Wealth management is the latest business line at embattled Wells Fargo to show signs of erosion, as fallout from the company overcharging customers weighed on second-quarter results and reputational hits threatened to inflict more damage.

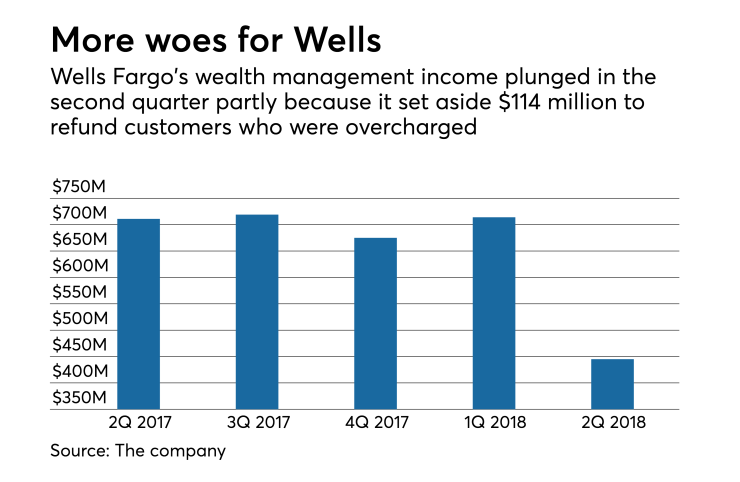

The $1.9 trillion-asset bank reported Friday that net income in its wealth and investment management division fell to $445 million in the second quarter, a 37% decline from the same period a year earlier.

The unit’s current struggles can be chalked up to a mix of causes, some fleeting and others longer lasting.

During the second quarter, Wells took an impairment of $214 million after selling its 65% stake in an investment manager called the Rock Creek Group.

Wells Fargo also paid a price for

While one-time charges explained the unit’s subpar performance last quarter, Wells Chief Financial Officer John Shrewsberry acknowledged Friday that the wealth management division also faces some longer-term challenges.

He said that the bank’s review of past fee calculations within certain fiduciary and trust accounts is still ongoing, which suggests that more money may eventually be returned to customers. Wells Fargo has separately disclosed that it is assessing, in response to inquiries from federal agencies, whether it made inappropriate recommendations regarding retirement plan rollovers.

Shrewsberry also acknowledged Friday that the reputational damage the bank has sustained from various scandals — in April it was hit with a

“This is a part of the business where reputation matters,” he said during a conference call with reporters.

One concern is that Wells Fargo’s financial advisers will look for other jobs because the bank’s tarnished brand has made it harder to sign up customers. During the second quarter, Wells had 14,226 financial advisers, down 2% from the same period a year earlier, though the decline may not be connected to the bank’s reputational woes.

“It’s always been a relatively high turnover type of business, where we attract new advisers and lose advisers,” Shrewsberry said.

Wells Fargo CEO Tim Sloan said that financial advisers are a bit older on average than bankers, and he noted that a substantial portion of Wells Fargo’s attrition is the result of advisers retiring. “I think that this is a challenge that the industry has,” Sloan said during a conference call with analysts.

The San Francisco bank also faces the challenge of holding onto wealthy clients’ assets at a time when the long-awaited rise in interest rates has led many customers to hunt for more yield.

Average deposits in the bank’s wealth unit dropped to $167.1 billion in the second quarter, down 12% from the same period in 2017.

Some banks have landed in hot water in the past for steering customers to their own wealth management products, which tend to generate bigger profits.

Sloan said Friday that the bank’s financial advisers are providing the appropriate advice to customers, regardless of how much money it generates for Wells. “It’s whatever makes the most sense for that customer,” he said.

Wells’ wealth management unit was not the only part of the bank to report results Friday that disappointed analysts.

The bank reported average loans of $944 billion, a 1% decline from the same period last year. Loans backed by commercial real estate, automobiles, and second mortgages all declined, while credit card balances rose.

Wells is operating under a consent order with the Federal Reserve Board that caps its assets at $1.95 trillion.

But bank executives said Friday that the five-month-old asset cap has not affected the bank’s ability to expand its core lending businesses. They also reiterated that they expect the asset cap to be lifted sometime in the first half of 2019.

For the second quarter, the company said that net income fell 13.5% from the same period last year, to $5.2 billion, or 98 cents per share. The earnings were hurt by a one-time income tax expense of $481 million.

Shares in Wells fell by as much as 4% in early trading Friday but had recovered somewhat by the end of the day. They closed at $55.34, down 1.23%.