Earnings

Earnings

-

The Dallas bank reported sizable growth in business and mortgage lending in the second quarter, but it more than doubled its provision for loan losses to cover four credits that went into nonaccrual status.

July 18 -

Analysts had expected the New York-based firm to boost its forecast as consumers increased spending on its cards.

July 18 -

Repayments on acquired residential mortgage loans were the main reason, but other bottom-line boosters more than made up for that, the Buffalo, N.Y., bank said in reporting second-quarter results.

July 18 -

The big custody bank's fees surged on new business gained from its deal for UBS business units in Europe.

July 18 -

The Minnesota company's profits rose by double digits despite some challenges in the second quarter, and its CEO says it will be expanding its digital offerings to simplify banking for customers.

July 18 -

The Mississippi company said it has recorded most of the expected charge-offs tied to the last severe decline in oil prices.

July 18 -

Goldman’s new CEO is expected to instill more corporate discipline; second quarter earnings jumped nearly 40% compared to a year earlier on higher revenues.

July 18 -

Comerica faced aggressive questioning Tuesday about how it could use freed-up capital now that it’s no longer considered a systemically important financial institution. It won’t be the last small regional to get such a grilling this earnings season.

July 17 -

The Los Angeles company's second-quarter profit also benefited from last fall's purchase of CU Bancorp.

July 17 -

Declines in corporate banking and energy loans were part of the reason loan growth was light, but the Dallas bank reported strong earnings thanks heavily to fatter margins.

July 17 -

One-time items included $43.2 million of second-quarter expenses related to the Capital Bank acquisition, but First Horizon executives forecast sizable savings from the deal.

July 17 -

David Solomon is officially named as Blankfein’s successor; the British bank is under pressure from an activist shareholder to boost its stock price.

July 17 -

Bank of America’s consumer loans grew a lot. But its rivals? Not so much. The mixed results raise questions about whether BofA’s performance is a leading or trailing indicator, and if credit quality is going to be more of a problem industrywide.

July 16 -

Loans in that business climbed 6.6% compared with a year earlier as Bank of America's overall profits rose by 33%.

July 16 -

Succession plan could be formalized this week; bankers may be getting nervous about extending construction loans.

July 16 -

The struggling Frankfurt-based bank expects to report net income of $468 million when it issues second-quarter results nine days from now, but it's unclear exactly where the earnings beat is coming from and whether the performance is sustainable.

July 16 -

Price competition on deposits may finally force the largest banks to pay up, and consumers’ aggressive use of rewards and promotional rates is weighing on card income. And then there are those tariff fights that could hurt global clients.

July 13 -

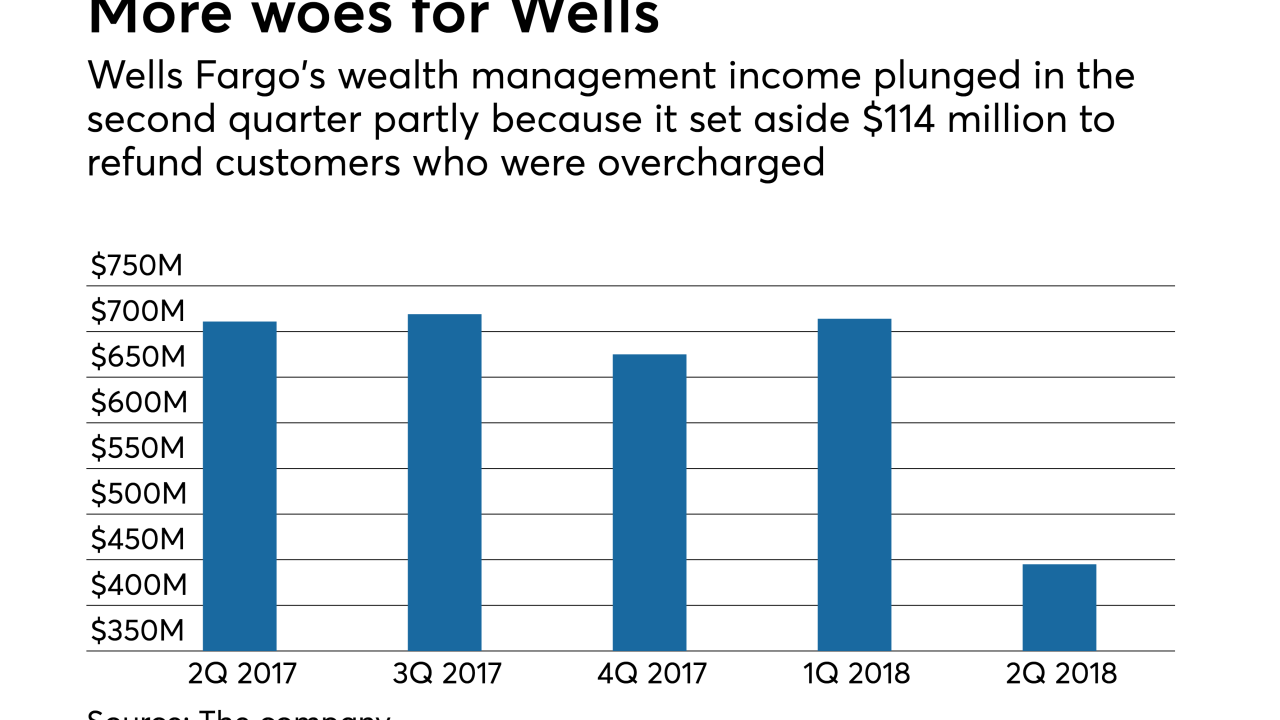

The unit’s profits plunged in the second quarter as the company contended with the fallout from overcharging wealth management clients. Was it a one-off or the beginning of a long-term problem?

July 13 -

The Pittsburgh regional detailed plans to enter a number of new markets with its digital bank and carefully chosen branch openings.

July 13 -

The industry is slated for another busy week, with more bank results on the horizon, plus a nomination hearing for Trump’s pick to head the CFPB.

July 13