-

The company and its global peers have seen their profitability hurt by half a decade of negative interest rates, which effectively make banks pay for holding clients’ cash.

September 9 -

A pandemic-driven surge in bank deposits helped drive the agency's insurance reserves below their statutory minimum.

September 9 -

A new report from the National Credit Union Administration shows how hard the industry was hit during the second quarter as businesses closed and consumer spending dropped.

September 8 -

A New York CDFI is halfway to its $100 million fundraising goal for a fund that would put deposits in Black-owned banks and make loans to key businesses or projects. It hopes the moves will improve availability of capital and access to mainstream financial products.

September 4 -

Why PayPal just deposited $50 million in tiny Optus Bank; ex-Bank of America employees allege 'extreme pressure' to sell credit cards; the Citi snafu may bring fresh scrutiny to custodial banks; and more from this week's most-read stories.

August 28 -

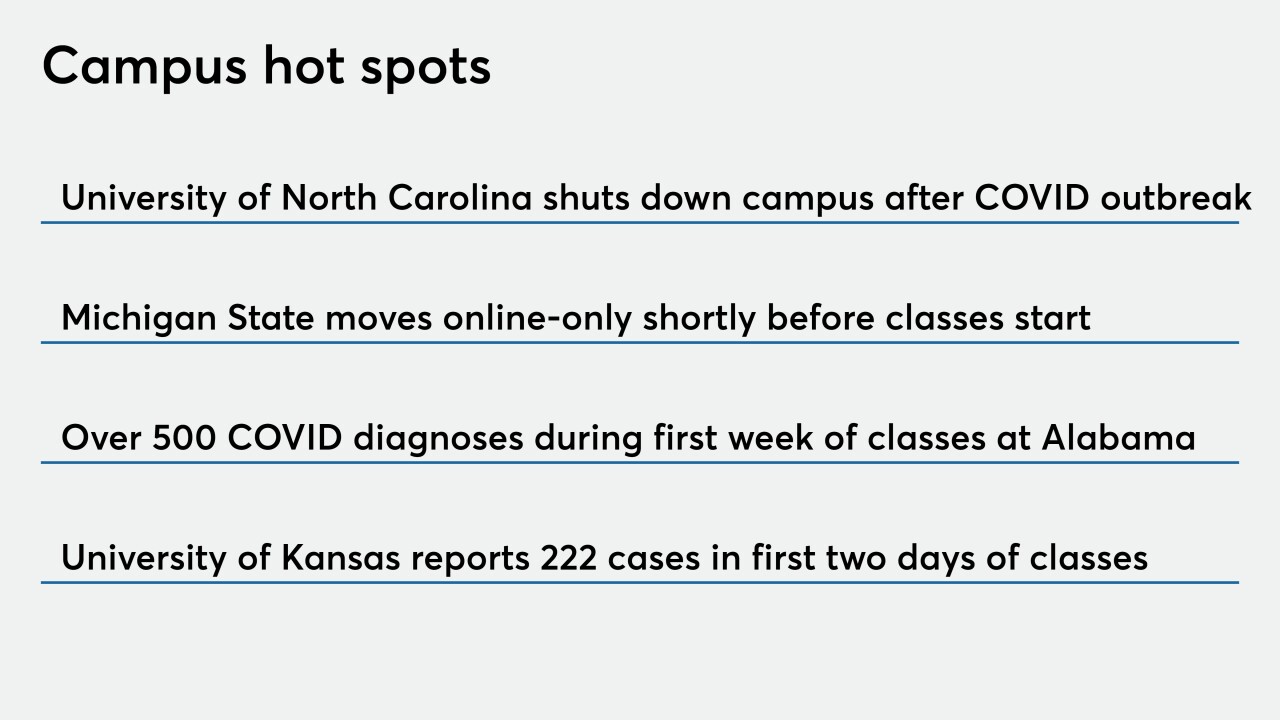

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

Whether the number of deals for 2020 can come close to last year's record-setting level will come down to one question: Can community banks generate strong enough profits in the second half to justify their independence?

August 25 -

Credit unions added more than $176 billion to savings balances in the first half of the year, according to new analysis from Callahan & Associates.

August 18 -

On Mar. 31, 2020. Dollars in thousands.

August 17 -

This isn’t the first time the industry has faced an influx of funds amid a slowdown in lending, but this instance could prove harder to manage than in the past.

August 17