-

Deposit prices are starting to rise, deposit growth is slowing, commercial loan growth remains tepid (with some exceptions) and concerns are mounting about the economic toll of U.S. trade policy, bank executives said just a few weeks ahead of the end of the quarter.

March 6 -

A debate is brewing about whether rising rates mean banks must pay more to hold onto deposits from city and county governments — and whether they are worth it. Some would say no question on both counts, while others say it all depends on the financial strategy of the client and how badly the bank needs that client.

February 28 -

On Jun. 30, 2017. Dollars in thousands.

February 13 -

On Sep. 30, 2017. Dollars in thousands.

February 13 -

Year to date Sep. 30, 2017. Dollars in thousands.

February 12 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

On Sep. 30, 2017. Dollars in thousands.

January 29 -

Both proposals aim to establish institutions that would be modeled after Bank of North Dakota, the nation's only public bank.

January 24 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24 -

NewDominion, which has completed an improbable turnaround, is the last community bank based in Charlotte, N.C.

January 23 -

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

Carter Bank & Trust’s founder shunned internet banking and handled most executive duties himself. He died in April and his successor, Litz Van Dyke, is now working at breakneck speed to modernize this once-hidebound Virginia bank.

December 29 -

David Becker is trying to prove to investors that his Indiana bank can succeed over the long term. With the rise of online banking and fintech firms, Becker is a community banker worth watching in the new year.

December 26 -

Banks are looking for ways to capture and retain deposits as interest rates rise, including promotional offers and focusing on relationship banking.

December 21 -

For the first time in nearly nine years, an acquirer of a failed bank agreed to purchase only the institution’s insured deposits, making it likely that some customers will not recoup all of their uninsured funds.

December 15 -

Executives at small banks are wary about 2018 as concerns about lackluster loan demand, low yields and rising deposit prices abound.

December 13 -

It’s only early December, but bank CEOs’ comments this week about tax reform, their thirst for deposits, consumer lending initiatives, and challenges in commercial lending offer a sneak peek at what’s coming when earnings season begins next month.

December 7 -

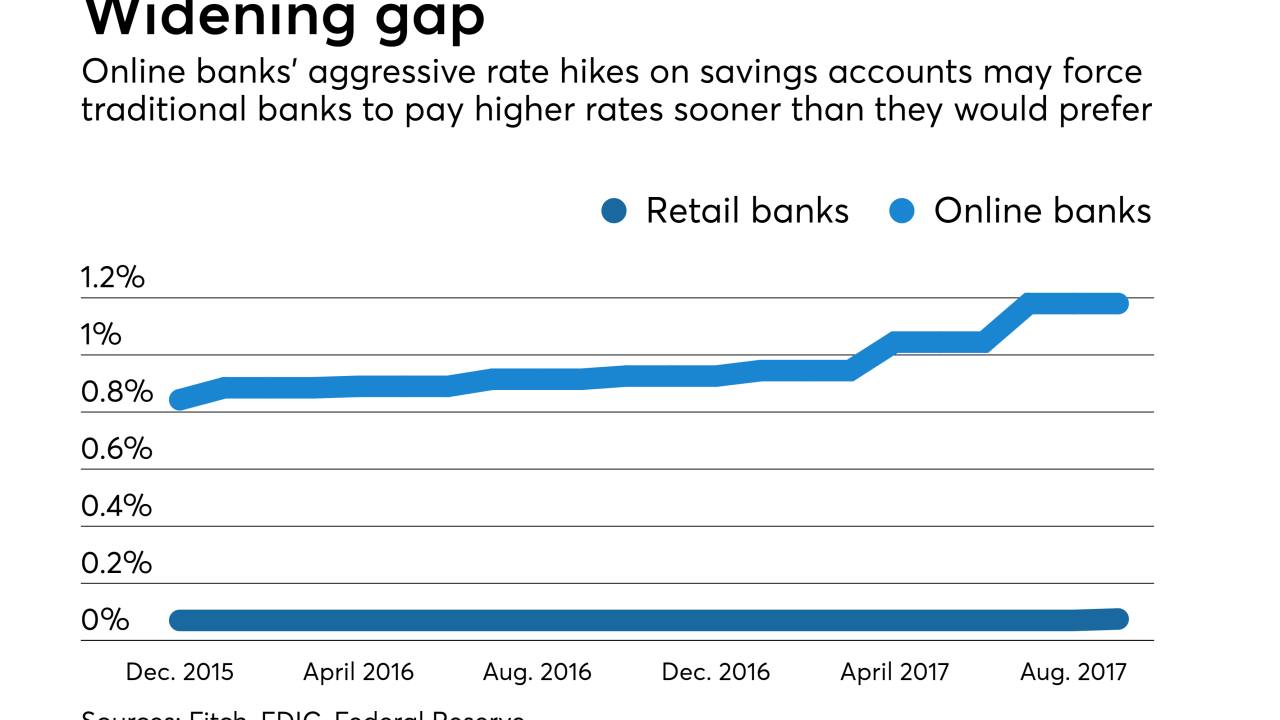

Online banks have been aggressively raising the rates they pay on consumer deposits, and that is forcing mainstream banks to consider following suit or risk losing valuable deposits to their more nimble competitors.

November 29 -

The Michigan company, which lost more than $1.4 billion in the aftermath of the financial crisis, is trying to become more of a commercial lender. Its recent agreement to buy a deposit-rich franchise in California could help it get there.

November 21