competitive.

July 14 -

Nearly half of U.S. consumers say they have been hit by credit card fraud within the last five years, and those breaches are becoming more commonplace, according to a survey released Tuesday.

July 12 -

The sharp fall in gas prices early this year helped U.S. consumers to stay current on their credit obligations during the first quarter.

July 7 -

The decision by a federal appeals court to toss out a blockbuster settlement between retailers and the card networks could re-expose some banks to legal liability and threaten their already challenged interchange income.

June 30 -

A $5.7 billion settlement by Visa and MasterCard was rejected by an appeals court in New York, potentially renewing years of litigation with U.S. merchants over allegations that credit-card swipe fees were improperly fixed.

June 30 -

The credit card industry's switch to microchips has improved security, but fraudulent online purchases remain a big vulnerability. A new credit card company called Final, which launches Wednesday, is aiming to fix that problem.

June 29 -

The court's decision to return Madden v. Midland Funding to a lower court leaves unresolved a number of important questions for marketplace lenders and other parts of the consumer-finance industry.

June 27 -

Kroger is suing Visa, alleging the network threatened to raise fees and cut off the supermarket chain from accepting its debit cards.

June 27