-

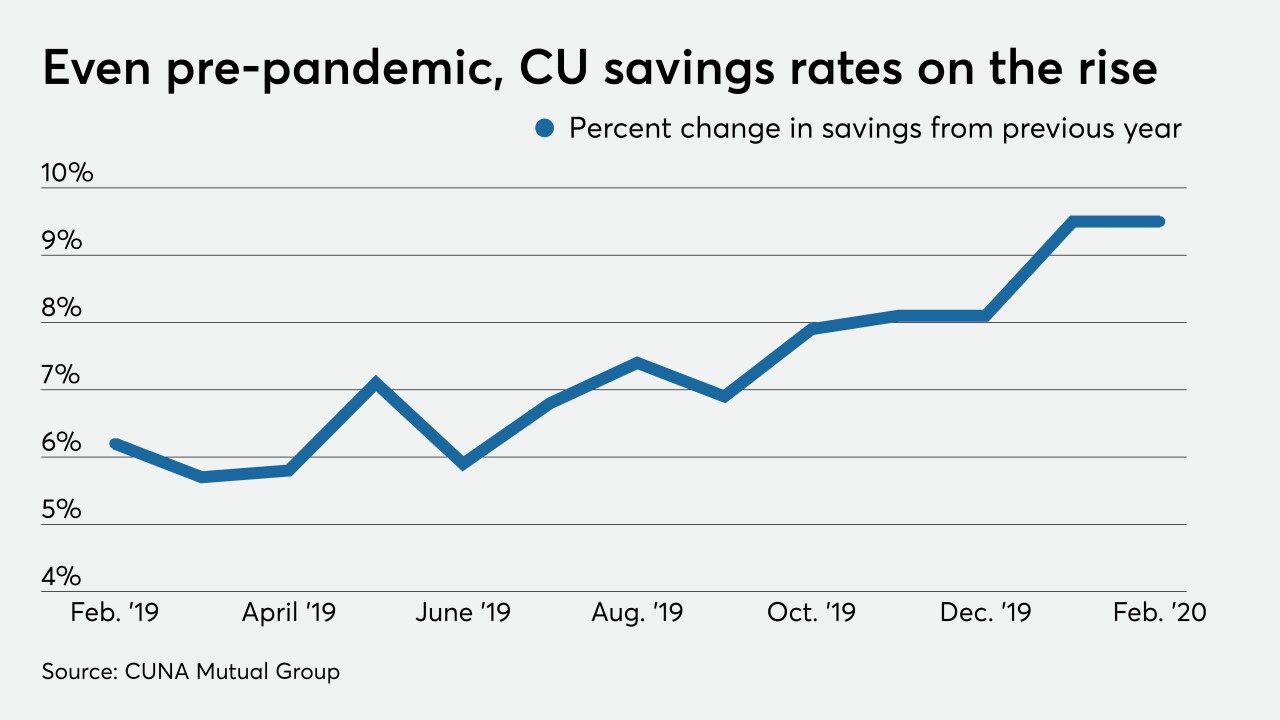

A record amount of funds have flowed into banks since the coronavirus hit, but a low-rate environment and tepid loan demand are complicating efforts to put that money to work.

June 17 -

The legislation would aim to address concerns that the current policy is outdated by establishing a new regime to limit asset growth for banks that are not well-capitalized.

June 17 -

The industry was well positioned in terms of net worth before the pandemic and recession, but some institutions could run into issues with sluggish earnings and a surge in deposits.

June 12 -

Industry figures have begun to speak out in support of demonstrations in the wake of the deaths of George Floyd and other African Americans, and new data is expected to show how the coronavirus impacted balance sheets.

June 8 -

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

May 29 -

The economic contraction caused by the coronavirus pandemic has been worse than the Wall Street firm had modeled two months ago, its president John Waldron said Wednesday.

May 27 -

The bank is trying to recover millions of dollars in returned deposits. It also has a $14 million loan to the company that allegedly conducted the scheme.

May 26 -

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

Bracing for a prolonged economic slowdown, many community bankers say they are considering a number of belt-tightening measures, including freezing salaries and delaying investments in technology and product development, according to a survey by Promontory Interfinancial Group.

May 18 -

Congress authorized the Federal Deposit Insurance Corp. to intervene if the pandemic caused a liquidity scare, but nearly two months later deposits are through the roof and the agency has not acted on the expanded authority.

May 14 -

The Federal Reserve also said in a supervisory report released Friday that it would conduct stress tests this quarter as planned, taking into account sudden deterioration in the economy brought on by the coronavirus pandemic.

May 8 -

Banks that relied on loan growth to outperform peers in 2019 will need to focus more on core deposits and expense control this year. Check out our annual ranking of the top 200 publicly traded community banks.

May 6 -

On Dec. 31, 2019. Dollars in thousands.

May 4 -

The central bank said customers will be able to make more transfers and withdrawals "at a time when financial events associated with the coronavirus pandemic have made such access more urgent."

April 24 -

The bill, which President Trump is expected to sign Friday, includes $310 billion more funding; the four largest U.S. banks took in $590 billion of the $1 trillion banks attracted.

April 24 -

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

April 16 -

Many states are offering additional flexibility as more consumers dip into their savings as a result of the pandemic’s economic fallout.

April 9 -

Firms that spread big-dollar deposits to community banks have seen a rush in demand as small businesses seek emergency loans to weather the coronavirus pandemic.

April 7 -

The agency proposed changes in December to how customer relationships affect the definition of brokered funds, which has big implications for banks that are not well capitalized.

April 3