Digital banking

Digital banking

-

Everything from fintechs to Amazon are threatening the financial services industry. Credit unions need a plan in place to keep up.

December 10 -

It’s still primarily a commercial bank, but the branding campaign — CIT’s first in a dozen years — is designed to appeal to the group driving its torrid deposit growth: retail savers.

December 7 -

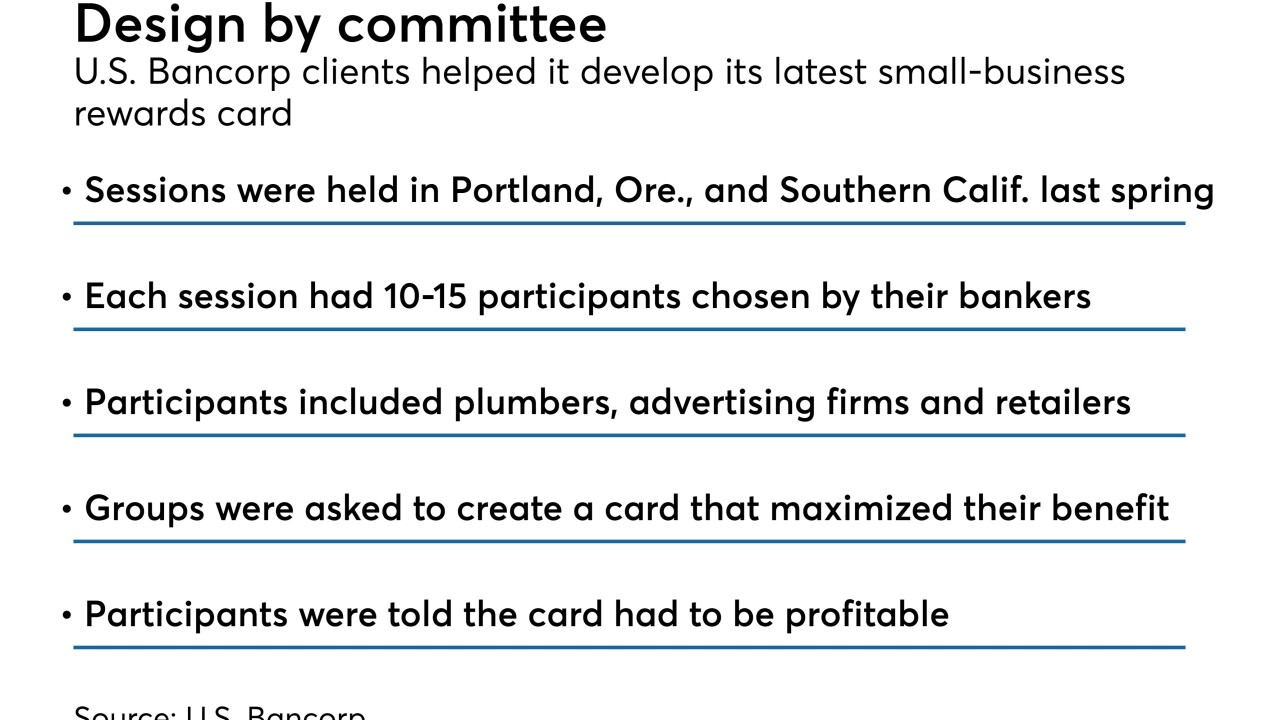

The regional bank is working with customers to help develop and launch new products, including a small-business credit card.

December 7 -

Not only did cardholders buy more in the days surrounding Black Friday, but more consumers completed digital transactions.

December 6 -

Michael Hanley, former head of digital for the World Economic Forum, and Anthony Thomson, the creator of Atom Bank, share their thoughts on the future.

December 5 -

The Chicago bank's new partnership with AutoGravity mirrors others struck this year by JPMorgan Chase and U.S. Bank with providers of mobile apps that bundle the car-buying and lending processes.

December 5 -

The online lender has acquired NextGenVest, which uses AI and text messaging to advise high school and college students about getting loans. CommonBond’s goal is to better understand the distinctly different demographic group rising behind millennials.

December 4 -

The company, which helps banks develop high-tech products and services, has agreed to buy Gro Solutions after recently completing its deal for Cloud Lending.

December 3 -

To convince skeptical bankers about the benefits of distributed ledger technology, some suggest it needs to be separated from the volatile digital currency it underlies.

November 30 -

Readers weigh in on consumers taking on more debt, President Trump's criticism of the Federal Reserve and Zions CEO Harris Simmons as Banker of the Year.

November 29