Well, not exactly. Credit card, installment and other consumer lending have cooled, also.

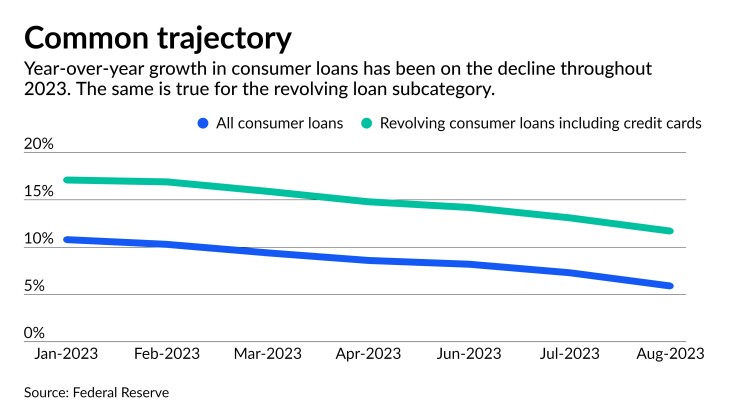

Consumer loan growth at U.S. commercial banks in July was 5.9% higher than the year-earlier period, according to data from the Federal Reserve. That is a decline from a 7.3% rate in June and 10.8% at the start of the year.

Tighter lending standards, higher interest rates and falling consumer demand are driving the continued decline in consumer-loan growth, experts said. Banks are less willing to lend to potential borrowers who may struggle with payments that are subject to some of the highest rates consumers have seen in years.

Moreover, total consumer loan balances at U.S. banks fell in July for the first time since 2020, according to Fed data. Americans had about $1.84 trillion of consumer loans in July, down from $1.89 trillion in June.

Besides putting the brakes on new lending, some banks are selling assets including consumer-loan portfolios as a means of generating liquidity and capital.

"The banks really are cutting back on consumer loans," said Warren Kornfeld, senior vice president at Moody's Investor Service.

Bank executives last month reported tightening lending standards across all consumer lending categories over the previous three months, according to a Federal Reserve survey of senior lending officers at commercial banks nationwide.

Growth in credit cards and other revolving loans, which the Fed categorizes as part of overall consumer lending, is also growing more slowly. The category saw year-over-year growth of 11.7% in July, down from growth levels close to 20% in 2022. Credit card balances at all lenders, not just banks,

Stimulus savings and other pandemic-induced cost savings gave American consumers a healthy buffer of savings in 2020 and 2021. Much of those rainy-day funds have since been spent, and Americans resumed their reliance on credit cards in 2022, driving balances up by double-digit percentages. That spending tear continued into this year before slowing more recently.

The outlook for banks in the credit card arena is rosier than the horizon for other consumer loans, analysts said.

"Inflation has decimated household budgets, and for millions of households credit cards are what's going to bridge the gap," said Greg McBride, chief financial analyst at Bankrate.com.

The rising costs of goods and services, coupled with higher interest rates, have also made car purchases out of the question for a large subset of consumers. The turnaround in demand has been more pronounced for automobile loans than for the broader consumer-loan category this year.

"There's absolutely a tempering of demand for auto loans," Kornfeld said.

Auto loans fell 2% in July from a year earlier. Balances

In the second quarter, banks reported rising rates of auto delinquencies as well as a broader decline in consumer credit. Banks are charging off more loans and worrying about providing more credit for consumers who are paying more for items and paying more to finance those purchases.

"We will see further deterioration in credit quality, particularly for borrowers who have marginal credit quality or those who are particularly stretched thin," McBride said.

Still,

"I'd say we're seeing a more cautious consumer, but not necessarily a recessionary one," Citigroup CEO Jane Fraser said during an earnings call in July.