-

The new administration is wasting no time assembling a team of regulatory appointees and urging agencies to pause pending rules.

January 21 -

Dave Uejio, who served as chief of staff to ex-Director Richard Cordray, was named by the Biden administration to lead the Consumer Financial Protection Bureau until the Senate confirms Rohit Chopra for the permanent job.

January 21 -

The administration faces a slew of immediate financial policy tasks, such as passing a new round of small-business aid, charting a course for Fannie Mae and Freddie Mac and filling vacant agency leadership posts.

January 20 -

After a pivotal Supreme Court ruling last year, the Trump administration’s handpicked leader of the Consumer Financial Protection Bureau was widely expected to leave voluntarily or be fired by the new president.

January 20 -

Former Fed Chair Janet Yellen told senators that as Treasury secretary she would create a “hub” to examine the effects of a changing climate on financial institutions and create a database of companies' true owners as required by a recent anti-money-laundering bill.

January 19 -

The odds are better now that Congress will pass a bill to help financial institutions serve cannabis businesses, but the question of the legislative path forward has grown murkier.

January 18 -

The California Democrat known for sharp questioning of executives was turned down for a waiver to serve on the Financial Services Committee by Speaker Nancy Pelosi, D-Calif., The Hill reported Thursday.

January 15 -

The FHFA and Treasury will allow Fannie Mae and Freddie Mac to hold more capital as part of the Trump administration's plans to release the companies from conservatorship. But it is unclear whether the incoming Biden administration will keep the mortgage giants on the same reform path.

January 14 -

The National Credit Union Administration and the Consumer Financial Protection Bureau will hold strategy sessions and share information tied to consumer protections at institutions with more than $10 billion of assets.

January 14 -

Most consumers expect to be offered a variety of digital payment options in stores in a post-COVID-19 world, and small and midsize business believe that change will be permanent, a Visa study finds.

January 14 -

The pace of forgiveness for Paycheck Protection Program loans is expected to accelerate when the Small Business Administration issues guidance on additional steps meant to streamline the process.

January 13 -

The Utah company, which serves more than 2,000 banks and credit unions, has grown rapidly because it helps financial institutions deliver the types of personalized financial advice consumers have increasingly come to expect.

January 13 -

Sen. Sherrod Brown, D-Ohio, said elevating affordable housing issues, examining the financial system through a climate and racial justice "lens" and holding banks accountable for their impact on consumers will be among his priorities.

January 12 -

Congress acted first when it freed financial firms from having to disclose the beneficial owners of commercial clients. Now it's time for regulators to further ease anti-money-laundering reporting requirements by freeing them from filing duplicative or unnecessary suspicious activity reports.

January 12 Debevoise

Debevoise -

The Mint’s facilities in Denver and Philadelphia worked overtime in the second half of 2020 so that banks and retailers could get more change into customers’ hands.

January 10 -

The agency that supervises Fannie Mae and Freddie Mac has pushed for revising an agreement with the Treasury Department allowing the mortgage giants to retain their profits. A deal could be out of reach once Joe Biden takes office.

January 8 -

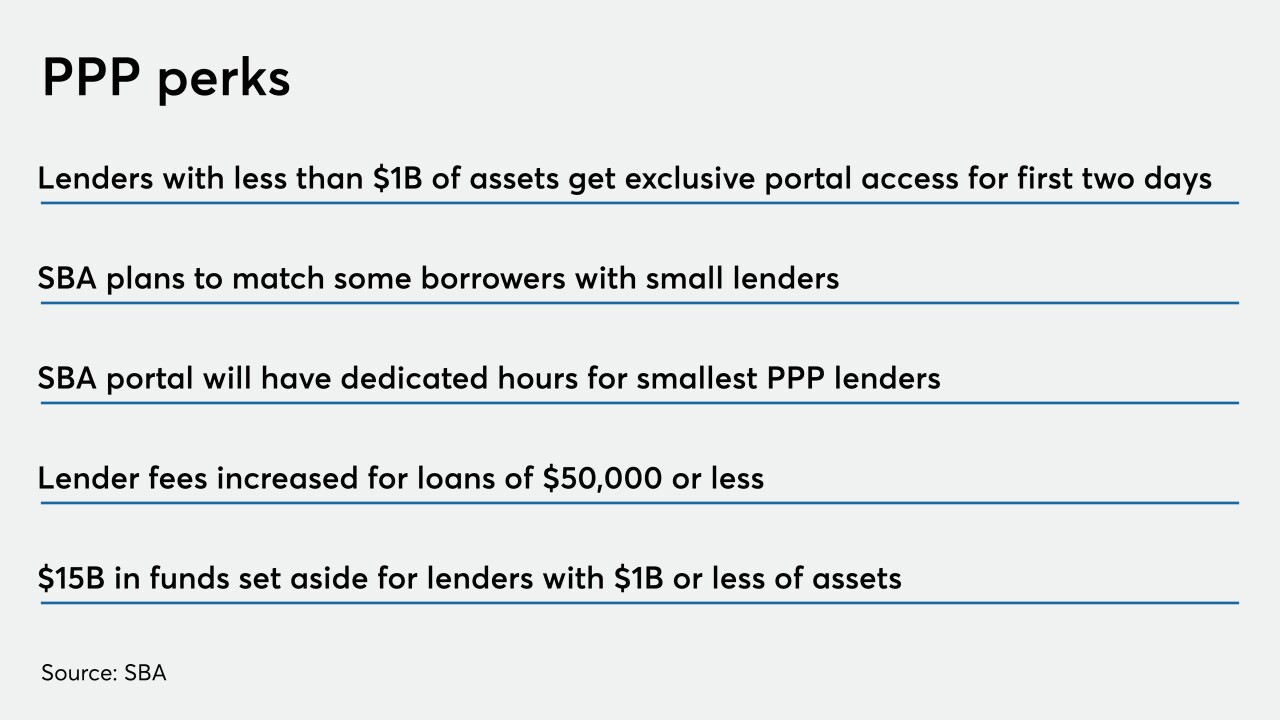

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7 -

Congress acted first when it freed financial firms from having to disclose the beneficial owners of commercial clients. Now it's time for regulators to further ease anti-money-laundering reporting requirements by freeing them from filing duplicative or unnecessary suspicious activity reports.

January 6 Debevoise

Debevoise -

The CFPB issued two rulemakings in 2020 that the financial services industry and consumer advocates hoped would finally clarify key issues over how collectors contact debtors and deal with legacy debts. But both sides want the incoming Biden administration to make further changes.

January 5 -

Congress's enactment of the defense spending bill opposed by the White House removes the final hurdle for a key anti-money-laundering provision.

January 2