Earnings

Earnings

-

The Providence, R.I., company reported a double-digit increase in quarterly profits despite a year-over-year decline in fee-based revenue.

April 20 -

The news of the data breach cast a shadow over relatively strong first-quarter earnings for the Atlanta bank.

April 20 -

The bank’s latest punishment would settle charges by the CFPB and the OCC; Staley did not act without integrity in trying to unmask a whistleblower.

April 20 -

“We know we've said this before, but we do feel we've put this behind us now,” Joseph DePaolo said Thursday.

April 19 -

Investing in technology has been an important focus for banks. But big questions remain about these investments, including how best to pay for them.

April 19 -

The Waterbury, Conn., company also posted a double-digit gain in net interest income thanks to a 7% increase in commercial loan balances and a widening net interest margin.

April 19 -

The North Carolina company's efforts to contain expenses made up for a marginal increase in revenue.

April 19 -

The Arkansas company's revenue increased largely due to its 2017 purchase of Stonegate Bank.

April 19 -

Spread income offset higher expenses during the first quarter at the Maryland bank.

April 19 -

The Bridgeport, Conn., company said that first-quarter net income climbed 52% over the same period last year to $107.9 million.

April 19 -

The custody bank benefited from a wide range of economic forces in the first quarter.

April 19 -

The Cleveland company's acquisition of a boutique investment banking firm contributed to an increase in its fee income.

April 19 -

Bill to end the guidance intended to fight discriminatory lending now goes to the House; card company’s push to make more loans to customers pays dividends.

April 19 -

The New York bank said it wrote down each taxi medallion loan to a value of $160,000. At their peak, New York City medallions were worth well over $1 million.

April 19 -

However, mortgage growth and servicing income weren't the only reasons profits rose by double digits at the Dallas bank.

April 18 -

Results were also aided by strong growth in residential construction, commercial and equipment financing.

April 18 -

American Express Co., long known to issue cards that had to be paid off in full every month, now wants its customers to take their time paying it back.

April 18 -

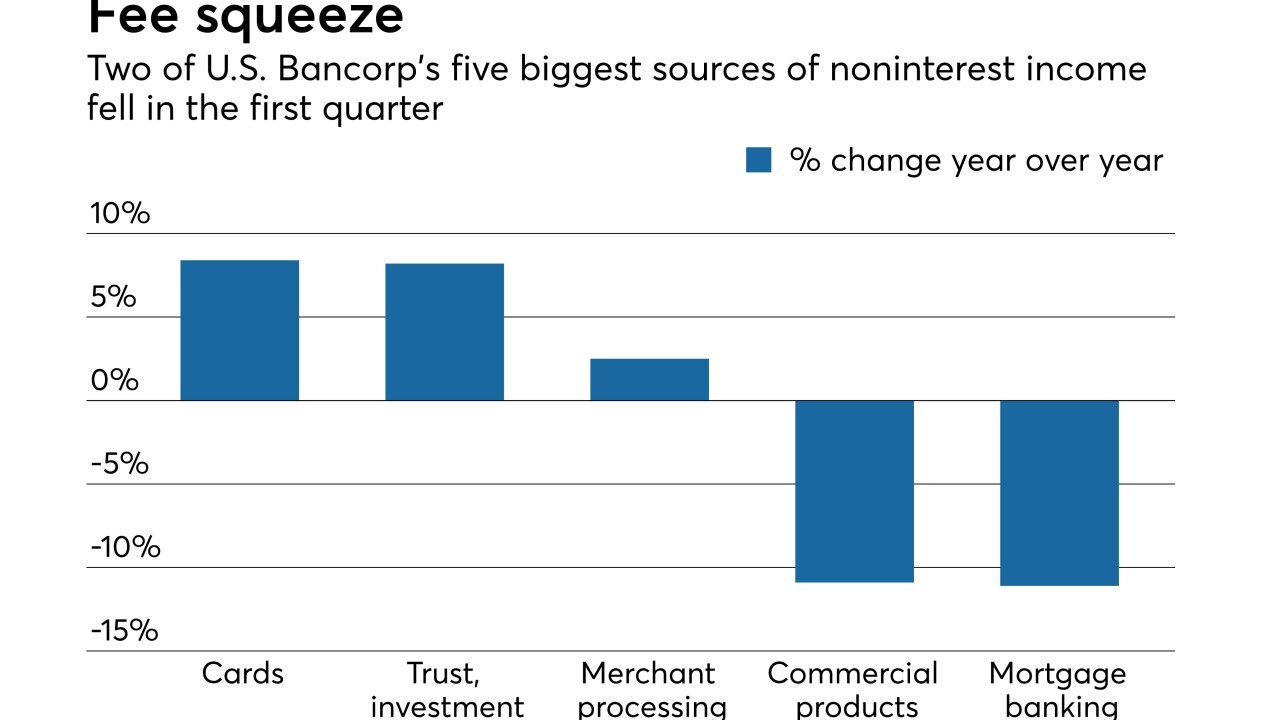

A sharp decline in capital markets fees at the Minneapolis company shows tepid loan growth is not the only side effect of tax reform at banks. How hard will it be to bounce back?

April 18 -

Quarterly earnings at the Minneapolis company were boosted instead by a wider net interest margin and a lower tax rate.

April 18 -

The Senate is expected to pass a bill that would ax controversial guidance on loans at car dealerships; lower tax rate may have skewed year-on-year comparisons.

April 18