-

Credit bureaus should know better than to include "impossible" data, such as someone defaulting on a loan before they were born, says Consumer Financial Protection Bureau Director Rohit Chopra.

October 21 -

Overdue loans for U.S. credit unions hit 0.42% in June — the lowest level in the industry's history. But some warn of deteriorating credit quality as the economy sours.

October 20 -

Executives at the Dallas company said they feel positive about the remainder of the year, though declining deposits could create issues going forward.

October 19 -

The megabank set aside a larger provision for credit losses during the third quarter as delinquency rates in its credit-card business ticked higher. Still, executives argued that the U.S. consumer outlook remains strong.

October 17 -

The nation's largest bank by assets cited a weakening economic outlook as one reason it added to its allowance for loan losses for the third straight quarter. But its third-quarter results beat analysts' expectations.

October 14 -

The London bank is working with Nova Credit to accept immigrants' credit histories from their home countries. It also invested $10 million in the company.

September 28 -

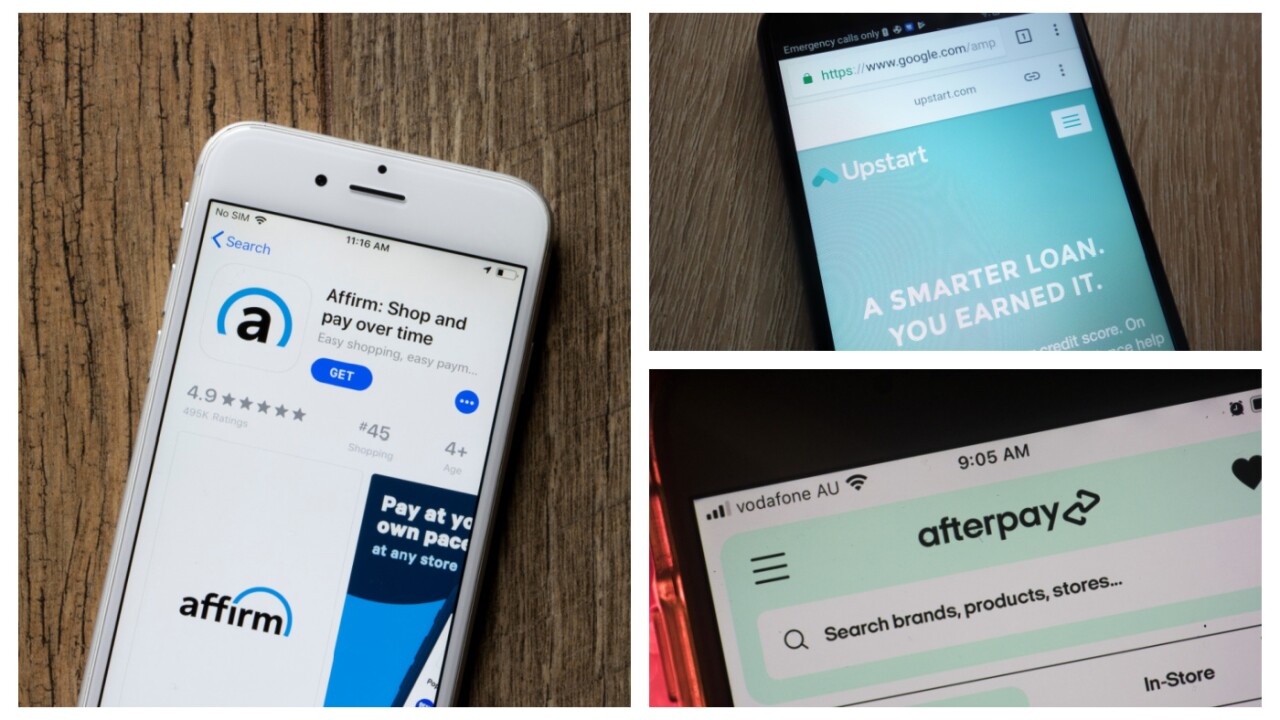

Millions of Americans have trouble accessing low-cost loans because they have thin or problematic credit histories. That could change as fintech innovations and new self-reporting tools give lenders troves of new data.

August 16 -

Late-payment rates are rising at nonbanks that lend to people with lower credit scores. "We're probably entering a stretch where you're going to see a separation between those that are relatively good underwriters and those that are not," one analyst said.

August 7 -

Even though delinquency rates were previously at extremely low levels, the recent uptick among poorer consumers is worth monitoring, New York Fed researchers said.

August 2 -

Silvio Tavares, the credit score company’s relatively new leader, is honing its models to be more inclusive, for instance by taking into account rent payment data and bank account data.

July 27