-

Bankers will be pressed on upcoming earnings calls to forecast how the coronavirus pandemic — and the government's response — will shape credit quality, margins and fee income.

March 25 -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

March 23 -

Banks are avoiding the once booming hospitality business, or charging a premium for additional credit, as new data shows how big a hit hoteliers have taken from the pandemic.

March 18 -

Lenders are concerned that the coronavirus outbreak will increase vacancies and add to credit risk.

March 17 -

Banks with the most exposure to oil and gas companies say they’ve added capital and changed their borrower mixes since the 2015 market fall. But skeptics question whether they can stave off losses if low prices endure.

March 10 -

The credit card issuer is seeking to rebound following a tumultuous year in which top executives departed and key retail partners declared bankruptcy.

March 4 -

A spike in loan-loss provisions dragged down first-quarter profits at the Toronto company’s U.S. unit.

February 25 -

The company revised its results to a net loss of $700,000 after deciding to record a $16 million loan-loss provision for the commercial loan.

February 24 -

A large charge-off and an additional loan-loss provision reduced quarterly profit by 12%, to $47.8 million.

February 14 -

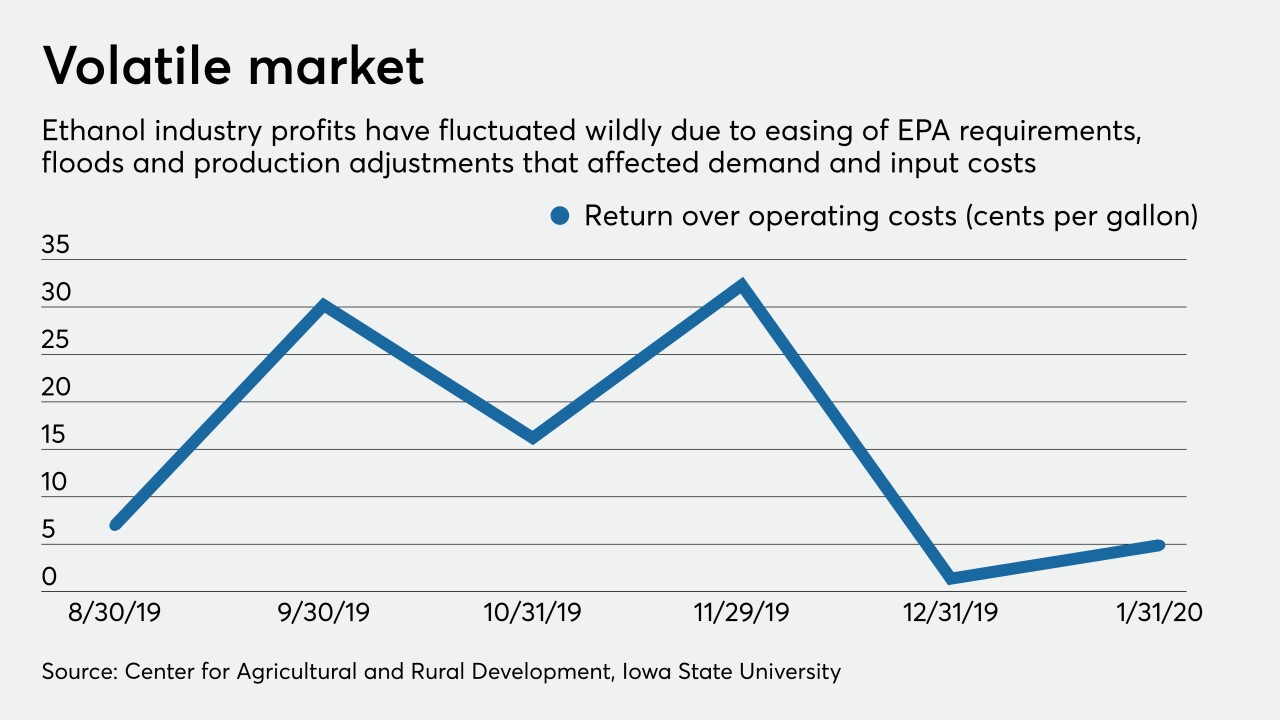

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12