-

The central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.

March 24 -

The National Credit Union Administration also ordered its own employees to work from home until at least the end of March.

March 16 -

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

March 9 -

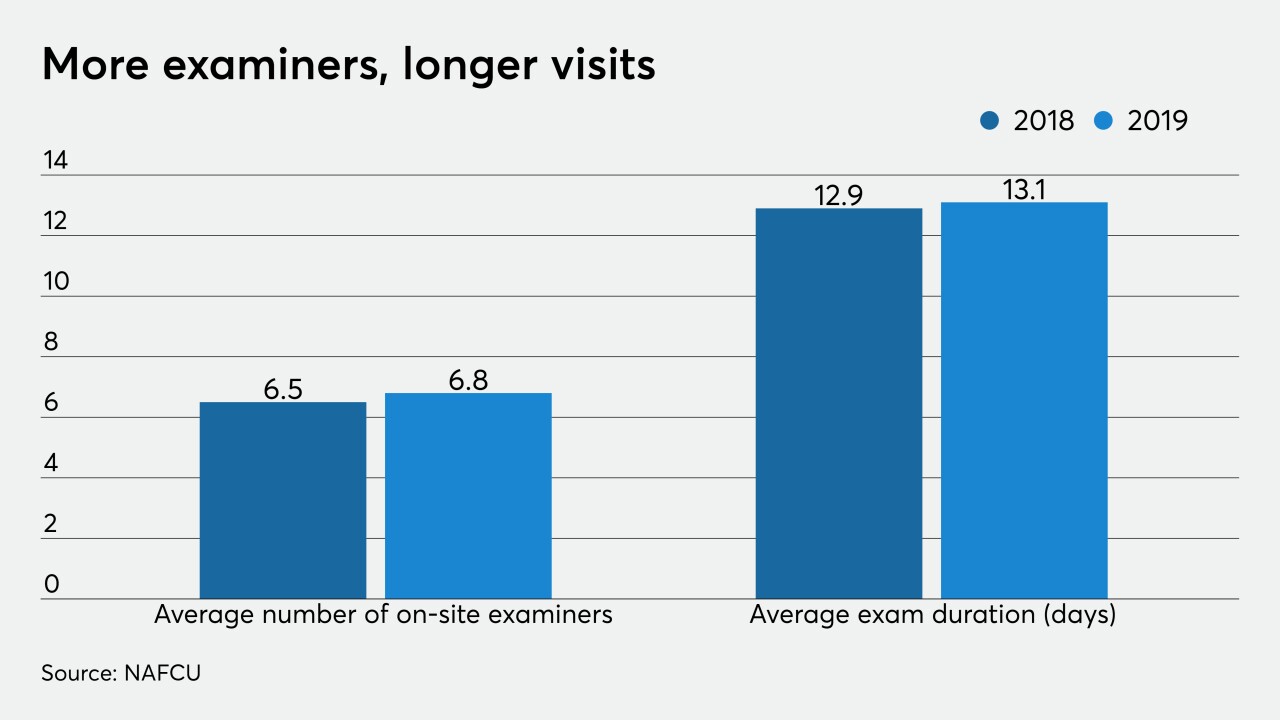

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

The Credit Union National Association believes the NCUA has not moved quickly enough to grant an 18-month exam cycle to credit unions with $3 billion or less in assets.

September 13 -

Before the passage of the recent regulatory relief law, only banks with assets of less than $1 billion were on an 18-month exam schedule.

August 23 -

The Office of the Comptroller of the Currency is eliminating a plan designed to ensure its examiners did not get too close to the big banks they supervise.

December 6 -

A Federal Reserve proposal acknowledges that good board governance results from directors being credible overseers of strategy instead of a redundant form of management.

September 1 SMAART.Consulting

SMAART.Consulting -

Four key areas examiners will be looking at related to the new rule that CUs should brush up on today.

June 20 nCino

nCino -

Violations of Bank Secrecy Act and anti-money-laundering compliance remain a hot topic for financial institutions as regulators can bar them from branch building and bank acquisitions. Here are some notable regulatory actions that are still unresolved.

January 13 -

The regulator is also evaluating relocating one regional office and scaling back from five regional offices to as few as three.

January 12 -

The Dodd-Frank Act is just the latest in a long string of policy out of Washington that harmed the greatest banking system devised by man.

January 10 Louisiana Bankers Association

Louisiana Bankers Association -

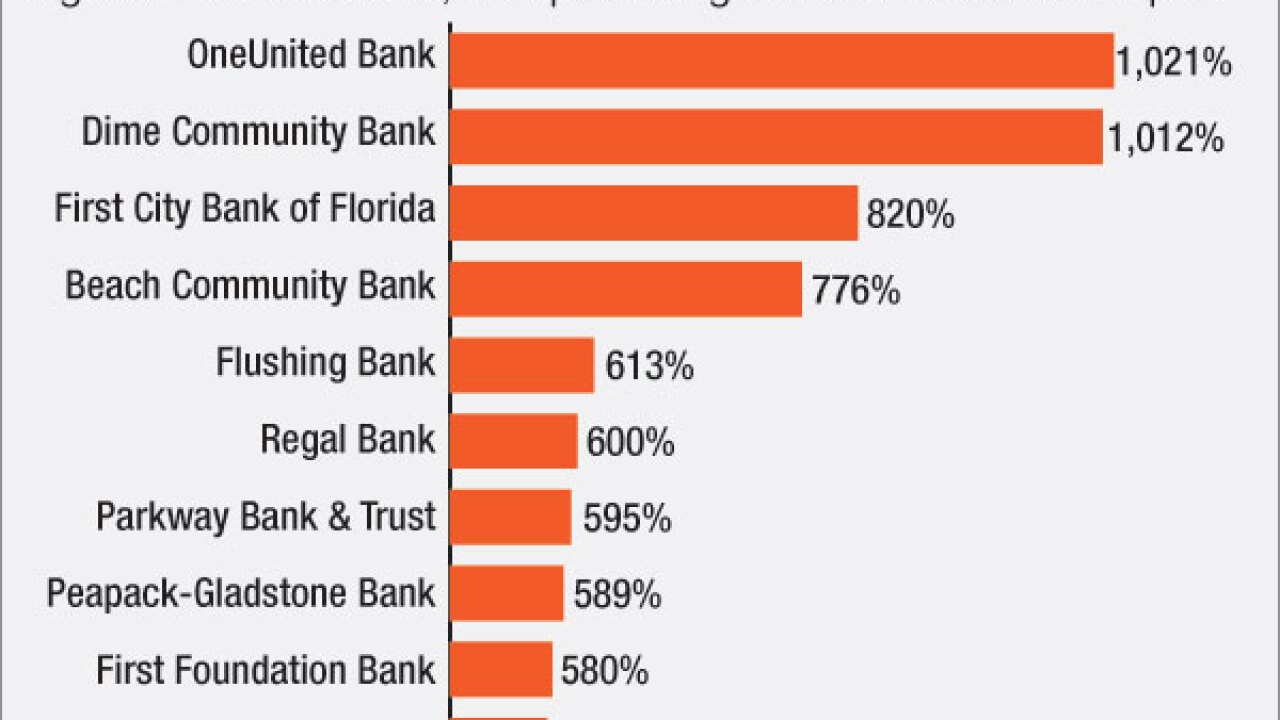

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

While other banking laws may be headed to the chopping block, the Community Reinvestment Act can address the needs of communities defined by their economic struggles.

December 12 Buckley LLP

Buckley LLP -

The Office of the Comptroller of the Currency is expected to downgrade Wells Fargo's Community Reinvestment Act rating in January to "needs to improve," from "outstanding," according to a story by Reuters, citing unnamed sources.

December 7 -

A Republican president and GOP-controlled Congress have the opportunity to disentangle the current regulatory web that leads to overlapping jurisdiction and duplicative rules.

December 7

-

You'd rather have a heart surgeon who has done a lot of bypasses than a novice, right? Perhaps the same thinking should apply to commercial lenders, according to several university researchers challenging the orthodoxy that making too many of the same kind of loans can only spell doom.

November 30 -

Regulatory costs may be warranted, but neither Congress nor the executive branch assessed the cost of the Dodd-Frank Act before its enactment.

November 11

-

While regulators discuss a potential federal fintech charter, another possible solution for firms trying to avoid multistate licensing already exists: the trust charter.

November 8 -

The piling on at Wells Fargo has reached an unprecedented level, even for a bank. Fifteen investigations are underway into Wells' phony account openings. Experts are quantifying the damage to Wells' reputation and what the bank can do going forward to repair it.

October 25