Credit unions chartered to serve colleges and universities could see traditional fall-semester membership gains decimated because of the coronavirus.

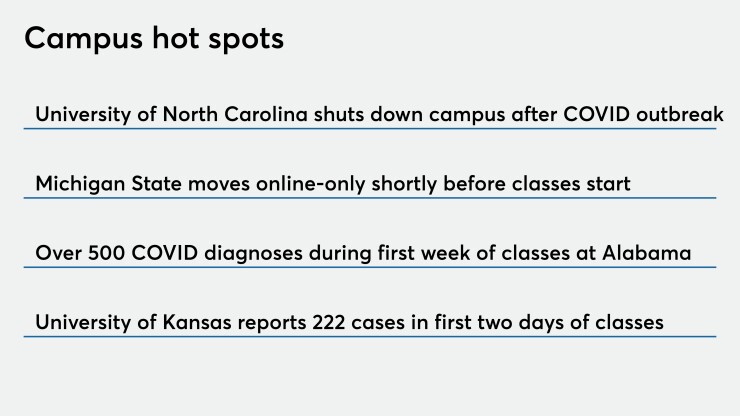

The start of the new academic year is often the biggest time of the year for recruiting new members, thanks in part to the influx of new students on campus. But many schools have had to alter their plans for the new semester because of the ongoing pandemic. The University of North Carolina in Chapel Hill initially had students on campus for in-person instruction but reversed course after one week. Similarly, Michigan State University switched gears at the last minute and moved to online-only courses shortly before students were set to return from summer break.

Several universities that had made plans for in-person coursework this fall have seen spikes in COVID-19 diagnoses with students back on campus. The University of Alabama reported roughly 560 cases during its first week of classes, while the University of Kansas saw 222 positive tests in just two days.

The National Credit Union Administration lists about 50 credit unions chartered to serve colleges and universities, and institutions serving those groups are doing their best to roll with the punches.

“Your strategic plan kind of went out the window on March 15,” quipped Daniel Berry, CEO of Duke University Federal Credit Union.

“From a student perspective, I think a lot of schools had the best of intentions,” he added. “They thought they could control it [with online classes in the spring, masks and social distancing] and kind of underestimated that teenagers want to be together. That’s part of the college experience.”

Duke CU serves some of the student population but is more targeted at faculty and staff. It normally sees about 100 new members per month, but that figure dropped by more than half

“Now you can’t put a tent up [in areas where students congregate], you can’t say, ‘Here’s a t-shirt if you join us.' Everything’s online,” said Berry, noting that other tactics such as geofencing also don’t work without the influx of people on campus. “You’ve got to adapt, but still your results are going to be lower than normal.”

Berry said it’s still unclear what sort of expectations the credit union should be setting since it’s so difficult to predict when things will get back to normal.

Achieving last year’s averages “may be an unrealistic target for 2020,” he said.

Michigan State University FCU normally onboards between 25% to 30% of the university’s incoming student population, an average of about 2,300 new members each year between May and September.

This year’s numbers are only at about 50% of the usual target.

“There’s normally about 50 different events we’d be at [on campus] and now the majority of those have been cancelled or…moved to a virtual setting,” said Deidre Davis, chief marketing officer at the $5.4 billion-asset institution. In instances where new-student orientation and other activities have been moved online, the credit union has in some cases been asked to provide a video to introduce MSUFCU and some basic information on financial wellness.

While upwards of 30% of the new student population may seem impressive, Davis said those numbers pale in comparison to 15 years ago when the credit union regularly had 80% or more of each year’s new class join.

“Back then you needed to have checks from a local financial institution, and with the advent of mobile banking people didn’t need to close one account and open another,” she said. “The rise of debit cards…made access to that previous financial institution so much easier, and so not as many students felt that need to have that local account.”

The credit union still gets significant mileage out of school spirit and connection to the university, including debit cards and checks with pictures of campus and the school’s mascot. Still, the number of new memberships each fall has dropped by about 10% in each of the last few years, and “this pandemic is causing a much greater decrease in the number of accounts," Davis said.

As of the end of July, Michigan State University FCU membership was up by almost 5.3% year over year, but year-to-date growth was just 2.3%. Assets have risen 22.1% year-to-date and deposits were up more than 23%.

Davis noted that some of MSUFCU’s hit to new memberships will be blunted by recent expansion efforts, including new branches across the state in the towns of Holt and Traverse City. Membership is open to state employees and a variety of other select employee groups.

Sam Brownell, CEO at the consultancy CU Collaborate, pointed out that this sort of scenario exemplifies why diversified fields of membership are important.

“Having a diverse field of membership has its pros and cons [but] one of the pros is that you have a more diversified risk exposure in terms of who your members are and things that could impact them,” he said.

Along with the hit to membership growth, Davis said MSUFCU may also see a reduction in what it forecasted for interchange income, since fewer new members means fewer new credit and debit cards issued. Management had budgeted for a 5.5% increase in debit interchange but is now expecting just 5% growth.

The picture for credit interchange is worse. Current plans predict just a 4% increase for that revenue stream compared with the 19% originally expected.

Berry and Davis both suggested 2021 may also be a challenge. Berry noted that even breaking even financially may be enough to call the year a success, in part because 2020 had two and a half months of “normal” activity before the pandemic hit.

Davis said MSUFCU has increased its digital marketing in order to reach members — including alumni along with faculty, staff and students — who aren’t on campus, but said expansions into other parts of the state in recent years could help with growth.

Brownell cautioned that even if CUs serving universities are eventually able to make up for the business they would have gained this year, it’s likely to come at a cost.

“Can you attract new members, deposits and loans through digital strategies from students who otherwise would have seen you in a branch? Definitely,” he said. “But will you be able to make everything up in terms of meeting your projections? Probably not. You’ll have to spend more money on digital marketing than you would have otherwise.”