-

There have now been a record 10 credit union-bank merger deals in 2019.

July 23 -

The New York-based institution will double the number of counties it can serve as part of the effort to grow.

July 22 -

The National Credit Union Administration caught flak after it approved raising the threshold for appraisals on commercial real estate loans to $1 million.

July 18 -

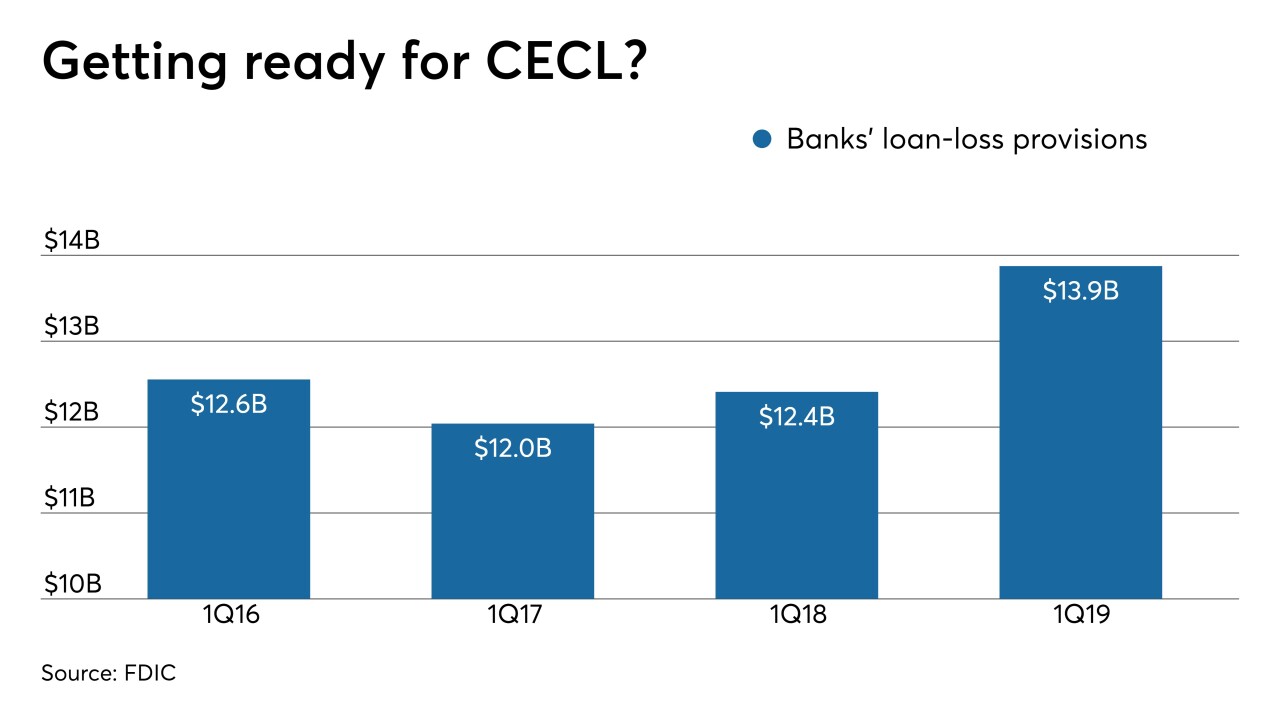

After FASB's decision to give most banks extra time to prepare, lobbying groups are pushing for more.

July 17 -

The former mutual, which had faced pressure from an activist investor, agreed to be sold to Corporate America Family Credit Union.

July 17 -

The Memphis-based developer of core processing software is now majority owned by three credit unions.

July 12 -

Alexander Lopatine, who founded Nymbus and has joined Mbanq, says alternative providers are gaining the confidence of more banks. However, questions remain about their staying power in the fight with traditional vendors.

July 2 -

Aside from BB&T-SunTrust, dealmaking got off to a sluggish start this year. But that may soon change, not just because of pressure to achieve scale. For many banks and credit unions, a technology-capability gap could be the determining factor.

June 28 -

From regulatory reform to natural disasters and more, here's a look at Credit Union Journal's special report on what to expect for the second half of the year.

June 28 -

First American Bank agreed to sell its Iowa branches to GreenState just weeks after arranging the transfer of its Florida locations to another credit union.

June 26