ESG

ESG

-

The greenhouse gas emissions associated with financial institutions’ investing, lending and underwriting activities are more than 700 times higher, on average, than their direct emissions, a report concludes.

April 28 -

CEO John Turner said green projects present a strong business opportunity for the Birmingham, Ala., company.

April 23 - AB - Technology

The fintech Fair isn’t using terms like “sharia” or “Islam” in its messaging, but it is offering interest-free loans and socially responsible investments that comply with Islamic rules.

April 23 -

Under the leadership of former Chief Risk Officer John D'Angelo, the new environmental, social and governance office will oversee the bank's sustainability and corporate social responsibility functions.

April 22 -

Called by House and Senate Democrats, the hearings with the heads of the nation's six largest banks will take place over two days and will likely examine the industry's response to the pandemic and efforts to address climate change and racial equity.

April 15 -

JPMorgan Chase set a goal to finance $2.5 trillion in initiatives that combat climate change and advance sustainable development over the next 10 years, while Citigroup said it would back $1 trillion of similar efforts by 2030.

April 15 -

Bank of America, which has had an environmental business goal since 2007, is significantly increasing its current commitment.

April 9 -

In his annual message to investors, the JPMorgan Chase CEO said Big Tech and fintechs are "here to stay" and vowed to be aggressive in taking on these new challengers. He also predicted that the economy would take off this year, but said capital rules prevented banks from doing more to help blunt the impact of the pandemic recession.

April 7 -

Policymakers have scrutinized social disparities in the financial system and banks' climate-change risks. That has led to a new line of attack from Republicans who say agencies such as the Federal Reserve should stay in their lane.

April 6 -

Activist investors are pressuring big banks to further curtail lending to the fossil-fuel industry, undergo so-called racial-equity audits and disclose more about their lobbying practices and financing of nuclear weapons manufacturers.

March 30 -

Bank of America said Tuesday that it would up its initial commitment from $1 billion to $1.25 billion and would increase support in Asian American communities, where violence and incidents of harassment have risen sharply during the COVID-19 pandemic.

March 30 -

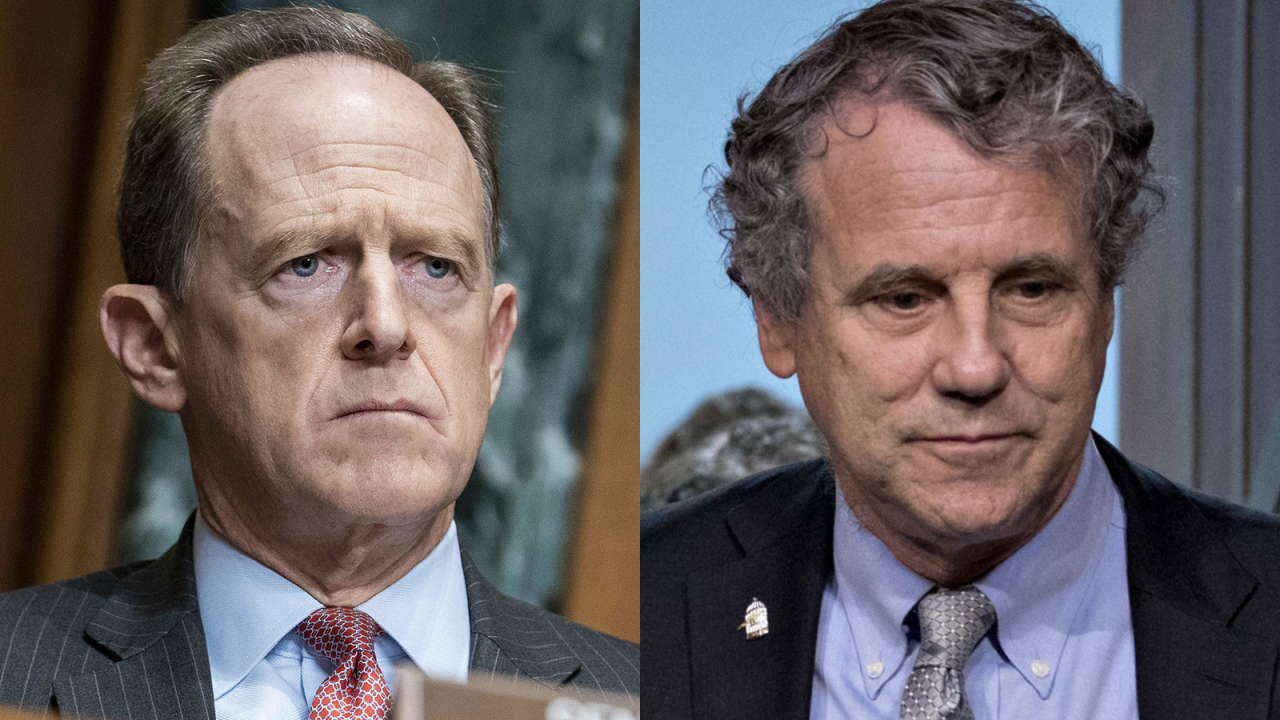

Sen. Pat Toomey, R-Pa., warned the regional Federal Reserve bank that its papers about environmental, social and corporate governance policies hurt its ability to stay neutral on partisan issues.

March 29 -

The Rainforest Action Network says the 2020 decline stemmed more from weak energy demand during the pandemic than banks’ pledge to reduce financing to firms that contribute to climate change.

March 25 -

Executive vice presidents and above will be evaluated on how they contributed to progress on efforts to curb the firm’s use of carbon, improve financial inclusion and reach gender-pay parity, CEO Michael Miebach said in a memo to staff.

March 24 -

The Treasury Department and U.S. regulators aim to boost demand for assets that tackle climate change, while preventing companies from making claims that could be considered “greenwashing,” or overstating the significance of emissions reductions and sustainability efforts.

March 19 -

Democrats want regulators to actively protect the financial system from losses tied to extreme weather events, while Republicans say climate policy is "beyond the scope" of their mission.

March 18 -

Big banks led the push to offer multibillion-dollar bonds that fund affordable housing, education and nonprofits that serve needy communities. But Truist's recent $1.25 billion bond is a sign that regionals want to attract progressive institutional investors — and burnish their images.

March 15 -

The bank also committed to finance $500 billion in sustainable businesses and projects by 2030.

March 8 -

Hector Negroni, a leader in pushing the needle in municipal finance, talks policy, infrastructure, ESG and a growing global audience for investing in state and local governments.

-

The bank’s new holding company, Amalgamated Financial Group, is the first publicly traded financial services company to become a public benefit corporation. It says the legal designation will help officers and directors balance the interests of shareholders and the public.

March 1