Earnings

Earnings

-

Though fourth-quarter net charge-offs reached a level not seen since the financial crisis, the Little Rock, Arkansas-based regional bank is forecasting better results in 2026 and an even stronger recovery in 2027.

January 21 -

The Providence, Rhode Island-based bank has steadily revamped certain parts of its strategy. Now, it will update its systems for serving customers.

January 21 -

The Minneapolis-based regional saw its fourth-quarter profits jump 23%. Consumer deposits bumped up, while operating expenses remained muted.

January 20 -

In the 11 months after Fifth Third completes its acquisition of Comerica, the Cincinnati bank plans to send 13 million-to-14 million pieces of paper mail to retail customers. CEO Tim Spence says the old-fashioned method "still works," and actually has some advantages over more modern modes of communication.

January 20 -

The Cleveland-based bank announced changes Tuesday to its board of directors, including the appointment of a new lead independent director. Last month, activist investor HoldCo Asset Management urged the bank's board to not re-nominate its longtime lead independent director.

January 20 -

The Huntsville, Alabama-based regional bank is well positioned to defend its Southeast footprint, according to CEO John Turner. It's hiring more bankers in growth markets, it has strong brand recognition and it has a long history in its core markets, he said.

January 16 -

"We're coming into your market," PNC Chief Executive Bill Demchack said Friday. "If you're not coming into our market to come fight us, we're coming to your market to come fight you, and we're going to get some percentage of your market."

January 16 -

During the fourth quarter, the Buffalo, New York-based bank reported its lowest ratio of nonperforming loans to total loans since 2007.

January 16 -

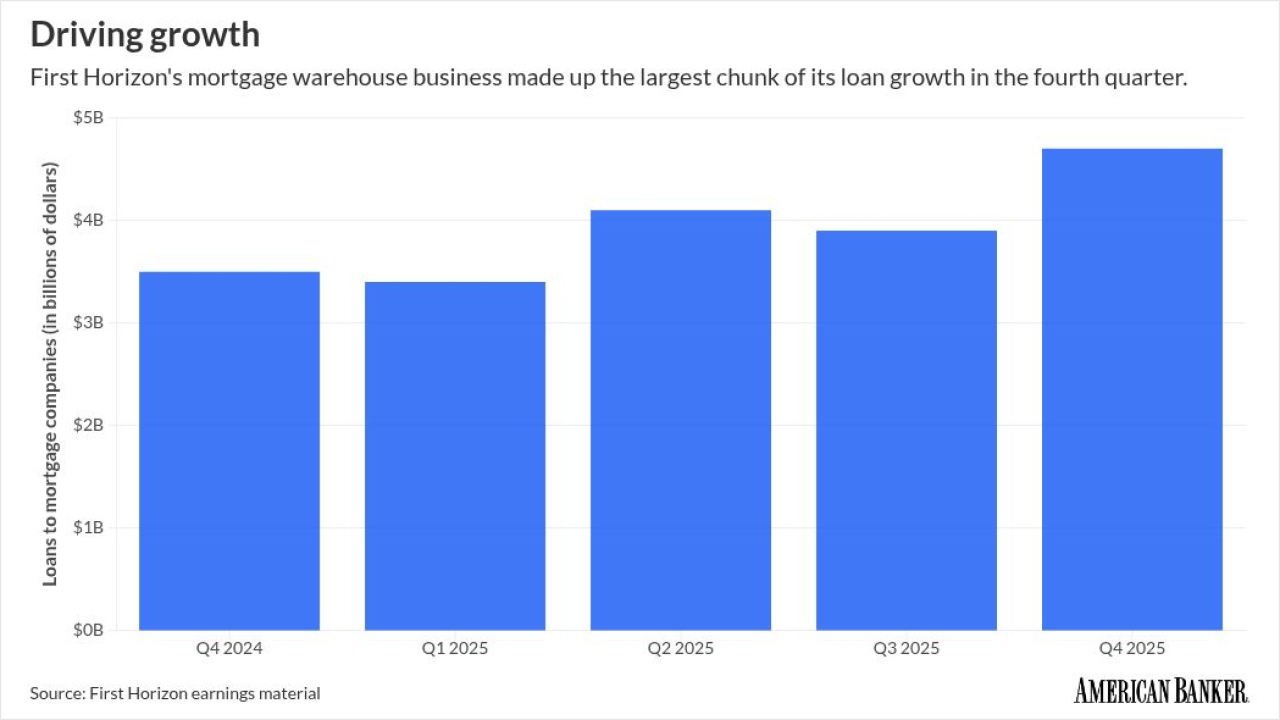

First Horizon's loans to mortgage companies in the fourth quarter rose at the fastest clip in more than two years, as the housing market showed small signs of revival.

January 15 -

Goldman Sachs' fourth-quarter earnings far exceeded analysts' forecasts, overcoming losses from its consumer-focused Platform Solutions unit.

January 15 -

The investment banking giant reported an 18% increase in net income for the fourth quarter and stuck to its 2-year-old financial targets, even as it exceeded some of them.

January 15 -

A week after President Trump demanded a 10% cap on credit card interest rates, top executives at big banks protested the idea in blunt terms.

January 14 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

In the fourth quarter of 2025, America's second-largest bank posted earnings that came in just above Wall Street's forecasts.

January 14 -

The custody bank reported a strong fourth quarter, as it continued to push forward with its new operating model. The momentum contributed to the bank's decision to lay out new financial targets, including a goal to achieve a return on tangible common equity of 28% in the next three to five years.

January 13 -

Top executives at the nation's largest bank spoke Tuesday about shifting dynamics in the credit card business, Federal Reserve independence, the bank's plan to increase spending in 2026 and its large portfolio of loans to nonbank financial institutions.

January 13 -

The largest bank in the country bulked up its reserves by $2.2 billion for potential credit hits from the Apple card portfolio, which JPMorgan is taking over from Goldman Sachs.

January 13 -

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

Midland States Bancorp has completed three major asset sales in the past 12 months, exiting national business lines and shifting focus to its core community banking franchise.

December 4