-

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20 -

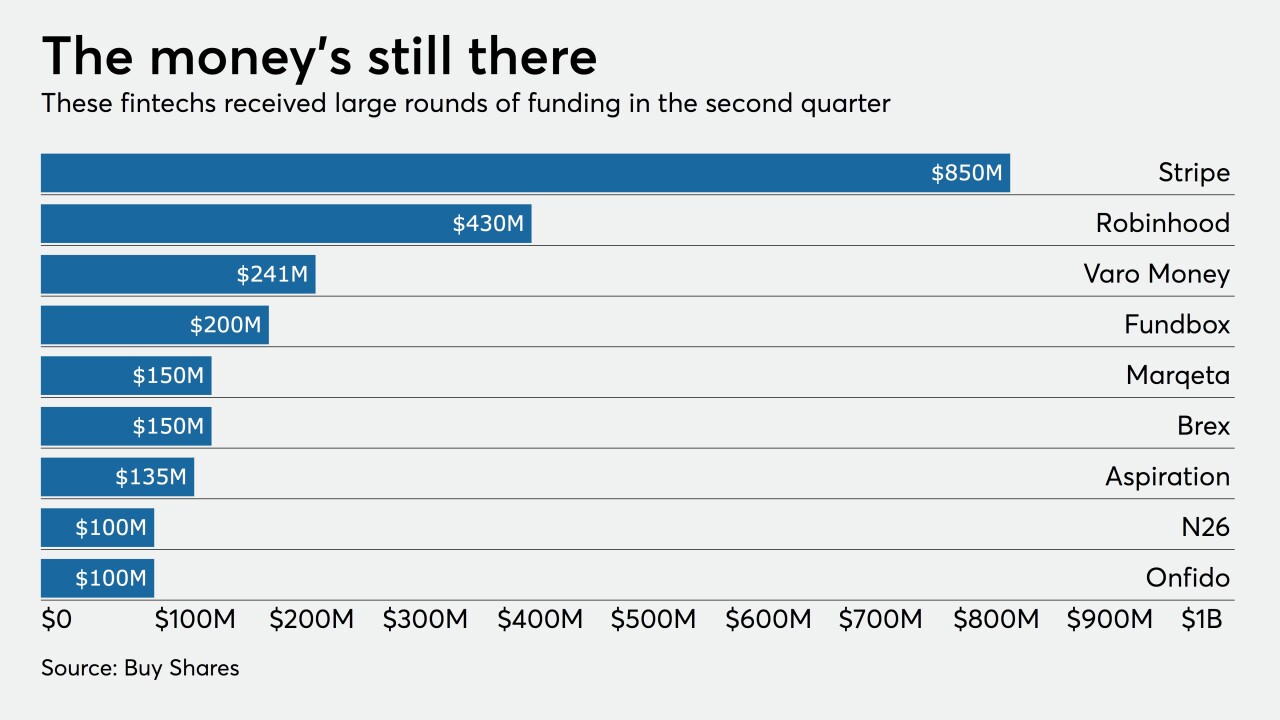

The mobile bank raised $241 million in its Series D round of funding, and expects to receive approval from regulators to become a nationally chartered bank this summer.

June 3 -

The global e-commerce site is rolling out a suite of banking tools for its growing U.S. user base later this year that will help them bank and manage their businesses all in one spot.

May 20 -

Complaints to the CFPB hit an all-time high, with mortgage servicers getting much of the fire; Frank Bisignano details his priorities as Fiserv’s new CEO; lenders worry they could be stuck with billions in Paycheck Protection Program loans; and more from this week’s most-read stories.

May 15 -

The neobank, which has been operating in the U.S. since last year with partner Sutton Bank, hopes to get a bank charter within two years.

April 24 -

The mobile-only bank offers many standard neobank features and some added payment options.

March 24 -

The all-digital bank is hoping to win over consumers with above-average savings rates and more detailed analysis of their spending habits.

March 8 -

In every segment except people older than 64, a majority would consider banking with Apple, Google, Amazon or Facebook, a new survey finds.

February 25 -

Andy Rachleff, the fintech's CEO, discusses the digital bank it's developing and the concept of "self-driving money."

February 3 -

The German challenger bank says it has quickly attracted Americans from every state and various demographic groups to its mobile banking app.

January 27