-

Despite a generally positive picture in the Shared National Credit report, regulators warned that underperforming loans in the portfolio remain elevated.

January 25 -

The Dallas company boosted its loan-loss provision in the fourth quarter to cover deteriorating leveraged loans, causing it to miss profit estimates.

January 24 -

The Virginia company cautioned that it expects lending to slow down this year.

January 22 -

A spike in charge-offs in the third quarter stoked concerns about commercial real estate exposure. Shares in the Arkansas company rose after it reported its fourth-quarter results.

January 18 -

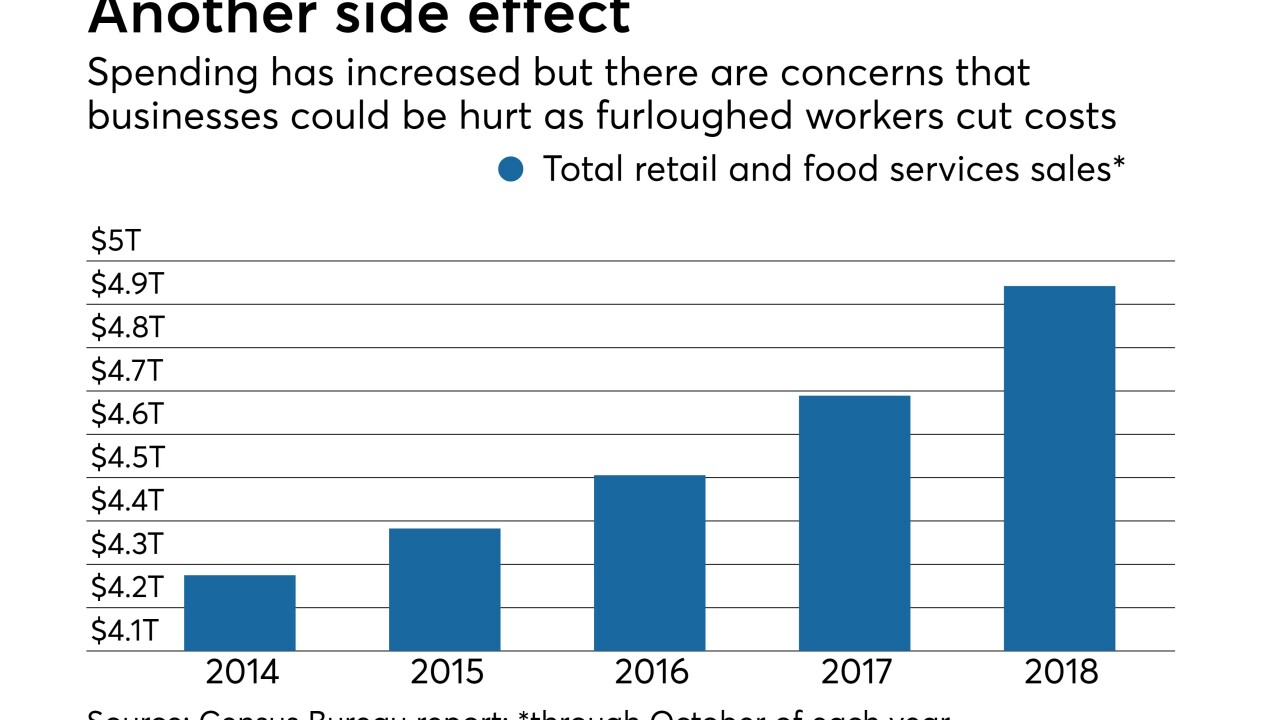

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

PNC chief Bill Demchak says he's pretty sure the U.S. isn’t heading into recession, but asset quality is so strong that the regional bank is giving itself a wide berth in forecasting its loan-loss provision in case of the unexpected.

January 16 -

Loans grew 6% at JPMorgan Chase, but the bank is "not going to be stupid" and assume that will last forever, its CEO says. Here are some precautionary steps it's taking.

January 15 -

Bank groups are pushing a variety of proposals to delay the loan-loss rule or soften its impact. The accounting standards board has agreed to review at least one of them — but at a pace that might not be fast enough for lenders.

November 21 -

Adults ages 18 to 29 may have a hard time getting a mortgage, but they are not shying away from other forms of consumer debt, according to a report by the New York Fed.

November 16 -

Self Lender is launching a secured credit card next year in the hopes of attracting big-bank partners that can use it to comply with the Community Reinvestment Act.

November 15