-

Acting Director Dave Uejio wrote in a blog post that the Consumer Financial Protection Bureau needs more time to consider rules that were finalized under the Trump administration but have not yet gone into effect.

February 5 -

Visa and partners fast-tracked the big game's digital overhaul as the pandemic caused a sharp spike in demand for contactless payments.

February 5 -

After the agency pulled back on fair-lending enforcement in the Trump administration, interim Director Dave Uejio has made clear his intent to use the “disparate impact” standard to launch more anti-discrimination probes.

February 3 -

Only 18% of businesses that received a Paycheck Protection Program or other loan from an online lender were satisfied with customer service, while 42% said they were dissatisfied. Banks, credit unions and CDFIs fared better in the Federal Reserve survey.

February 3 -

The bank trade group called for lawmakers to revoke the industry’s tax exemption and suggested that credit union acquisitions of banks create a “brain drain” of local lending expertise that could slow any economic recovery.

February 3 -

The central bank aims to roll out FedNow sometime in 2023, which is more optimistic than its previous timetable. The official leading the project noted progress in developing the infrastructure and its compatibility with private-sector solutions.

February 2 -

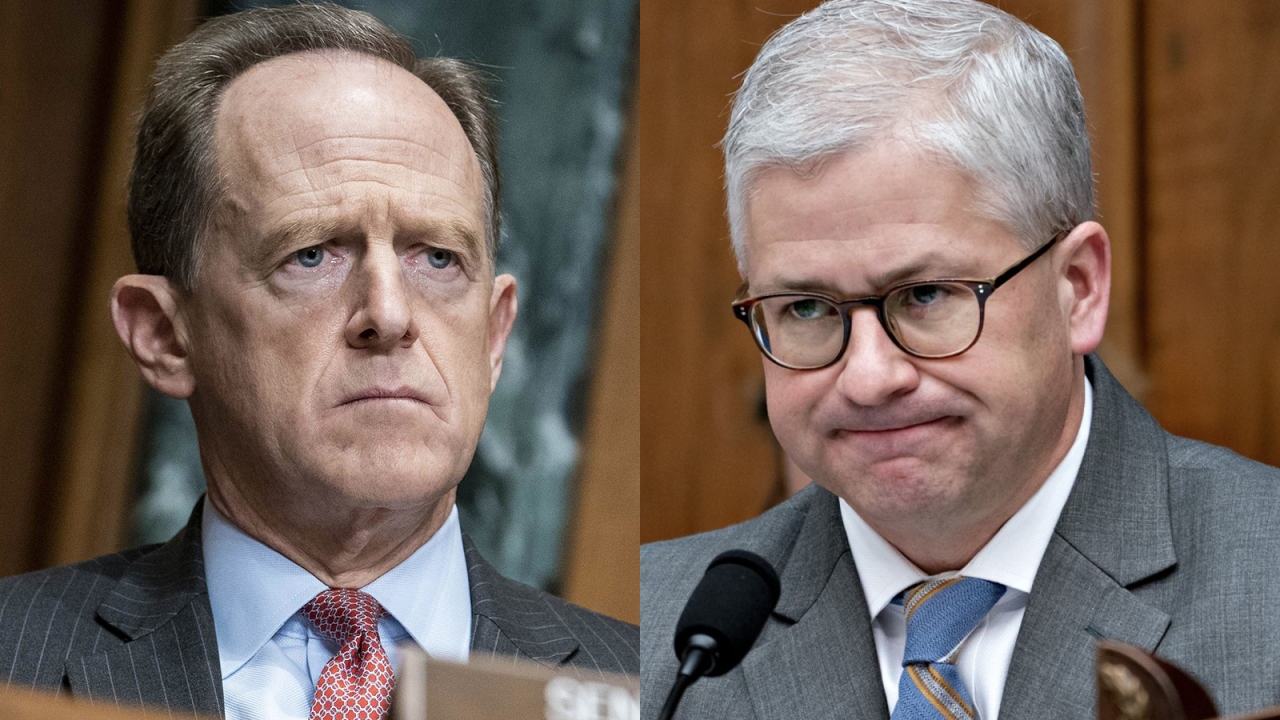

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

The agency has amassed more in fines than it has returned to wronged customers. With Democrats now in power, some hope the bureau will allocate the unused money more aggressively.

January 25 -

The Minnesota credit union's deal for Brainerd Savings & Loan comes about 11 months after it bought Neighborhood National Bank in Minnesota.

January 25 -

President Biden and Democrats in Congress have backed plans to subject a broader array of companies to Community Reinvestment Act requirements. But there’s no guarantee such reforms will happen.

January 22