-

The pace of forgiveness for Paycheck Protection Program loans is expected to accelerate when the Small Business Administration issues guidance on additional steps meant to streamline the process.

January 13 -

The Utah company, which serves more than 2,000 banks and credit unions, has grown rapidly because it helps financial institutions deliver the types of personalized financial advice consumers have increasingly come to expect.

January 13 -

Sen. Sherrod Brown, D-Ohio, said elevating affordable housing issues, examining the financial system through a climate and racial justice "lens" and holding banks accountable for their impact on consumers will be among his priorities.

January 12 -

Congress acted first when it freed financial firms from having to disclose the beneficial owners of commercial clients. Now it's time for regulators to further ease anti-money-laundering reporting requirements by freeing them from filing duplicative or unnecessary suspicious activity reports.

January 12 Debevoise

Debevoise -

The Mint’s facilities in Denver and Philadelphia worked overtime in the second half of 2020 so that banks and retailers could get more change into customers’ hands.

January 10 -

The agency that supervises Fannie Mae and Freddie Mac has pushed for revising an agreement with the Treasury Department allowing the mortgage giants to retain their profits. A deal could be out of reach once Joe Biden takes office.

January 8 -

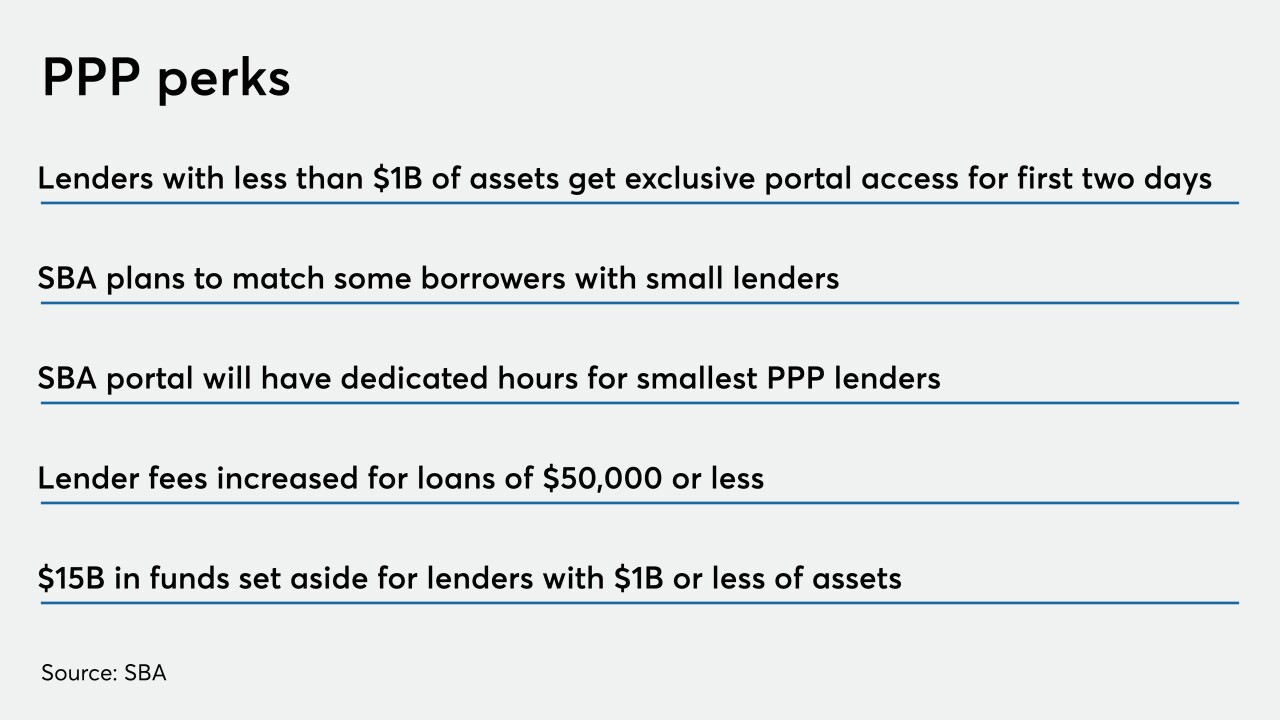

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7 -

Congress acted first when it freed financial firms from having to disclose the beneficial owners of commercial clients. Now it's time for regulators to further ease anti-money-laundering reporting requirements by freeing them from filing duplicative or unnecessary suspicious activity reports.

January 6 Debevoise

Debevoise -

The CFPB issued two rulemakings in 2020 that the financial services industry and consumer advocates hoped would finally clarify key issues over how collectors contact debtors and deal with legacy debts. But both sides want the incoming Biden administration to make further changes.

January 5 -

Congress's enactment of the defense spending bill opposed by the White House removes the final hurdle for a key anti-money-laundering provision.

January 2 -

Challenger banks aimed at Blacks, Hispanics, immigrants and other underserved groups are offering financial education and support for charities in addition to basic banking services.

December 31 -

An impasse over pandemic relief checks for Americans is holding up an override of President Trump's veto of a bill shifting beneficial-owner requirements from banks to their commercial clients.

December 30 -

Eleven Democrats on the Financial Services Committee have asked the heads of the Treasury Department and IRS to eliminate service charges tied to debit cards used to distribute COVID-19 relief.

December 29 -

The new legislation includes a provision sparing lenders from having to pay such fees on Paycheck Protection Program loans, except in cases where they agree in advance with borrower representatives to do so.

December 29 -

Treasury Secretary Steven Mnuchin approved the extension of the Main Street Lending Program, which offers loans to midsize companies affected by the pandemic, to Jan. 8.

December 29 -

The Consumer Financial Protection Bureau is headed for more disruption in the new year with a Democratic administration likely to reverse several GOP-backed policies. More aggressive relief for mortgage borrowers, a rollback of Trump-era rulemakings and yet another realignment of CFPB offices will all be on the table.

December 29 -

The Federal Reserve is credited with containing damage to the financial system from the coronavirus pandemic, but experts say the limits of the central bank’s power to prop up the economy will likely become more apparent in the new year.

December 28 -

The top Democrats on the House and Senate banking committees urged the Trump administration to pull the plug on any steps to overhaul Fannie Mae and Freddie Mac with the pandemic still taking a toll on the economy.

December 23 -

The proposal would require the government-sponsored enterprises to craft resolution plans similar to regulations imposed on the largest U.S. banks.

December 23 -

The legislation allows the Small Business Administration to waive fees and raise the guarantee for 7(a) and 504 loans, which could encourage more small businesses to apply for loans as the economy recovers.

December 22