-

Digital ID platform developers are competing to sign up partners to deploy their technologies to replace vulnerable usernames and passwords with a single sign-in. The challenge is to sign up a sufficient volume of partners to make these platforms attractive for consumers and businesses.

August 29 -

Michael Terpin explains how hackers stole $24 million worth of cryptocurrency from his mobile phone and why he’s suing AT&T for $224 million; Luke Lombe of PlayChip describes his new ICO.

August 27 -

In the same way a card skimmer steals credentials at an ATM, gas pump or point-of-sale terminal, the Magecart malware hides beneath the surface of a website with a digital skimmer to obtain card and personal information.

August 27 -

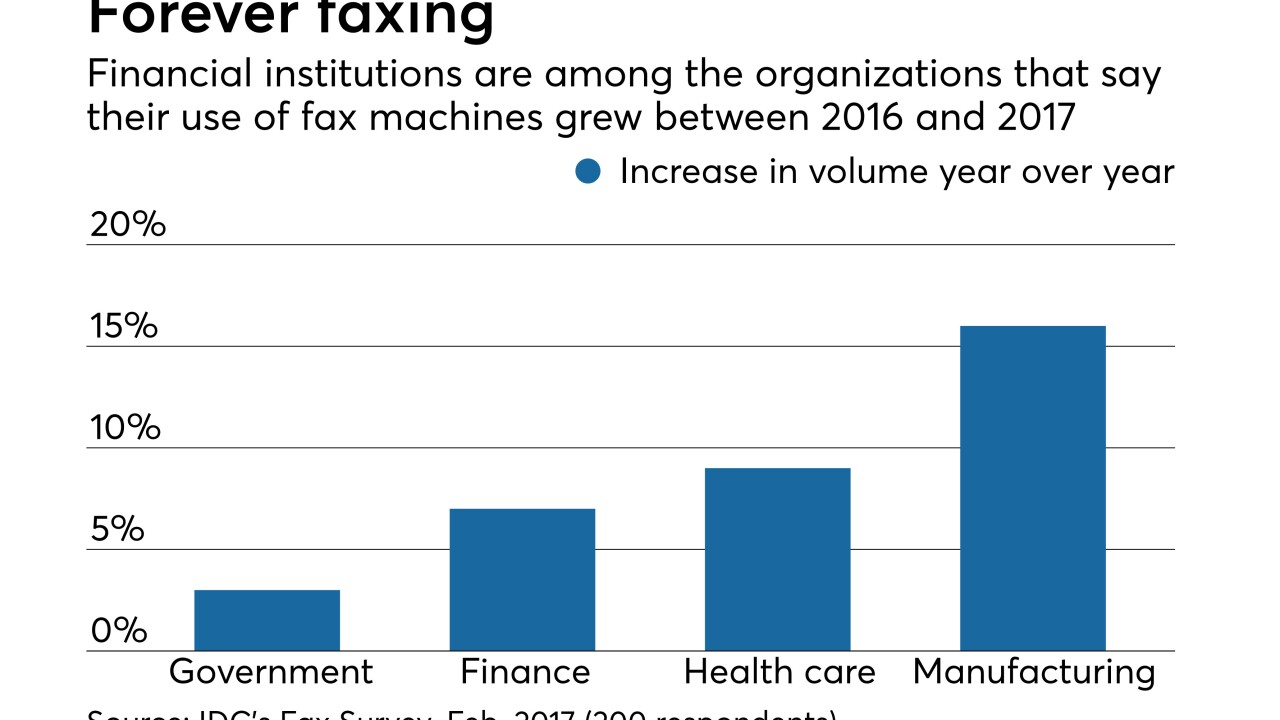

Security researchers have raised alarms about the vulnerabilities of fax machines (yes, many banks are still using them) and printers. It is the kind of threat companies tend to overlook.

August 27 -

Citigroup was so impressed with a test drive of AI software it invested in its maker; the FBI's warning of a cyberattack targeting ATMs came to pass — expect more to come; debating whether state AGs can serve as de facto CFPBs; and more from this week's most-read stories.

August 24 -

A letter supposedly sent to U.K. bank customers warns that Barclays debit cards could explode. The letter then urges recipients to mail their cards, along with their PIN codes, to an address in Bangalore. But is this really happening?

August 24 -

After researchers exposed how hackable mobile point of sale systems are, vendors quickly shored up their defenses — while also blaming some vulnerabilities on payment methods they characterize as outdated.

August 24 -

Due to all the data breaches and privacy mishaps, there is now a strong demand for a better, more secure solution for digital transactions, writes Mick Hagen, CEO of Mainframe.

August 24 Mainframe

Mainframe -

Despite recent scrutiny of mobile point of sale devices, the mobile payments category as a whole has generally carried a promise of initiating a safer transaction through the use of biometrics, device ID, geolocation and other factors.

August 23 -

BNY Mellon, JPMorgan and Bank of America are recruiting interns from Year Up, many of whom lack college degrees but are trained in high-demand fields such as cybersecurity and anti-money-laundering.

August 23 -

A more open approach to banking will bring major changes, with quality data on banking services and IT security now becoming a significant factor for consumers in selecting a provider.

August 22 -

A heist in India appears to be the very thing U.S. law enforcement had foretold. But banks shouldn't let their guard down, because cybercrooks have raised raids on cash machines to an art form.

August 22 -

Account takeover (ATO) fraud currently drives the largest fraud losses at North American financial institutions within digital channels, according to a new report from Aite Group and Early Warning, the bank organization that operates the Zelle payment network brand. And according to data from RSA, phishing remains a vital part of this scam.

August 22 -

Our phones are rapidly becoming a massive single point of failure in our digital lives.

August 21 -

Kevin Jenkins, former managing director of Visa U.K. and Ireland, joined the board of London-based fintech Nuggets to oversee business development for the blockchain-based security provider as it enters the massive mobile payments market in Asia.

August 20 -

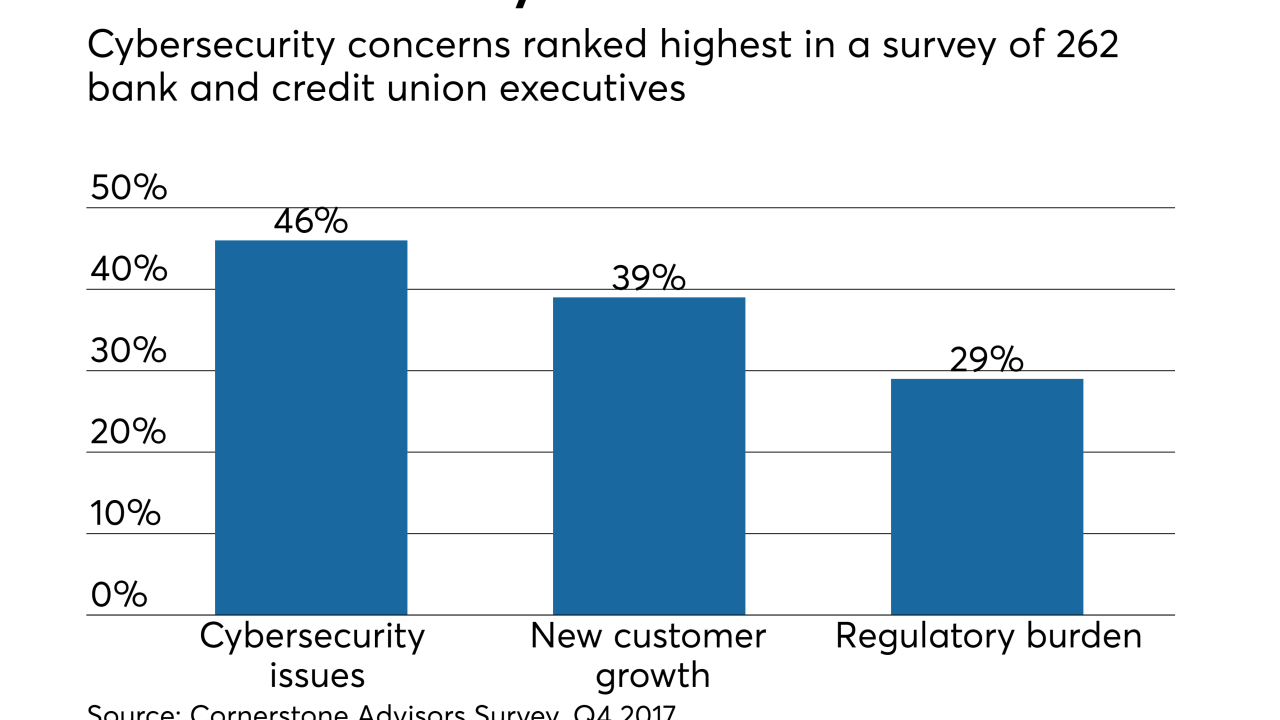

One community bank decided it can build closer relationships with business clients by hosting events to help them learn how to fortify their cyberdefenses.

August 17 -

Financial institutions are hoping to get ahead of the growing and seemingly insurmountable problem of payment card fraud not just by looking at who cyber-attackers are going after currently but who they are likely to defraud in the near future.

August 17 -

As the state phases in tougher requirements from its 2017 regulation, federal agencies continue to show an interest in updating their cyber policies.

August 17 -

After warnings of an impending major ATM cash-out had bank security teams working overtime last weekend, crooks made off with over $13 million over the weekend in a double attack on India’s venerable Cosmos bank.

August 17 -

Thieves stole more than $13 million from an Indian bank just days after an FBI warning; Fed’s special oversight restrictions from 2015 lifted.

August 17