-

Year to date Jun. 30, 2020. Dollars in thousands.

November 23 -

The company's latest report predicted there could be sustained economic pressures well into next year tied to rising coronavirus cases.

November 20 -

Technology imperatives, weak loan demand and the need for increased efficiency could put pressure on dozens of regional banks to join forces with rivals.

November 17 -

The forthcoming measure could override staff opinions that helped certain deposit-gathering companies partner with banks.

November 13 -

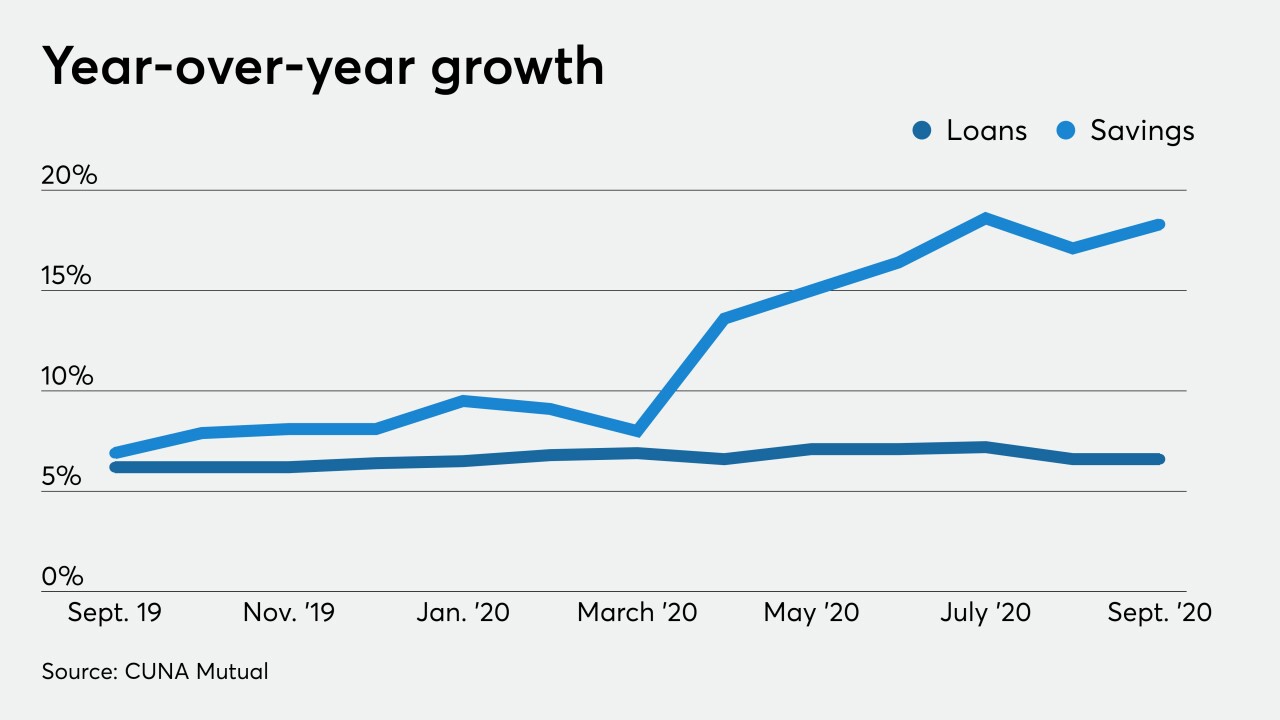

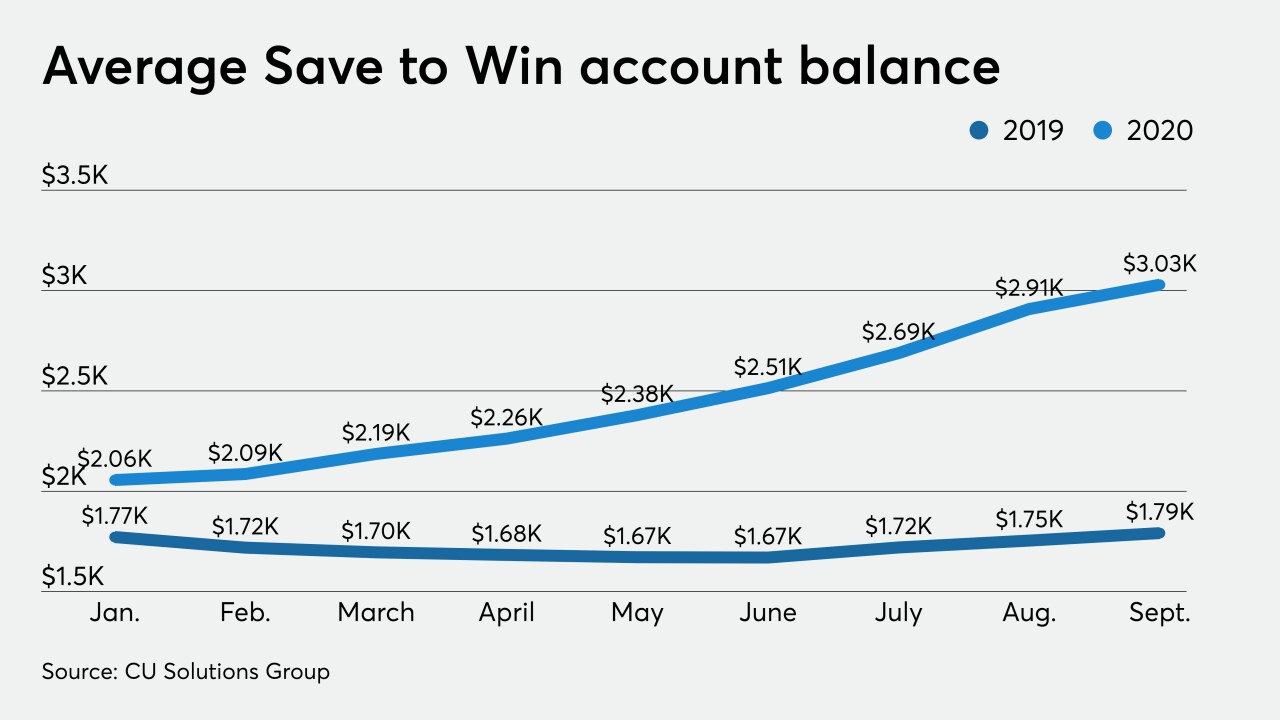

Many credit unions offer these accounts to help members improve their financial behaviors, but some in the industry are wondering how long the surge could last.

November 10 -

On Jun. 30, 2020. Dollars in thousands.

November 2 -

The company is best known for its reciprocal deposit program, but it’s finding new ways to serve banks without competing for their customers.

October 29 -

First City Bank of Florida had suffered “longstanding capital and asset quality issues” that were unrelated to the pandemic, the FDIC said.

October 16 -

The family-owned bank from the South and the New York commercial lender each would fill a clear need for the other. First Citizens would gain business lending expertise and an online deposit-gathering platform, and CIT would get the cheap deposits it coveted.

October 16 -

Cash, Treasurys and other securities effectively guaranteed by the federal government now make up more than 35% of the combined balance sheets of the 25 biggest U.S. banks, according to data compiled by the Fed. That’s the biggest share in records dating to 1985.

October 9