-

The San Antonio-based bank is in the midst of a yearslong expansion effort spanning Houston, Dallas and Austin — all of which are fueling loan growth.

July 25 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

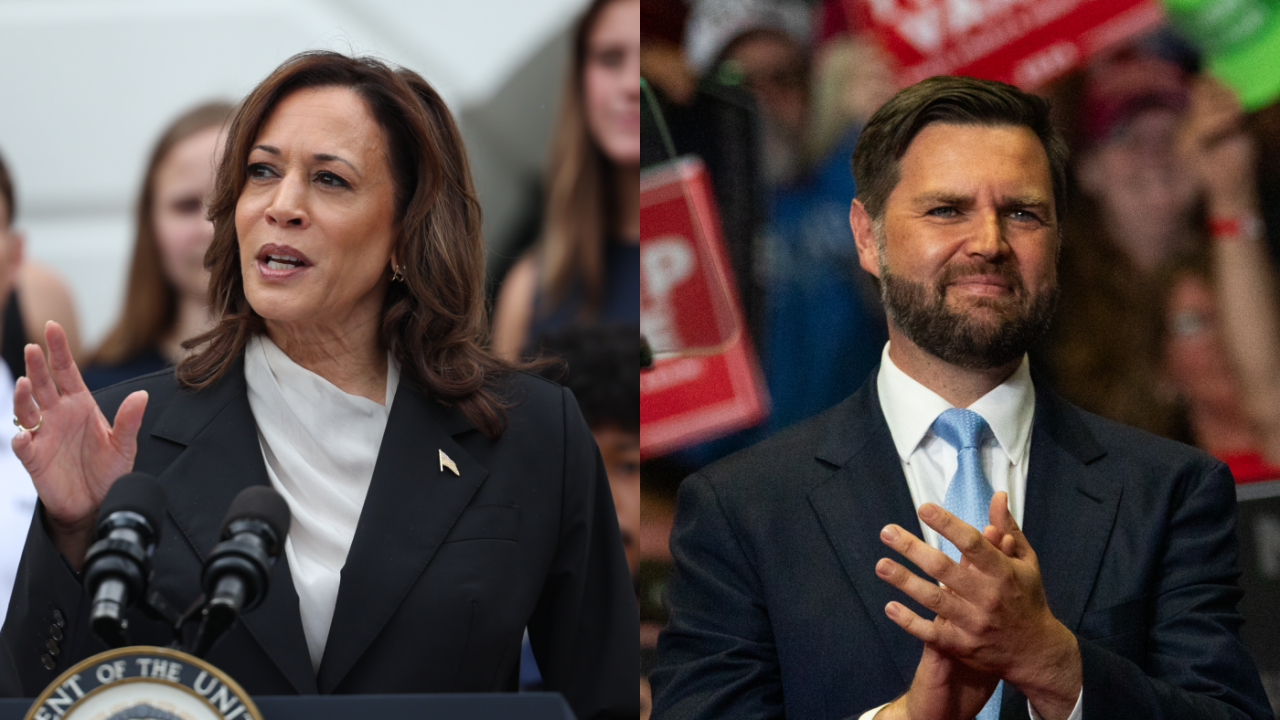

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The Biden Administration firmly rejects proposed cuts to key financial oversight and consumer protection agencies in the Republican-backed financial services appropriations bill for fiscal year 2025.

July 22 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

Even though the 30-year fixed rate mortgage is at its lowest level since mid-March, consumers are being cautious in returning to the market, Freddie Mac said.

July 18 -

The Cleveland-based regional bank continues to benefit from strength in investment banking, though concerns about stalled loan growth emerged as CEO Chris Gorman described demand as tepid.

July 18 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

CEO Ron O'Hanley touted an "encouraging financial performance" at the $326 billion-asset custody giant due to asset inflows and a jump in income from securities and loans.

July 16 -

The New York-based company saw assets under custody and management jump, driving strong increases in both fees and overall revenues for the quarter ending June 30.

July 12