-

The six bills championed by Democrats aim to reduce consumer burdens and provide opportunities for borrowers to rehabilitate their credit, but the legislation garnered no Republican support.

January 29 -

The six bills championed by Democrats aim to reduce consumer burdens and provide opportunities for borrowers to rehabilitate their credit, but the legislation has garnered no Republican support.

January 28 -

The changes will mean a bigger gap between the best and worst borrowers; the bank will require companies they take public to have a ‘diverse’ board member.

January 24 -

Regulators are beginning to recognize the importance of using alternative data to provide credit for the underbanked. Now is the time to expand its use across the industry.

January 14

-

Testing shows an overreliance on machine learning data can unfairly harm credit scores.

December 12 FICO

FICO -

Banks will not have to file reports on customers just because they're in the hemp business; making it easier for people with no credit history to get loans.

December 4 -

The credit bureau will consider borrowers’ rental payment history and professional licenses; bank looks to build business on the other side of the Atlantic.

November 7 -

Readers react to Regions Financial's plan to replace its core deposit system, a House bill meant to curb jobs moved overseas, a resurgence of consumer complaints against the credit bureaus and more.

October 24 -

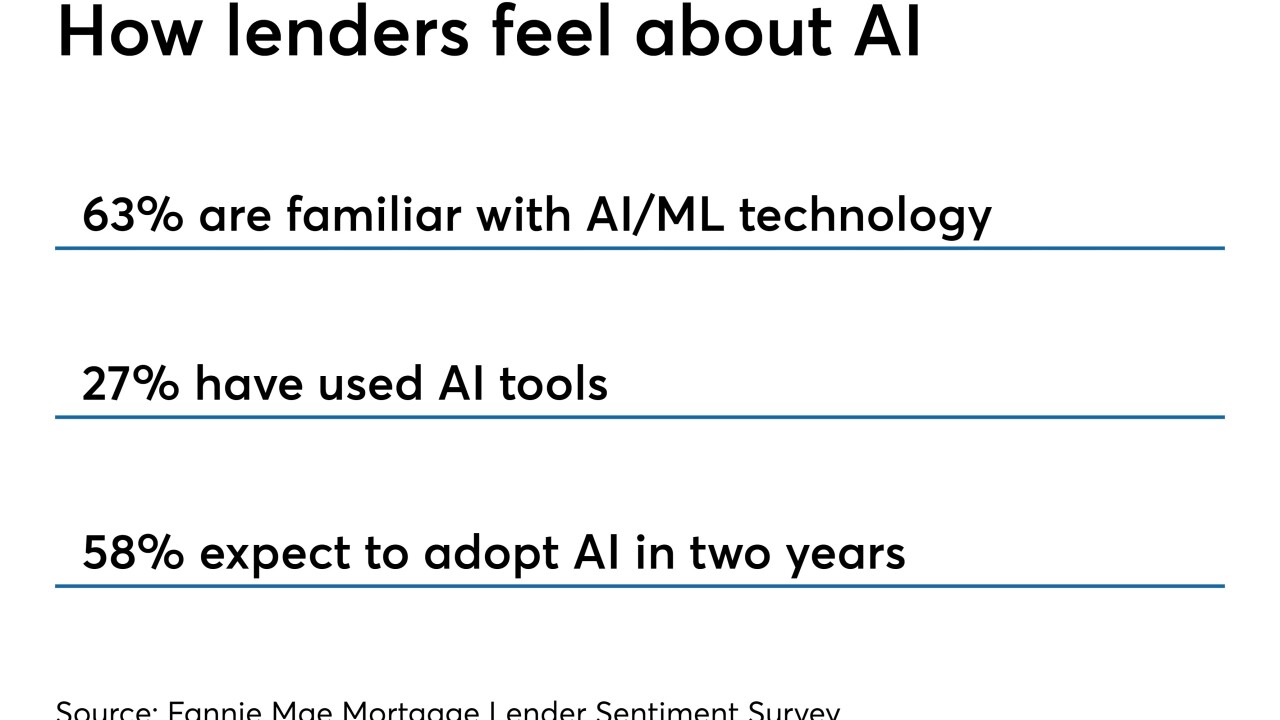

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

The Fed’s injects funds into the repo market for first time in more than a decade; bank trying to partner firms with cash with those with market share.

September 18